Author: Robert Swift

Don’t expect a ‘mea culpa’ from policy makers for 20+ years of ‘monetary policy for rich people’ but we are getting a shift in thinking and so off we go to the next experiment (or paradigm if you are in academia). This has implications for the kinds of stocks and sectors and countries in which you should invest. Incidentally, it’s not exactly the shift to a policy we expected, but it is probably better than repeating what has been done for the last 20 years, which always prompts the definition of madness.

We wanted and anticipated a shift from ZIRP to something a little more fiscal and supply side to encourage investment and jobs growth.

Article: When 1 + 1 Makes 3?

The fiscal stimulus we are getting ($4tn+ and counting) is pro cyclical not counter cyclical. This looks like a big increase in government spending and borrowing in conjunction with low short term interest rates, at a time when the economy is growing quite well. That’s quite a heady and unusual combination.

In the US economy ‘animal spirits’ seem to be stirring. Vaccinations are running ahead of other countries’ programmes (as Churchill said, the USA always invariably does the right thing but only after exhausting all other possibilities) and the tech embargo has produced a large planned increase in onshore SPE capital investment. Interestingly too, the Biden Administration has not (yet?) removed Trump’s ‘unnecessary and damaging’ tariffs on Chinese exports. We are thus in a ‘full on’ return to National Industrial Policy which will boost aggregate domestic demand and inflation expectations. [Build Back Better – Buy American]

Since ZIRP or Zero Interest Rate Policy hasn’t worked other than for those on Wall Street, or with lots of moolah to start with, we had expected a shift to fiscal policy and a normalisation of monetary policy which would potentially benefit Main Street – i.e. higher interest rates at the long end as the Fed began to reduce its interventions/QE, and letting bad financial decisions have their consequences rather than free put options and bail outs for Wall Street. This would be orthodoxy or certainly post 1980 Reagan orthodoxy from when large scale government intervention was deemed to be part of the problem, and private enterprise was less concerned about share buy backs and more concerned about sustainable growth through re-investment.

There really is no need for a large pro cyclical fiscal AND monetary stimulus other than if you think it’s time to throw out the old post 1980s playbook and try something new? Essentially the Reagan era orthodoxy looks to be out the window, and so off we go into what for many people will be the unknown. At this juncture let’s just say that quite a few global investors have careers that only encompass ZIRP….we are all about to be tested.

There really has never been any deflation as this chart from the Cleveland Fed shows. So, continued ZIRP with a big fiscal boost is inflationary.

- Infrastructure but a huge clean energy expansion with credits for Electric Vehicle purchases

- Incentives to return technology supply chains to USA soil

- Unionisation of the workforce to drive up wages relative to profits (not necessarily a bad thing given where they are now relative to history)

- Higher headline taxes (will the likes of AMZN actually pay them?) including a multi-national tax proposal which we view as essentially ‘soft form’ capital controls if it passes through globally.

So it’s a return to big government and centrally directed capital allocation or essentially the 1950s. We have christened this SPLURGE or Spending Public money Like U R Giving it Everything. The USA is a first world country with 3rd world infrastructure, so we view this spending on the national capital stock as an essential part of the US’ rebuilding process, and do like infrastructure companies as investments, but this has to be paid for AND inflation expectations can’t be let loose or we’re not back to the 1950s but back to the 1970s.

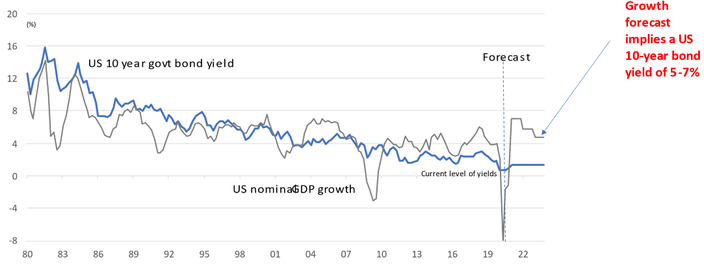

We see the USA as on a tightrope. One side is uncontrolled inflation as ZIRP + SPURGE are implemented but the productivity boost never happens, and the other side is bad or compromised legislation and no real fiscal boost but only more ZIRP which continues to fail Main Street. Rebuilding and recalibrating wages vs profits is essential for social cohesion so we like the fiscal plans – assuming SOME of it actually gets to where it should go. However, if inflation becomes even more visible than it is now and the Fed can’t ‘jawbone’ and persuade people to relax about the ‘temporary’ spike in inflation (eh? Ed), then treasury auctions become difficult. It was a poor treasury auction of 7-year notes that created the sell-off in Q1 and there are quite a few auctions coming up! If the long bond sells off too aggressively, we have the topic of yield curve suppression back again which is essentially capital controls.

Why?

At 100% debt to GDP, a 10-year note at 3% costs 3% of GDP just to service the debt. So that possibly won’t be allowed to happen? (For those of who think years and years of ZIRP and QE was a good idea, USA debt to GDP was about 50% in 2008. In other words you haven’t got a lot for your money.) Chairman Powell has subtly so far NOT mentioned YCC but if that long bond rises to the same percentage as nominal GDP, as it typically does, then watch out.

So, how to pay for it?

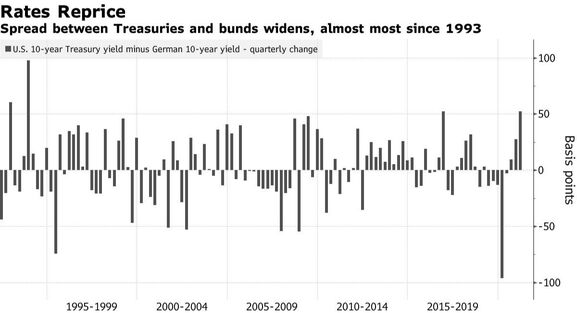

The USA budget deficit this year could be anything from 10-17% of GDP and it is highly likely that foreigners will have to buy some bonds since the US domestic savings pool is not big enough. To that end the rise in longer US rates relative to foreign rates is very helpful and a master stroke by the Fed.

Corporate tax rates are going up too and fiscal drag will also be used to raise taxes on the individual. We have loved the rallying cry to pay more tax at the higher rates, by the CEOs whose last few years have been spent aggressively minimising their global tax burden! Chutzpah.

Nonetheless, deficits will increase and you won’t be repaid as a debt holder in 2021 dollars when you redeem your bonds in a few years. Inflation has been mandated.

Here is what we are considering as investors:

- Cash is expensive. You will lose more by timing the markets in and out of cash, than by being diversified in risk assets

- Long term bonds will probably come under more pressure but if they hit 3% then they are attractive

- Corporate credit will do well as growth is run hot – we especially like Asian credit where the Chinese have begun to tighten, allow property loan defaults and generally restrained the potential consumer speculations they mistakenly allowed in the past. E.g. Ant Financial being regulated.

- Infrastructure equities – there is a LOT of technology in building a nation’s capital stock and connecting renewable energy to the grid, for example, is not straightforward but a speciality of companies like Quanta (PWR.NYSE) which we have owned for a while. Not as cheap as it was but as cheap as Facebook and it performs a (more?) useful service, so good on the ESG dimension.

- Clean energy companies like AES (AES.NYSE), NextEra Energy (NEE.ASX), TransAlta Renewables (RNW.TSE) and Johnson Controls (JCI.NYSE) which specialises in reducing ambient heat generated by the built environment.

- Industrials such as Schneider (SU.EPA), Cummins (CMI.NYSE), ABB (ABBN.SWX), Emerson Electric (EMR.NYSE), Eaton (ETN.NYSE), Ebara (6361.TYO)

- Materials companies – BHP (BHP.ASX), Rio Tinto (RIO.ASX), CRH (CRH.LON), Heidelberg Cement (HEI.ETR), Anhui Conch Cement (600585.SHA), China Lesso (2128.HKG)

- True technology especially in the SPE space such as Advantest (6857.TYO), NXP Semiconductors (NXPI.NASDAQ), KLA (KLAC.NASDAQ)

- Smaller Asia companies are particularly attractive relative to elsewhere – cheap, growing and with better governance. We have an Asia Small Companies strategy which has been running for over three years now