Rerun: Needs Not Wants: 2 Stocks That Fill A Need

16 Jun, 2022 | Stock Insight

This week we continue to look at investing in needs and not wants, highlighting two stocks in our portfolios. Following the volatility in markets this year we have been extensively reviewing our portfolios and looking for companies that have steady earnings, inflationary protection and a service/product that is a necessity and is immune to the central banks attack on consumer spending.

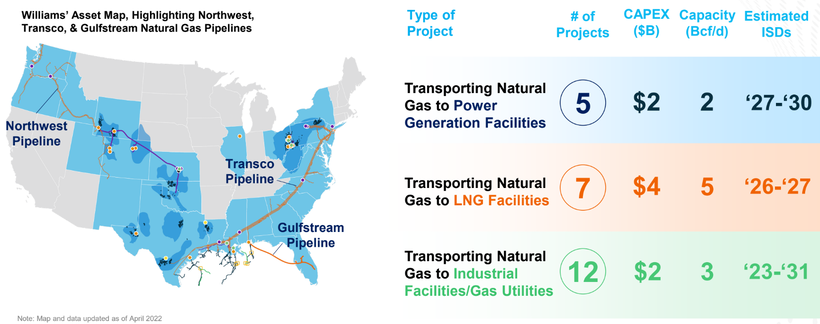

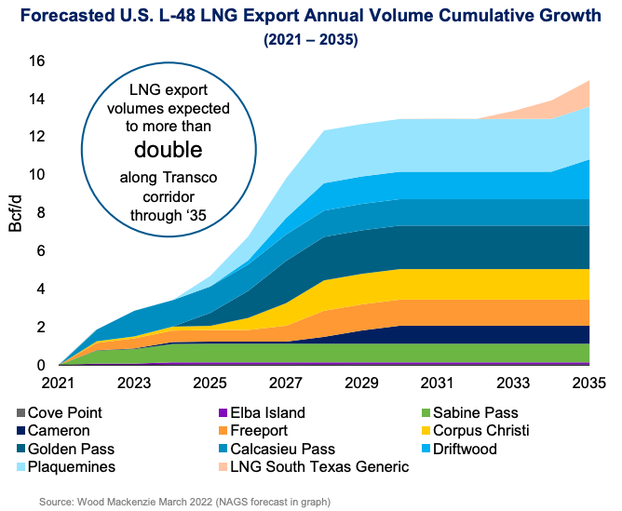

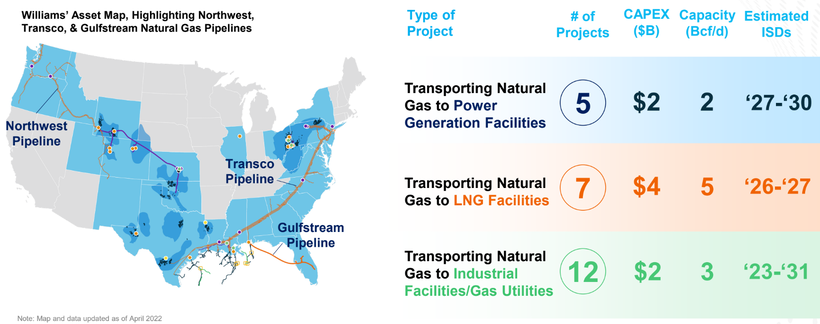

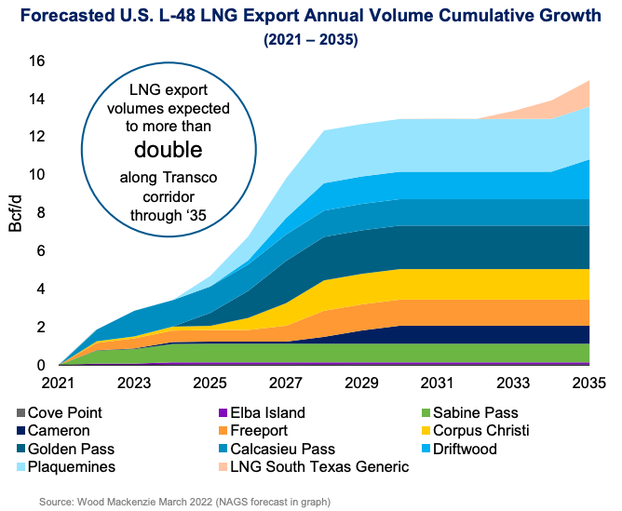

The Williams Companies, Inc., is an American energy company based in Tulsa, Oklahoma. Its core business is natural gas processing and transportation, with additional petroleum and electricity generation assets. Williams Companies is one of the largest natural gas-focused midstream companies in the United States, handling 30% of the gas used in the nation. The company is embarking on a number of projects meant to increase its capacity to supply gas to LNG producers and power plants along the East Coast. This will allow the company to continue their recent track record of steady cash flow growth.

Source: WMB company filings

The continuing conflict in Ukraine has put energy in the spotlight and, as much as society wants to move away from fossil fuels, we are finally starting to accept how critical oil and gas are going to remain during the transition period (regardless of where you stand on this being due to a short-sighted bungling of this transition over the past decade or so or not). As it currently stands, the pipelines that transport oil and gas are essential pieces of infrastructure. Without them homes would struggle to keep the lights on.

The company’s flagship pipeline system is the Transcontinental Gas Pipe Line (Transco), which is one of the major suppliers of natural gas to the highly populated Northeast. The Williams Companies has begun a $1.4bn capital spending program in order to expand the capacity of the Transco pipeline system to satisfy demand.

Williams are in a unique position to capitalise on the dire energy situation that New England currently finds itself in. New England have closed down their nuclear power plants and have limited access to LNG. Due to the treacherous winter they face, solar panels are made redundant by snowfall and the icy cold conditions only increase the demand for the warmth that LNG provides households.

Last winter the region, which has limited ability to bring natural gas via pipeline from neighbouring states in the prolific Appalachian Basin, burned the most oil to generate electricity in over a decade. If the Northeast continues to consume more oil to produce power, emissions are likely to rise. More urgently, virtually every attempt to expand the region’s natural gas pipeline infrastructure has been delayed, blocked, or abandoned. The book Shorting the Grid by Meredith Angwin discusses this issue in great detail.

Source: WMB company filings

Williams are set to increase their EBITDA by +38% this year and are currently sitting on a dividend yield of 5.3%. The barriers to entry are high and the demand for Williams’ infrastructure is rising. The rise of ESG has deterred spending for further development of oil & gas resources and without companies investing in new supply we will continue to see energy shortages. William’s ticks all our boxes when looking for stocks that people need. It has a monopoly over the northeast pipelines, high barriers to entry with regulatory authorities unwilling to approve new pipelines and delivers a service that we need now more than ever.

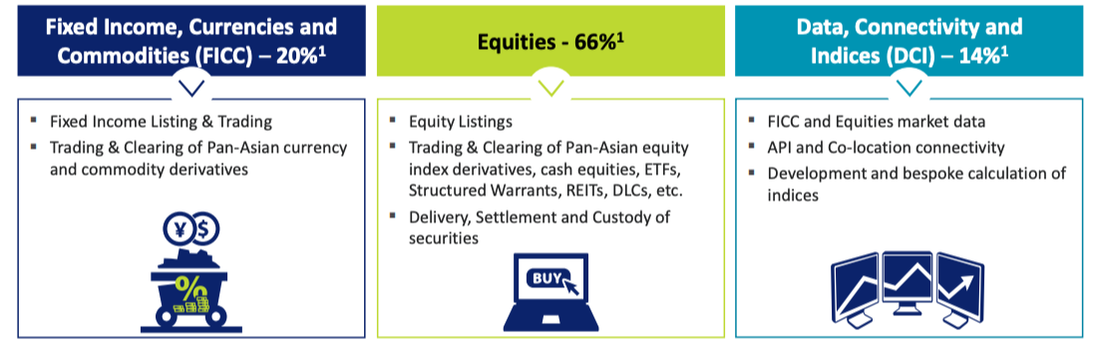

Headquartered in Singapore, about 40% of companies and over 80% of bonds listed on the exchange originate outside Singapore. Singapore’s stock exchange is arguably Asia’s most international and connected exchange. The SGX comprises of 673 listed companies with a total market capitalisation of US$658bn. SGX famously tried to takeover the ASX back in 2014 and there were also rumours that the SGX was in talks with the London Stock Exchange regarding a transaction.

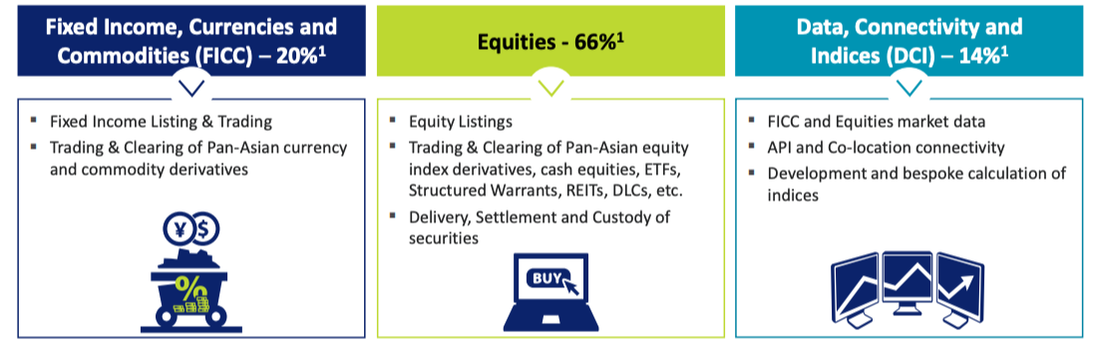

The Singapore stock exchange has three main businesses:

- Fixed income, currencies and commodities

- Equities

- Data connectivity and indices

Source: S68 company filings

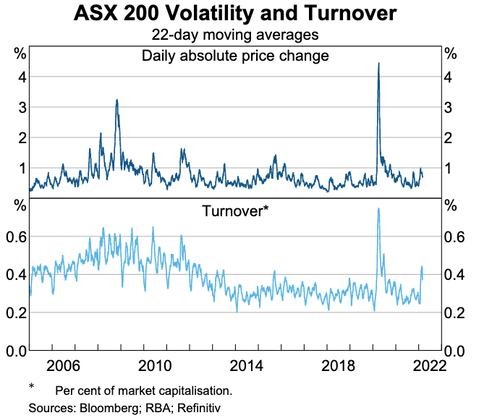

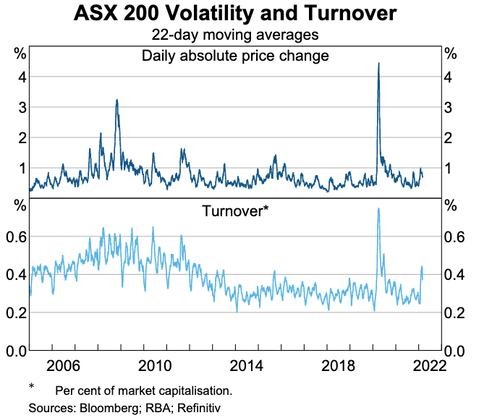

Singapore Exchange is somewhat of a hidden gem among the “needs not wants” crowd. They have a monopoly in one of the biggest financial hubs in the world, their revenues are stable and they provide an essential service. How else is everyone going to panic sell all their shares right now? Most wouldn’t categorise a stock exchange as an infrastructure-like holding, however we view it as a piece of systemically important financial infrastructure. Without exchanges markets will fail.

With markets taking a tumble, one might reasonably assume that owning an exchange would be a huge loser. The IPO market is a contributor, yes, but it only makes up 5% of the equity segment’s revenues. Trading and clearing make up most of the revenue for S68’s equities segment. With a Daily Average Trading Value (DAV) of S$1.4bn, S68’s average clearing fees for Cash Equities (includes ordinary shares, REITs and business trusts) was 2.73 basis points (Annual Report 2021). When markets are volatile we often see a spike in trading, this was evident in March 2020 with the initial pandemic crash. Just this week we saw the ASX fall in excess of -4% on the 14th of June, this saw a 70% increase in trading volume on the previous trading day. It’s simple, more trading = more fees.

Source: ABS

S68 should also be a beneficiary of higher interest rates, their Treasury income has suffered under lower rates. S68 reported a S$12bn float from collateral posted by derivative traders. These balances are invested in bank deposits, meaning interest income. The majority of this is going to derivative clearing members but a portion is retained by SGX. In FY21 this brought in S$72m of interest income, representing 13% of FY21 operating profit. On the back of big rate rises from central banks around the world, this income will grow substantially.

Singapore Exchange has been able to maintain its expense guidance for FY22 despite inflationary pressures. Their EBITDA margins are high at 57% and they have a 5-year CAGR of 4.9%, seeing steady growth in revenues.

There are a number of potential tailwinds for S68 moving forward. Companies in China will be eyeing listings in Singapore to hedge political risks. If some of these companies are forced to delist from US exchanges the SGX is a logical destination with ongoing concerns over Hong Kong’s autonomy going forward. Commodities and forex derivative volumes are rising as demand for risk management instruments (hedging) surges, this will only be exacerbated through central bank rate hikes. On the other side, building a stock exchange obviously has significant barriers to entry and is a highly regulated space, it’ll be tough for a genuine competitor to spring up. S68 is one of few stocks to hold up so far this year, up approx. +3% YTD.