Probiotec Limited (PBP.ASX)

![]()

Results

Outlook

PBP has great earnings visibility and were able to provide FY22 guidance of $170-180m in revenue and EBITDA of $32-33m. PBP have been active in the M&A space and will continue to go down that path. They are sitting on a strong balance sheet and only have a net bank debt/underlying EBITDA ratio of 0.75x, leaving them plenty room to grow through M&A. As mentioned, we see further upside in the recovery of their cold and flu segment for FY23. PBP have secured all the contracts required to meet their FY22 guidance so there is a good chance we see them beat that. Currently PBP are trading at an EV/EBITDA of 6.15x. We believe this is too cheap heading into easier 2H trading conditions, we expect to see a number of acquisitions this year.

Healthia (HLA.ASX)

Results

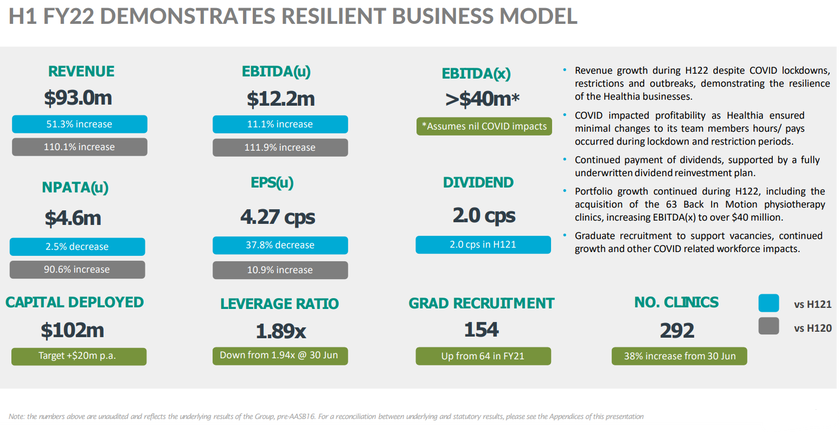

HLA had a challenging half with lockdowns in NSW and VIC; they had huge staff impacts from Covid-19 and the lockdowns heavily affected their operations. They didn’t lay any staff off which led to a higher fixed cost base. Their natural fit stores were mostly closed during Q1, hurting margins. They continued their acquisition strategy during the half, acquiring 76 physio clinics in the period (along with 3 optical stores and a podiatry clinic). Even with all the headwinds during the half, HLA saw a +51.3% increase in revenue to $93m and an +11.1% increase in EBITDA to $12.2m. Their ‘Bodies and Mind’ stores were minimally impacted and were stable during the half, recording a 19.4% EBITDA margin (still below expectations). ‘Eyes and Ears’ were the most impacted but there should be plenty of pent up demand for this segment, people still need to get their eyes tested but have just delayed their visit; unlike the physio segment which has very little pent up demand comparably.

HLA had a tough half but, looking forward, they are targeting 3-6% same store growth. As long as they continue to acquire clinics at cheap prices, they are building a super profitable business that is growing rapidly through M&A. There have been some impacts felt in January and February but from here they should be hitting full steam. In November they saw a more normal trading environment, seeing +5% organic growth. The management team knows what the business can do in good operating conditions. Q4 will be a great indicator of what the business will look like moving forward and HLA has provided the market with a FY23 EBITDA target of $40m. Importantly, this number is based on their current portfolio and doesn’t account for future acquisitions. Based on their FY23 target, they are trading at a forward EV/EBITDA of 8x.