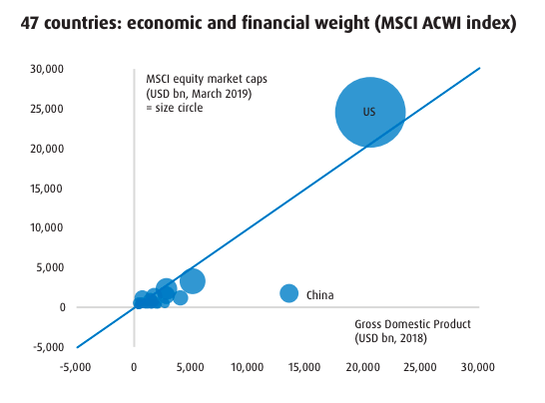

China has been rapidly growing their domestic economy through ongoing urbanisation, which is projected to rise to 70%. As most are probably aware, there have been increased political tensions surrounding China, causing an isolation of China’s economy and increased concerns about political risk when it comes to investing in Chinese companies. Our Asia Small Companies portfolio only invests in Chinese companies that are listed on the Hong Kong Stock Exchange to somewhat mitigate these risks. The negative attention surrounding China has led to cheaper valuations of Chinese companies which is creating a huge opportunity for investors to capitalise. To give some perspective, the US accounts for 25% of the world economy and has a 65% world cap weight compared to China who account for 15% of the world economy but only have a 1% world cap weight.

Xinyi Glass (0868.HKG)

Xinyi Glass is a glass manufacturing company headquartered in Hong Kong providing high-quality float glass, automobile glass and energy-saving architectural glass. Xinyi has a sales network covering over 130 countries and regions around the world. Float glass currently represents 67.5% of Xinyi’s revenue with automobile and architectural glass making up the remainder. Xinyi’s share price is up 224% in the past year and expects their net profit to increase by 260-290% due to current glass supply dynamics.

The EV Tailwind

Automobile production is starting to gain some traction due to the increased production of electric vehicles. Emissions mandates are putting more pressure on car companies to shift away from combustion engines while the general sentiment towards clean energy has also shifted and this is enticing a race for practical and scalable electrification for auto manufacturers. This is a tailwind for Xinyi’s automobile glass business given their key customers include Volkswagen, Ford and General Motors, all of whom are investing significant capital towards developing electric vehicles.

New Plant in Malaysia

As mentioned before, with the increased isolation of China’s economy, many Chinese companies have chosen to list in Hong Kong as opposed to Beijing as well as establish overseas production plants to maintain and expand their exporting capabilities. Xinyi established a plant in Malacca, Malaysia which spans over 444 000 square metres. This plant is essential for Xinyi increasing both their domestic and international market share. The Malacca plant will feed product into international markets, allowing more of the domestic production in China to stay in the home market.

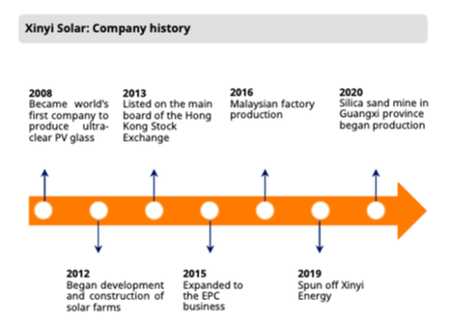

Xinyi Solar Holdings (0968.HKG) is the world’s largest solar glass manufacturer, trading on the HK stock exchange with Xinyi Glass owning 23% of the company. Xinyi Solar has been benefitting from the roaring solar panel industry, projected to reach $223bn by 2026 growing at a CAGR of over 20%. Xinyi Solar recently announced guidance of a 100-120% increase in net profit for the half year ended June 2021, they have significantly expanded their production capacity and are benefiting from the incentive programs in place to reduce emissions thus increasing demand for their solar glass. Xinyi Solar is currently trading at about 10x EV/EBITDA and are paying a 1.64% dividend yield.

Thesis

Simple, Xinyi Glass has been the biggest benefactor of tightened glass supply and they are ramping up production to fully capitalise. Their half year guidance puts them at an EV/EBITDA ratio of approximately 12.3x (a conservative estimate given that their holdings in Xinyi Solar and Xinyi Energy combined are worth over $33bn HKD), a compelling metric with their 200%+ increase in NPAT. Xinyi also stands to benefit from the shift towards cleaner energy through their automobile glass segment which will see increased demand on the back of electric vehicle production and through their holdings in Xinyi Solar. Management have announced share buy back programs and have already bought 1% of the total shares outstanding since March, showing great confidence in the company and something which has been reflected in the share price.

Lien HWA (1229.TPE)

Our next stock is Lien HWA Industrial Corporation, a Taiwan-based company mainly engaged in the processing and distribution of wheaten food products. These wheaten food products include flour, wheat bran and pasta, amongst others. The company operates a number of business operations, including a leasing segment which operates real estate leasing and a development business. While they started off as a flour producer they are now a holding company and the hidden gem is their 73% stake in MiTac, an innovative electronics business that is driving Lien’s profits.A feature we like of the Taiwan stock exchange is that companies must report their sales figures monthly, providing greater transparency to shareholders and giving us more timely information to make investment decisions.

The Hidden Gem: Subsidiary MiTAC

MiTAC is a provider of smart technologies, electronics and cloud services. MiTAC is looking to capitalise on the emerging thematics of IoT, smart cities and autonomous vehicles, something we touched upon in a previous article. To capture these markers MiTAC also provides integrated hardware and software solutions including dashcams, smart cameras and navigation systems to the automotive industry. These products also tie in with their connected car and smart city solutions. MiTAC currently accounts for around 50% of Lien’s earnings, recording $11b TWD of revenue for the first quarter.

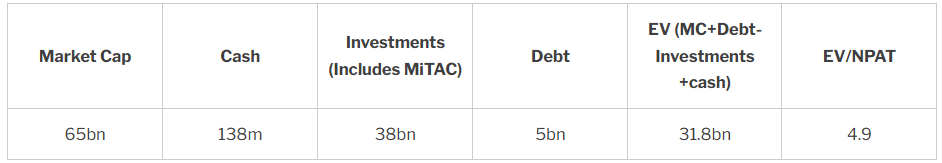

Lien HWA Property Development is a subsidiary company, established in 2019 from the real estate & leasing division of Lien HWA Industrial Corp, with management and development of company-owned real estate across Taiwan as its core business. A special unit has been established in conjunction to provide professional services to meet customer demands including real estate leasing, assets enablement and value-added developments. The property development segment further diversifies Lien’s revenue mix and currently accounts for 4% of their revenue. Lien holds around $4bn TWD worth of property.ThesisRIght now there are very few analysts covering Lien. Lien HWA is a misunderstood company and, just like some of the Asian markets in general, it has hidden gems that aren’t being appreciated to the extent they should. Lien HWA may look like a simple flour business but it is actually a flour business with a key stake in an innovative electronics business as well as an established real estate business. Lien HWA presents an extreme value proposition with the growth upside of a tech company targeting emerging thematics. We see MiTAC continuing to drive Lien’s earnings, benefiting from autonomous vehicles and smart cities given their IoT and connectivity offerings. Lien is currently sitting on a 5.8% dividend yield and distributes both a cash and stock dividend.