DGL Group (DGL.ASX)

Author: Ron Shamgar

Author: Ron Shamgar

DGL is a well-established, founder-led, end to end chemicals business that manufactures, transports, stores and manages the processing of chemicals and hazardous waste. The company operates a network of sites, both owned and leased, across Australia and New Zealand.

The key operations of the group include:

- Formulation and manufacturing of specialty chemicals

- Collection, transportation, storage, and logistics

- Treatment, recycling and disposal

The company was listed in May of last year, raising $100m.

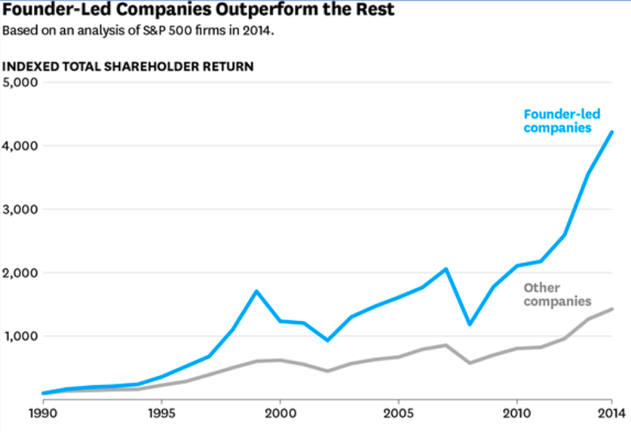

When assessing the merits of a company’s management team it can often be positive if you discover they are a founder-led business. There have been numerous studies about founder led companies and why they tend to outperform. Founders are typically more aligned with shareholders, usually having a significant amount of their own wealth tied up in equity. This alignment makes them more of an owner of the business which deters them from diluting shareholders.

Founders have been found to have a front line obsession. This typically shows up in a love of details and a culture that values those at the front line of the business. Employees at founder led companies typically feel more engaged. Bain & Company’s research found that engaged employees are 3.5x as likely to solve problems themselves and invest personal time in innovation as unengaged workers.

Founders also have more attachment to the company than your typical CEO. After all, the success of the business is essentially their legacy; it’s “their baby”. Founders are typically more prudent with accounting methods and capital allocation; a good example is DGL’s prospectus forecasts (see below). They were extremely conservative and ended up being exceeded by quite a margin. Many of the biggest tech businesses of the last couple of decades have been founder-led; think Apple, Microsoft, Amazon, Facebook, Tesla etc. While they aren’t a tech company, Andrew “Twiggy” Forrest deserves a special mention here in Australia. Given all of the above, we are starting to see a number of venture capital (VC) funds, Andreessen Horowitz for example, voice their preference for investing in companies where the founder is the CEO. DGL’s founder and CEO, Simon Henry, currently holds 53% of the company and recently bought another 500,000 shares for a consideration of $1.43m!

M&A Strategy

As part of DGL’s ambitious growth plans, they are embarking on an aggressive M&A strategy. During the half, DGL made seven acquisitions and all have been integrated well so far. DGL is looking to acquire companies that will unlock cost synergies for the group as well as broaden their services to create cross-selling opportunities. The more businesses they acquire, the more clients they acquire to cross sell to. A good example is recent acquisition Australian Logistics Management (ALM), which offers safe and reliable transport for dangerous and hazardous materials, focusing on sampling, specialised packing, compliance, and freight service of product samples. This acquisition expands DGL’s service offering while also giving them the opportunity to cross sell this service to existing clients. DGL is also looking to acquire properties to establish their processing facilities, as seen recently with their acquisition in Rocklea, QLD. It isn’t easy to build the infrastructure required for chemical and waste management on leased sites so DGL will continue to acquire properties to facilitate its growth strategy. DGL have typically used a mixture of cash, debt, and scrip to make their acquisitions; they like including scrip to ensure the acquiree remains aligned with DGL.

Outlook

The advantage of being an incumbent in the chemical waste industry is that there are very high barriers to entry. The CAPEX required to start operations is high, it is expensive and quite difficult to obtain the licences required to operate in the sector. DGL has a broad portfolio of licences, accreditations, and regulatory approvals which are hard to replicate.

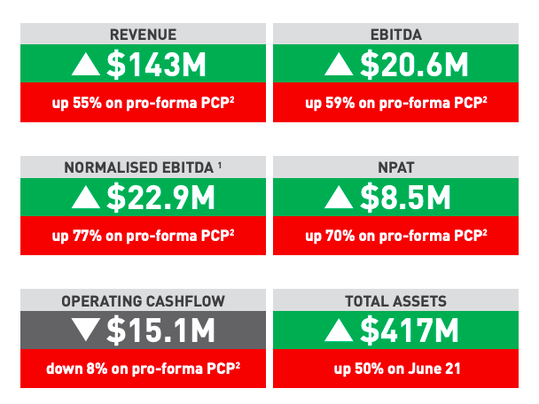

DGL has far exceeded its FY22 prospectus forecasts; they released FY22 guidance of $343m revenue and $54m EBITDA compared to the prospectus forecast of $210m revenue and $29m EBITDA. DGL has a huge pipeline of M&A opportunities and will continue to acquire more companies in the half; they still have 25% of their borrowing facility unused and are happy to go to a leverage ratio of 3x (currently at 2x). Most of DGL’s targets to date have been fairly small so a larger acquisition could get a lot more attention from the market.

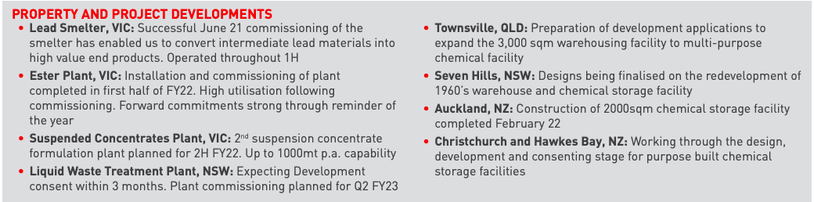

DGL currently has nine projects under development, some of which have been completed in February with others expected to be completed some time this year. These developments will significantly improve their chemical storage and manufacturing capacity.