Ron Shamgar, TAMIM’s Australian Equities Portfolio Manager, continues his 2025 stock picks series with Gentrack (ASX: GTK) a standout performer in mission-critical software solutions for utilities and airports. With a business model built on recurring SaaS revenue and professional services, GTK exemplifies innovation and resilience in an increasingly digitised world.

Transformative Growth Across Key Segments

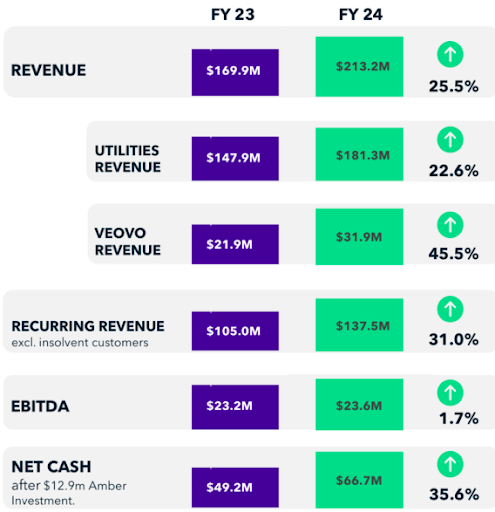

- Utilities (G2): Representing two-thirds of total revenue, the segment grew by 23% to $181 million in FY24. Stripping out one-off insolvency revenues, growth exceeded 50%, driven by a 33% rise in recurring revenue. The segment’s non-recurring revenue also doubled, reflecting heightened demand for upgrades and new implementations among existing and new customers.

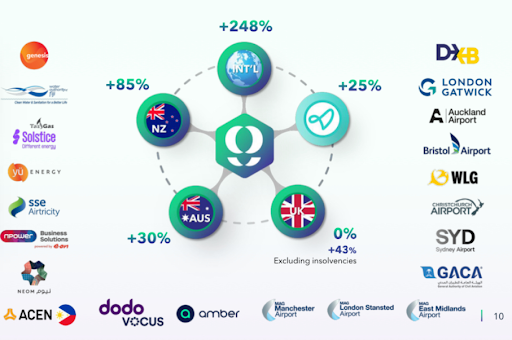

- Airports (Veovo): Revenue from this segment grew 25% year-over-year (45% including hardware sales), reflecting GTK’s leadership in automating airport operations. The company is actively exploring M&A opportunities to expand Veovo’s offerings and enhance its appeal to global tier-1 and tier-2 airport clients, including Dubai, Sydney, and London airports.

Source: Gentrack Presentation

Operational Efficiency and Margin Expansion

Despite robust revenue growth, GTK has managed to keep headcount increases moderate, driving significant operating leverage. This efficiency, combined with its high-margin recurring revenue streams, allowed the company to expand EBITDA margins.

Source: Gentrack Presentation

GTK’s FY24 EBITDA of $23.6 million was impacted by one-time costs related to its long-term incentive schemes and UK payroll taxes. Adjusting for these, underlying EBITDA grew an impressive 42% to $41 million. The company’s practice of expensing all development costs further highlights the strength of these results compared to peers.

Looking ahead, GTK expects these one-time costs to decline, supporting its medium-term EBITDA margin target of 15-20%.

Strong Cash Flow and Strategic Investments

GTK reported free cash flow of $30 million in FY24, closing the year with a 35.6% increase in its cash balance to $66.7 million. This was achieved despite a $12.9 million investment in Amber Electric, reflecting GTK’s ability to execute while maintaining financial strength.

Growth Catalysts for the Future

A key driver of GTK’s future growth is its G2 platform, which has been widely adopted by its existing customer base. The platform’s advanced features and capabilities set it apart from competitors, making it the go-to choice for new contracts.

Source: Gentrack Presentation

While GTK remains strong in its core markets of Australia, New Zealand, and the UK, it is also making inroads into Asia and Europe, with new client wins in Saudi Arabia and the Philippines. Though these regions present longer sales cycles, they provide significant long-term growth potential.

TAMIM Takeaway

Since our initial investment in mid-2022 at $1.50, GTK has delivered over 8x returns, now trading at $12.50. Its journey from a niche software provider to a highly profitable tech company underscores its ability to execute and capitalise on long-term tailwinds like the energy transition.

We believe the stock is now being more fully appreciated by investors with substantial growth tailwinds for the next decade. The energy transition is real and every utility company (Energy/Water) will need to upgrade their billing stack in the next few years.

We see significant catalysts in the next 12 months as the pipeline of new business has reached a maturity inflection point and some larger contract wins should be announced in the near term. Hence we believe GTK’s growth story is far from over. Our updated valuation of $25.00 reflects this confidence, with key drivers including:

- Continued expansion of the G2 platform in core and emerging markets.

- Growing market awareness of GTK’s role in the energy and infrastructure transition.

- Larger contract wins that signal a maturing sales pipeline.

For 2025, Gentrack (ASX: GTK) remains our highest-conviction holding in the TAMIM Australian Equities portfolio. It exemplifies the type of transformative companies we seek businesses with strong fundamentals, clear growth drivers, and a commitment to delivering shareholder value.

___________________________________________________________________________________________________

Disclaimer: Gentrack (ASX: GTK) is held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.