EML Payments Limited (ASX: EML), a global leader in payments solutions, is in the midst of a strategic overhaul. With the release of its FY24 results and a thorough investor briefing, EML is making significant strides toward a brighter future. The company’s focus on debt reduction, operational efficiency, and renewed growth signals a positive transformation that could redefine its trajectory.

Strong FY24 Results and Strategic Milestones

EML’s FY24 results brought much-needed optimism to investors- although that wasn’t readily seen from the share price reaction post the results. The standout figure was an underlying EBITDA increase of 34%, reaching $57.1 million, at the higher end of guidance. Revenues rose 18% to $217.3 million, fueled by a 6% bump in customer revenue. This growth was particularly evident in EML’s General Purpose Reloadable (GPR) and Digital Payments segments. This performance is largely due to EML’s focus on cost optimisation and its success in securing new business toward the end of FY24. Notably, the company’s regulatory remediation in the UK has been completed, removing growth cap restrictions, which now allows EML to expand in this key market.

Key Segment Performance: Gifting, GPR, and Digital Payments

All three of EML’s major segments—Gifting & Incentive, General Purpose Reloadable (GPR), and Digital Payments—performed well in FY24 although were skewed to the 1H, showcasing the company’s ability to diversify its revenue streams.

- Gifting & Incentive: Gross Debit Volume (GDV) increased by 5% to $1.8 billion, with revenue rising 9% to $81.5 million, driven by the success of corporate incentive programs.

- General Purpose Reloadable (GPR): A core business area for EML, the GPR segment saw a 3% rise in GDV to $7.8 billion, and customer revenue grew by 7%. This was largely due to strong demand in the government and human capital sectors.

- Digital Payments: Recorded a 19% increase in GDV, reaching $236.8 billion. This was supported by EML’s Sentenial business, which has now been fully divested in early September and removes a loss making and non core division from the group.

Sentenial Sale: A Game-Changer for EML’s Balance Sheet The sale of Sentenial, including its Nuapay business, to GoCardless for €32.75 million (~AUD $53.4 million) has been a transformative move for EML. This transaction allowed the company to shift from a net debt position of $48 million to a net cash position of approximately $5 million post FY24 balance date. There is an additional earnout kicker for EML if Sentenial delivers better growth than expected next 12 months. This improved liquidity provides EML with the flexibility to focus on its core operations and invest in new growth areas. Additionally, the company now has access to a $70 million debt facility, giving it further financial headroom for future initiatives.

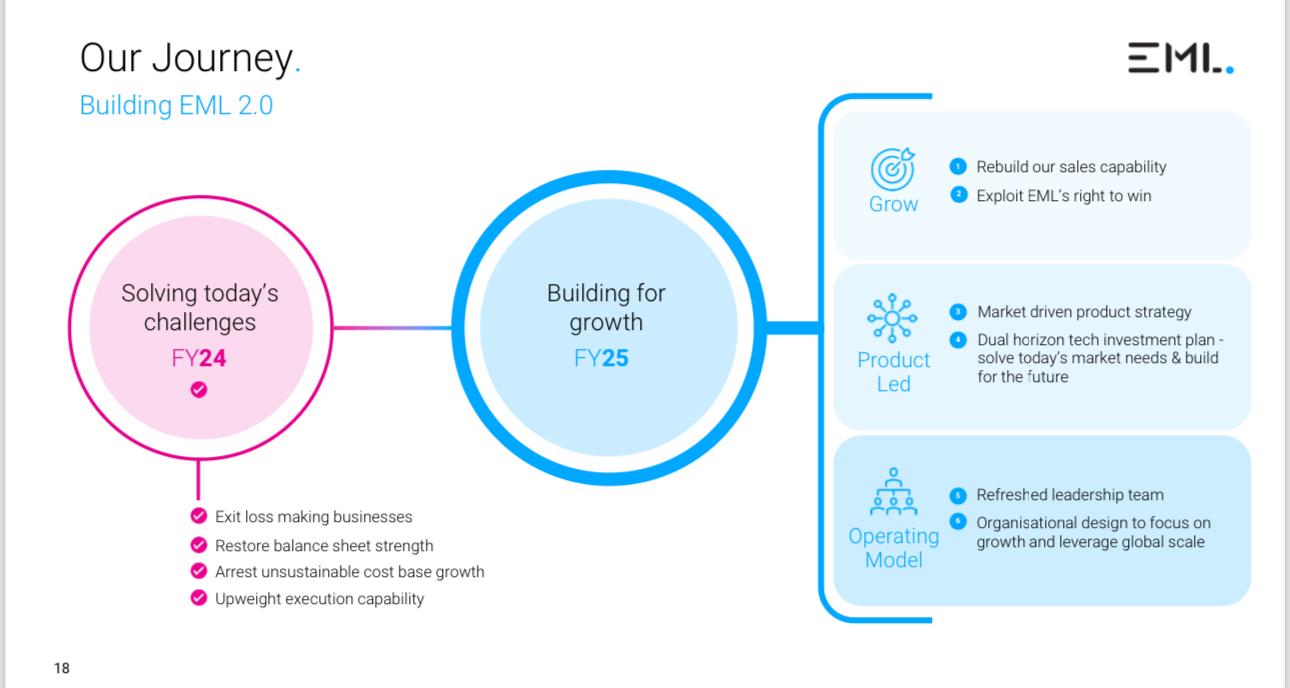

Future Growth Strategy: EML 2.0

Under the leadership of CEO Ron Hynes, EML’s “EML 2.0” strategy focuses on three core areas:

- Reinvigorating Growth: EML is doubling down on organic growth, enhancing its sales and go-to-market strategies to expand its customer base, particularly in the UK, where growth restrictions have been lifted.

- Product-Led Innovation: The company is aligning its product roadmap with evolving customer needs, leveraging data analytics and artificial intelligence to offer more innovative payment solutions.

- Uplifting Organisational Capabilities: EML is streamlining its operations and bringing in new talent to ensure its growth strategy is executed effectively. Key hires in sales and other critical areas are expected in the near future.

Customer Churn: Addressing North American Challenges

While EML’s outlook is generally positive, challenges remain, especially in North America, where customer churn has impacted performance in the shopping mall gift card division. This churn is attributed to the financial difficulties of certain customers. However, EML is rebuilding its sales pipeline and improving customer retention strategies to mitigate these challenges.

Long-Term Outlook and the Road Ahead

Looking ahead, EML’s guidance for FY25 estimates underlying EBITDA between $54 million and $60 million which compares well versus the $49 million EBITDA for FY24 excluding PCSIL contribution. The company will focus on cost optimisation, responsible growth, and technology investments as part of its long-term strategy. EML is expected to provide a more comprehensive medium-term strategy at its November 2024 AGM, giving investors more insights into its future financial and operational metrics. We believe this will be a key catalyst for the trajectory of the stock in the short term. With regulatory challenges behind it, a revitalised leadership team, and a strengthened balance sheet, EML is well-positioned to take advantage of the growing global payments market.

The Tamim Takeaway

EML Payments has made meaningful strides in its turnaround journey, with FY24 results indicating a stronger financial position and a more focused growth strategy. The sale of Sentenial and the lifting of growth caps in the UK are critical milestones that set the stage for future expansion. While challenges like customer churn remain, EML’s strategic initiatives provide confidence in its ability to deliver long-term value to shareholders. Trading on an undemanding 4.8x EV/Ebitda, we believe a takeover of EML in the near term is likely. _______________________________________________________________________________________

Disclaimer: EML Payments Limited (ASX: EML) is held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.