Guy Carson

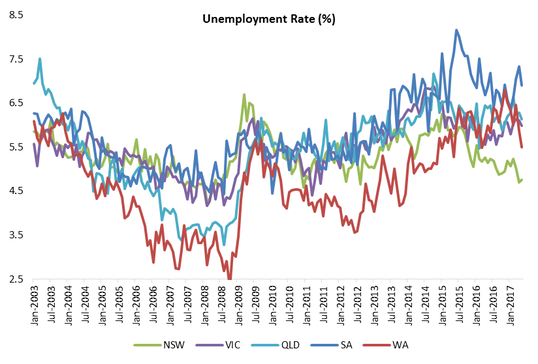

The change of course for the Australian economy seems to have started around March when the employment data took a significant turn for the better. Over the three months starting March we saw employment gains of 60k, 46k and 42k. For a steady unemployment rate a figure of around 15k is needed to keep pace with population growth. As a result the unemployment rate has fallen from 5.9% to 5.5%. The biggest improver somewhat surprisingly has been Western Australia where the unemployment rate has fallen from 6.5% to 5.5%. The other main improver is New South Wales which continues to have the lowest unemployment in the country.

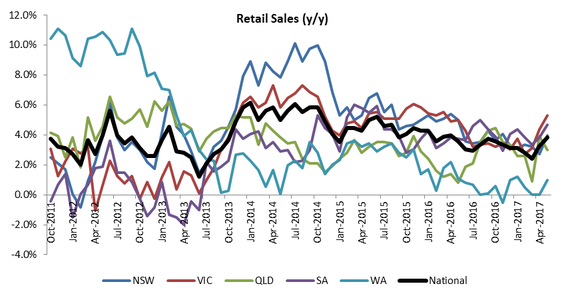

These are positive turnarounds, more people with jobs leads to increased consumer spending and increased economic activity. Whilst GDP is a near impossible number to predict, we can say the foundations are there for a rebound in the June quarter. Hence the question we get is have we turned the corner? Are we out of the woods yet again?

At this point, we are not confident that these positive signs will be maintained. Yes, near term economic signals are positive but for us three key structural challenges remain. These challenges are:

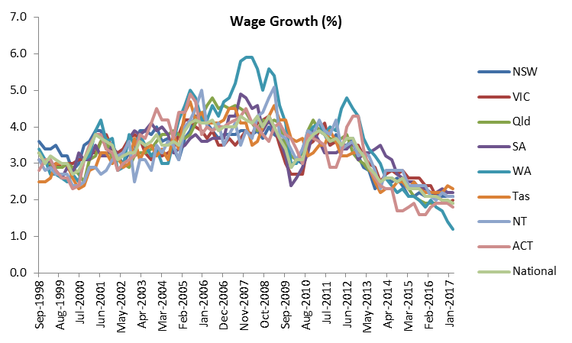

- Record low wage growth.

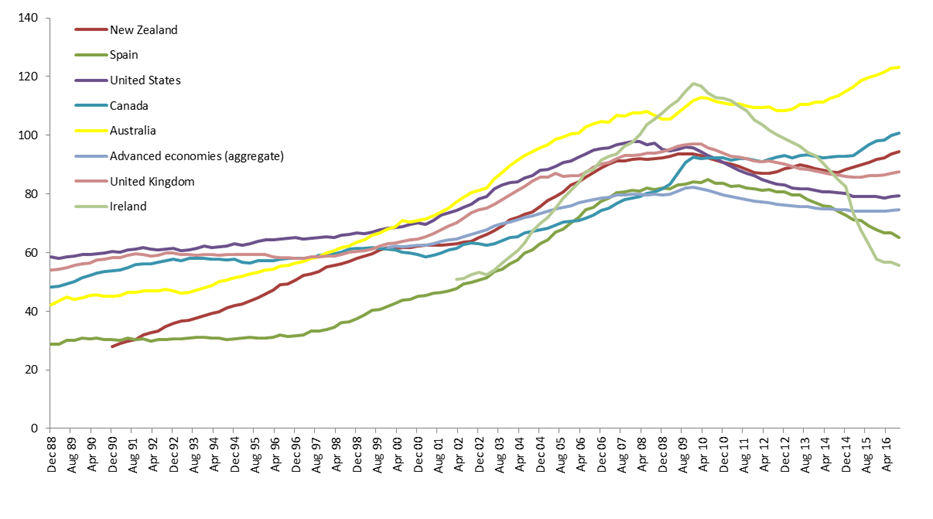

- Record high household debt.

- An unprecedented building boom that appears to be softening.

Despite the strength in the labour market over the last three months, we are yet to see signs of wage pressures. In fact wage growth has declined steadily in Australia since 2012 and is currently running at its lowest level on record at 1.9% year on year. During this period we did see a significant decline in unemployment in 2015 but even this did little to stop the wage trend. The current bounce in the employment numbers would therefore, in our opinion, need to last significantly longer to have an impact.

A majority of this debt sits against residential property which has been a key driver of the Australian economy in recent years. In response to the end of the mining construction boom, the RBA began to cut interest rates in 2011. All up they have cut rates from 4.75% to 1.50% and have seen off a recession we most likely would have had otherwise.

The interest rate cuts have enabled households to borrow more. In turn this has led to house price increases and higher house prices have led to greater incentive to build. The residential construction industry has as a result boomed, primarily across the East Coast and primarily in apartments. The RBA has effectively replaced a mining boom with a property boom.

There is a considerable amount of research around about the impact of residential construction booms. The Bank of International Settlements has warned against cutting interest rates to boost asset prices and the consequences that it can have. Regular readers of ours will also know about Edward E. Leamer’s paper “Housing IS the business cycle” where he paints residential construction as the major cause of economic recessions. One of the key points that Leamer makes is that “house prices are very inflexible downward, and when demand softens as it has in 2005 and 2006 [in the US], we get very little price adjustment but a huge volume drop. For GDP and for employment, it’s the volume that matters.“ So whilst most of the commentary and focus remains on Sydney and Melbourne house prices, we would suggest that people need to be more focused on the volume and here we are starting to see potential signs of a decline in construction activity.

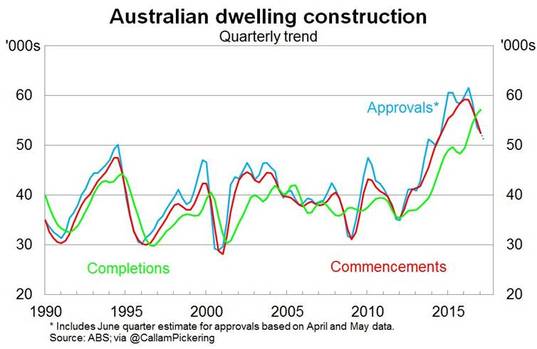

The chart below looks at residential building approvals, commencements and completions on a national level. From this data we can see that building approvals act as an excellent indicator of building activity and they are showing signs of rolling over. If we were to see a continued decline in approvals from here we will start to get very nervous. Typically commencements follow approvals closely and completions tend to peak 6-9 months thereafter.

With the residential construction boom potentially coming to an end, there will be a growth hole to fill. The RBA cut interest rates by 3.25% to fill the hole from the mining boom, but now with interest rates at 1.5% they have significantly less fire power. Which begs the question of how the RBA would deal with a prolonged slowdown?

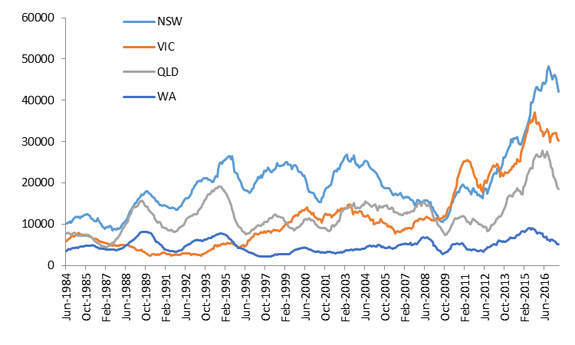

The counter argument to our assessment of the residential boom is that due to record immigration levels, current building levels are rational and must be maintained. We take a slightly different view and would suggest that immigration may have a component that is pro-cyclical, i.e. people will move to where there is work. On that basis, it’s the building work drawing people here and not the people moving here that is forcing the building work. On this point we would highlight that Iceland, Ireland and Spain all had record immigration in 2007 and we probably don’t need to remind people what happened in 2008. For Australia, whilst immigration has remained high over the last decade or so, there are three clear surges. These surges occur with both stages of the mining boom (pre GFC and post) as well as the recent residential construction boom.

In summary, the last few months has seen renewed energy from the Australian consumer and that could provide some short term relief to sectors such as retail and financials. However, when we invest we take a longer term view and believe the risks to the downside outweigh the upside for these sectors. As a result, we continue to focus our efforts on finding companies with structural tailwinds, global earnings and strong value propositions. These companies should be able to grow and prosper despite an uncertain domestic economic environment.