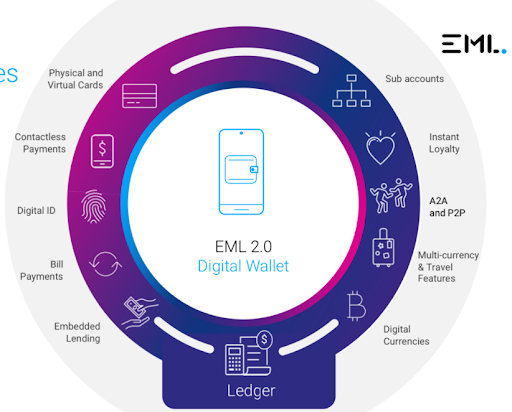

Recently we attended EML strategy day and met with management. EML outlined a clear and focused 2.0 strategy centered around three key pillars: nurturing and growing their existing core business, accelerating into new verticals, and expanding into new geographic markets. This strategy is underpinned by three strategic enablers: implementing a single global operating model, reviving their revenue engine, and building a new global technology platform.

(Source: EML)

On the core business, EML acknowledged they have a solid foundation with a presence in three of the world’s largest and fastest growing payments markets – Europe, North America, and Australia. They process over $23 billion in GDV and have $2.1 billion in stored value float, providing a strong revenue base. The focus here will be on extracting more value from their existing 1,100 customer relationships through cross-selling and deepening partnerships.

To accelerate into new verticals, EML sees opportunities in areas like insurance disbursements, mobility/fleet, and travel where they believe complex payment flows remain underserved. They have a track record of identifying gaps in the market and building unique solutions, like their salary packaging and perks businesses. The plan is to take a structured and resourced approach to selling across all products and markets.

For geographic expansion, EML will be opportunistic, partnering with existing schemes, banks or infrastructure providers to enter new markets, rather than investing ahead of revenue. This capital-light approach allows them to follow the opportunities rather than trying to create new demand.

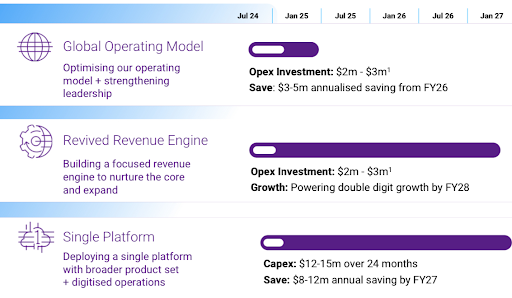

Enabling this strategy are three key initiatives. First, implementing a global operating model with centralised shared services and best practices, under new global COO Brian Lewis. Second, rebuilding their sales and revenue engine, led by new CRO Shabab Muhaddes, after years of underinvestment. And third, transitioning from three legacy technology stacks to a single global platform, at a cost of $12-15 million, which will drive significant operational efficiencies.

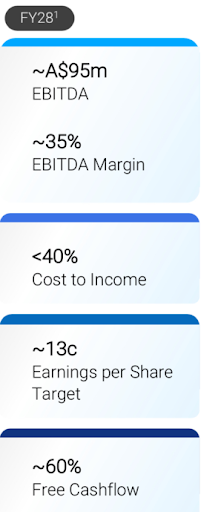

Financially, EML is targeting double-digit transaction revenue growth and a 35% EBITDA margin by FY2028. This equates to $95 million EBITDA, $60 million of free cashflow and 13 cents EPS. In the near-term, they have reaffirmed FY2025 EBITDA guidance of $54-60 million, with Q1 trading in line with expectations.

The company expects interest income to moderate over time as rates decline, but this will be offset by growth in the core business and operational efficiencies. They project a flat cost base over the medium-term, with $15-20 million in savings offsetting inflation and investment in sales/marketing.

Overall, EML is confident in their ability to execute on this plan, noting a renewed sense of urgency and focus within the organisation after a challenging period. The strategy is clear, the financial targets are ambitious but achievable, and the leadership team has the experience to deliver. If successful, it will transform EML from a good business to a great one, delivering sustainable double-digit growth and material margin expansion.

The TAMIM Takeaway

EML Payments is at a pivotal juncture. With a renewed sense of focus and urgency within the company, the 2.0 strategy has the potential to drive sustainable growth and material margin expansion. Momentum in new sales is beginning to emerge, supported by ambitious but achievable financial targets.

Moreover, with a $95 million EBITDA target in three years versus a current EV of approximately $350 million, EML presents itself as a compelling takeover candidate. A bid in the range of $500-600 million ($1.50 per share) seems highly plausible within the next six months, offering significant upside for shareholders.

For investors seeking exposure to ASX small caps with transformative potential, EML stands out as a stock to watch in 2025.

_________________________________________________________________________________________________

Disclaimer: EML Payments (ASX: EML) is held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.