|

In 2002 Wimbledon officials took out pandemic insurance at $3.2 million a year following the outbreak of SARS. It wasn’t until almost 20 years later when a 1 in 100 year pandemic struck that the move paid off. Covid-19 forced the All England Lawn Tennis Club to cancel the tournament for the first time since WWII and was due to lose around $500 million in revenue. Thanks to the foresight to insure against such an event Wimbeldon recovered a large portion of the loss despite the fact a ball wasn’t served.  Having insurance in place for such rare disasters isn’t always front of mind. When a catastrophe does strike you want to ensure that you are protected. What we’re seeing in 2023 is an increasing amount of cyber security disasters. In recent times company’s like Optus and Medibank Private have shown the severe PR impact a breach can produce. Having the appropriate security in place to avoid catastrophe is crucial. ASX listed cloud data backup Dropsuite Limited (ASX: DSE) fills one aspect of cybersecurity by securing backups and restoring Email, Microsoft 365, Microsoft 365 GovCloud, Google Workspace, and QuickBooks Online. Dropsuite’s mission is to safeguard data and assist businesses in maintaining operational continuity. The company’s cloud platform facilitates backup, archiving, discovery, and recovery of data, serving as a robust defence against various forms of data loss, particularly cyber-attacks, while aiding in regulatory compliance. Per the company:

Dropsuite is led by long time Managing Director Charif El Ansari. El Ansari took over as CEO of the company in 2013. Originally known as Dropmysite the company only served as a backup for websites before adding Dropmyemail in 2012 and Dropmymobile in 2014. The business rebranded in 2016 as Dropsuite before listing on the ASX via a backdoor listing that same year.

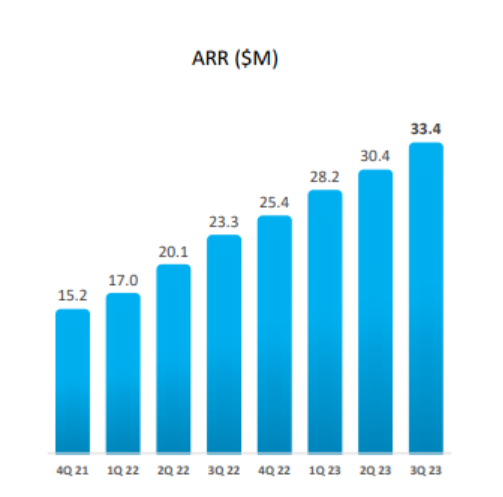

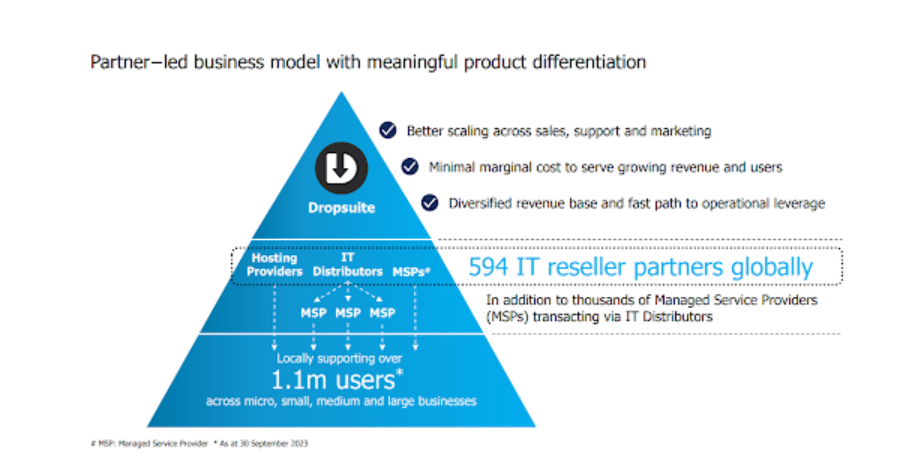

How Does Dropsuite Scale?Dropsuite generates its revenue primarily through a partner-led business model, focusing on Managed Service Providers (MSPs) who incorporate Dropsuite products within packages for clients transitioning to Office 365. The company’s organic revenue growth hinges on the collective efforts of its MSP partners, with expansion driven by both increasing the number of these partners and expanding their product sales. This strategy provides several advantages, such as enhanced scalability across sales, support, and marketing, minimal marginal costs associated with revenue and user growth, and a diversified revenue base, paving the way for operational leverage. Dropsuite’s global reseller partner network has grown significantly due to heightened demand in the data backup and recovery market.  Is Microsoft a Threat?Microsoft (NASDAQ: MSFT) recently announced the launch of a Back up and Archive solution to complement its release of Syntex. While always frightening when a global goliath like Microsoft enters the market it hasn’t phased Dropsuite’s management team. While Syntex includes a backup solution, Dropsuite offers an independent solution taking data from Microsoft’s ecosystem, encrypting it, and storing it on Amazon Web Services. This is in contrast to Microsoft’s backup which management believes primarily suits minor data retrieval needs and lacks comprehensive disaster recovery coverage. Furthermore, Dropsuite focuses on small and medium-sized businesses and mid-enterprises. The customers typically pay around $12 USD for Microsoft Office 365 and approximately $3 USD for Dropsuite’s backup and archiving services. The price points associated with Syntex’s data extraction and backup services range from $5 USD to $8 USD giving Dropsuite a price advantage. Dropsuite’s management team remain confident that its unique value proposition, cost-effectiveness, and focus on disaster recovery set it apart from Microsoft’s offerings, which primarily cater to a different segment of the market. Quarterly UpdateLast week the company reported its third quarter results displaying impressive growth. Dropsuite recorded Annual Recurring Revenue (ARR) of $33.4 million up 10% on the previous quarter and an impressive 44% on the previous corresponding period (PCP). Average Revenue Per User (ARPU) continued its strong growth, increasing by 9% Quarter on Quarter (QOQ) and 17% on PCP, reaching $2.57. Dropsuite’s gross margin remained stable at 68% which tends to be a little lower than traditional software companies on the ASX as it incurs storage costs. From a cash perspective the company generated $1.39 million in operating cash flow ending with a cash balance at 30 September 2023 of $4.6 million. Cash from operations benefited from a slight delay in Q2 receipts but it continues to show it may be at an inflection point given the consistency of its cash generation. In terms of partnerships, Dropsuite onboarded 35 new direct and 209 indirect transacting partners, expanding its network. User levels increased by 33 thousand for the quarter to 1.1 million paid users. This was despite the loss of a low ARPU legacy partner. To date, approximately 89k of these users have rolled off Dropsuite’s platform, and an additional 40k users are expected to be deactivated in Q4 FY23. The loss of the client was put down primarily to macro-economic challenges in the region of operation. With Dropsuite’s product priced in USD the depreciation of the client’s currency can have a material impact on the cost of the product. So what to do with this cash? The company remains committed to actively exploring strategic acquisitions. Dropsuite has made no secret of eyeing off opportunities that align with their existing business model. While they have encountered challenges with high valuation expectations, management is determined to make any potential mergers and acquisitions synergistic. Outlook & summaryWith a robust foundation of existing partners and a burgeoning pipeline of new ones, Dropsuite is poised to capitalise on industry tailwinds. The prevailing market forces of data security and evolving regulations, amidst the rising tide of cyber threats, provide an enormous opportunity. In our view, it’s not often you see a profitable technology business growing at these rates on the ASX.

Disclaimer: Dropsuite Limited (ASX: DSE) and Microsoft (NASDAQ: MSFT) are held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.

|