Property and hotel/tourism fund manager and investment company, Elanor Investors Group (ASX:ENN), is a core long term holding of the fund that we believe represents compelling value at current prices. We have been adding to our position in ENN recently.

ENN ticks a large number of boxes for a high quality business including:

- Strong management with a proven history of operational out-performance;

- High levels of recurring income;

- A strong track record of buying assets well, adding value and then realising the asset value;

- Favourable tailwinds in the form of growing long term investment demand for high quality, high yield, tourism and property assets; and

- An exceptionally strong balance sheet.

In terms of value, ENN is currently trading broadly equal to the market value of the various real estate, tourism and investment assets that it owns. In addition to the ‘hard’ assets that it owns, ENN is building a very successful and profitable funds management division that the market is attributing limited value to. In our experience, this is an unusually attractive opportunity for a high quality, well run business.

The funds management business

The business has powerful leverage to ongoing funds under management (FUM) revenue growth and significant potential performance fees. ENN’s management are optimistic about converting their strong pipeline of new fund initiatives which should support good growth into FY18, following a significantly increased origination and capital raising capability.Management’s ability to purchase assets well, and to add value to assets through active and astute management has also resulted in significant embedded performance fees (off balance sheet) that will accrue to ENN as assets are realised over the coming years.The key funds that ENN currently manage include:

- Elanor Retail Fund (ASX:ERF) – listed on the ASX in 2016 with gross assets of over $250m

- Elanor Hospitality and Accommodation Fund – unlisted fund formed in March 2016 with gross assets of over$100m

- Elanor Metro and Prime Regional Hotel Fund – recently announced unlisted fund with gross assets of $73m.

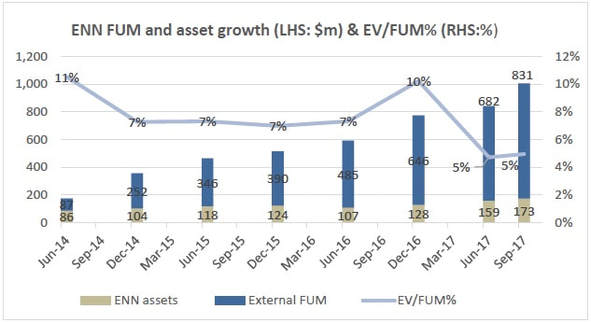

As illustrated below, the growth in FUM over the past several years has been impressive, however the emerging funds management business being developed by ENN has yet to be properly recognised by the market.

The chart above sets out the growth in assets both owned by ENN and externally managed by ENN, together with our calculation of the business value (enterprise value) as a proportion of external funds under management – a metric that highlights the relative value the market is applying to ENN’s fund management business.

When ENN listed on the ASX in 2014, its funds management business was valued at 10% of its FUM at the time. This metric has been reducing and sits at c. 5% today, which indicates the business is cheaper now relative to any other time in its trading history. Further, if we were to adopt our estimates of the market values of ENN’s investment assets, rather than the audited book values (with some key assets recorded at cost) used in the analysis above, then the business would appear even cheaper, at less than 2% of its FUM.

The market has been attributing less and less relative value to ENN’s funds management business, over a time when the business has been generating increasing profits and scale and a track record of strong performance outcomes – this represents a compelling opportunity for us. ENN’s underlying funds continue to mature and provide potential for ENN to capture material performance fees.

Valuation

As value investors we are focused upon identifying the most compelling under-valued high quality smaller companies on the ASX. ENN currently stands out as a particularly compelling value opportunity based upon its asset and earnings base.

As a result of recent valuation uplifts to its Hotel and Tourism assets, and forecast mark to market values of its real estate (e.g. ENN’s Merrylands property) and co-investment assets (e.g. ENN’s Belly City fund investment) we estimate ENN’s underlying NAV is now approximately $2.00. With its current share price at around $2.10, this implies very limited value is being applied to ENN’s funds management business. We view the current opportunity to buy a share of a high quality funds management business with a top class management team for next to nothing (and where the share price is supported by the value of its assets) as unusually attractive. Catalysts to potentially unlock this value include the sale of non-core assets, new fund initiatives and asset realisation / generation of performance fees. We remain committed long term investors and look forward to seeing this value being unlocked over time.