Ron Shamgar provides an update on a number of the companies held in TAMIM’s Australian equities portfolios.

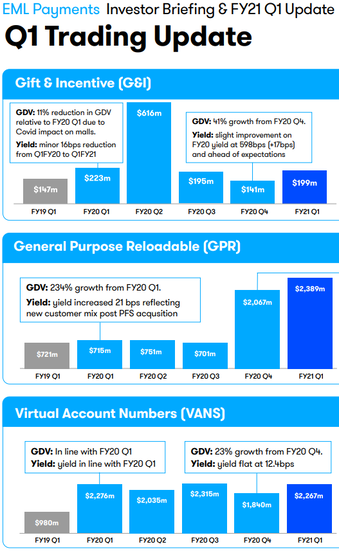

EML Payments (EML.ASX) provided a trading update for Q1 with revenues of $40m and EBITDA of $10m. EML’s transaction volumes have recovered strongly since the depths of the pandemic crash with GDV and revenue increasing +20% on Q4. The Gift & Incentive (G&I) segment was only down 11% on last year as shopping malls reopened globally. There is still uncertainty for investors as the Q4/Christmas period still is a key seasonal driver of earnings for the gift card segment with an incremental $19m of profit generated in the November/December period.

EML is currently annualising over $60m of EBITDA based on last year’s seasonal peak, which is over 10% higher than consensus expectations. Our discussion with management in November points to steady volumes so far. There is a decent possibility that we see consensus analyst upgrades come in February next year.

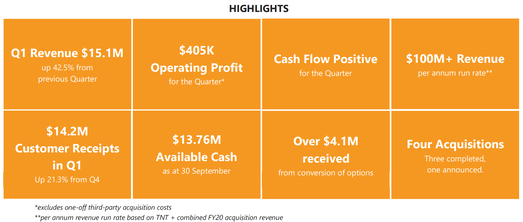

Tesserent (TNT.ASX) is now officially an “8x bagger” for us since we bought in at 5 cents last year. The company continues to aggressively acquire cyber security firms in Australia but, more importantly, is winning new contracts organically which shows that the strategy is working so far. TNT provided the market with a bullish update in October, Q1 revenue was up 42% to $15m and annualised revenue run rate in excess of $100m.

The company is cashed up and now profitable. In addition, management has given a new annualised revenue target of $150m by June next year. Investors have responded well with the stock hitting our valuation of 40 cents during the month. We took the opportunity to continue taking profit. We expect more acquisitions and probably an expansion overseas. Based on their June forecast, we value TNT closer to 50 cents.

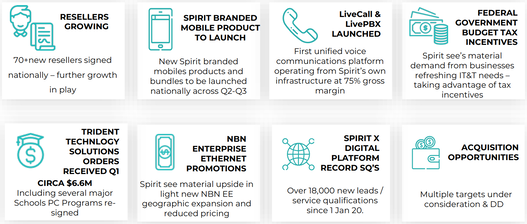

Spirit Technology (ST1.ASX) provided a Q1 update with revenue up 150% to $15.6m, 70+ new resellers signed and $30m of cash and debt for further acquisitions. We expect a deal to be announced before Christmas and we see greater focus on enhancing the company’s cyber security offering. We expect ST1 to finish FY21 with an exit run rate of $150m of revenues and EBITDA in excess of $22m.

Source: ST1 company filings

The business is operating in two segments of the market where we are seeing strong customer demand and consolidation (Telco/IT and Cyber Security). We believe management aspirations are to crystallise value for shareholders via a transformational transaction in the next couple of years. We value ST1 at over 50 cents.

AVA Risk Group (AVA.ASX) is a technology company compromising of AVA Global, providing risk management and logistics solutions, and Future Fibre Technologies, providing security solutions through electronic locks and fibre detection technologies. We took a position in AVA mid-year at 15 cents as we saw a new management team turn the business around and reduce costs while growing revenues. During October, the company provided a robust Q1 update with revenues up 73% to $17m and EBITDA up 522% to $7.7m. The company is cashed up with a net cash position of $11.5m.

We estimate FY21 EBITDA of $20m and a cash balance of $25m. The company has a strong pipeline of new business opportunities of which management expects to win a large share. In addition, the services division is looking to participate in ongoing industry consolidation and we believe a possible sale of the business could yield $40m+. The stock is now up 4.5x since we bought and we have taken the opportunity to take profit. The next catalysts to watch for are contract wins and corporate activity.

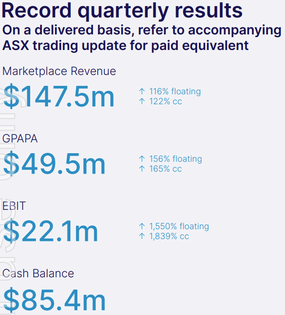

Redbubble (RBL.ASX) provided a strong trading update for Q1 that saw sales up 116% to $148m and EBIT of $22m with strong free cash flow generation of $27m. The business’ cash balance is at $90m. Historically, Q1 accounts for 22% of annual revenues so, on the current run rate, RBL is on track for EBITDA of $120m in FY21. The market is currently pricing in $70m. We track RBL’s global web ranking regularly as it’s a good measure of its growth trajectory over time.

|

|

|

Based on the data at hand and a seasonally strong Q2 sales period, we expect the next update to be very strong and well received by investors. RBL is currently the fastest growing and most profitable cash generating e-commerce company on the ASX, yet trades at a material discount on all metrics to its local and global peers. The recent CEO sell down of shares has dampened sentiment for the stock but we see this as a buying opportunity on a longer term basis. Our valuation is currently $7.00+.

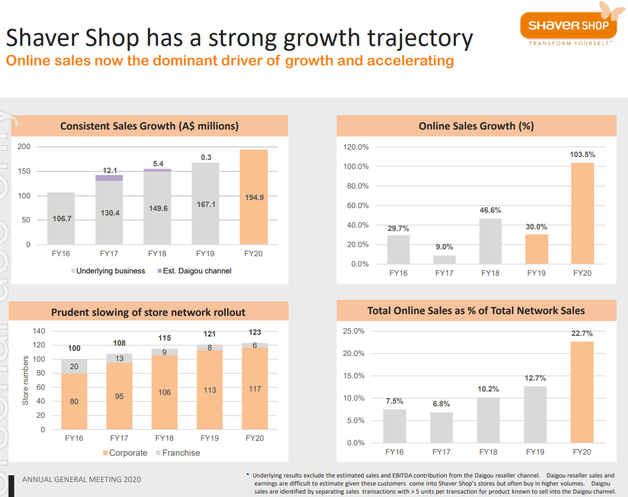

Shaver Shop (SSG.ASX) provided a stellar first quarter update with sales up 20% to $49m, online sales growing 192% (now 33% of group sales), and NPAT up 185% to $4.9m. For perspective, SSG reported $11m profit for the whole of last year! Unlike many other retailers, SSG never received JobKeeper. We see the company benefitting from the structural shift online as consumers are still discovering the Shaver Shop brand.

We believe the company is taking market share away from traditional brick and mortar retailers and department stores. The personal care market in Australia is worth $11bn and we believe SSG will continue to grow and take share for the next few years. The stock is trading on an estimated 9x PE and a 7% fully franked yield. We see the 2H sales momentum as key for the stock to rerate to a multiple that is more reflective of its growth rates, a quality cashed up balance sheet and relative peer valuations. We value SSG at $1.50.

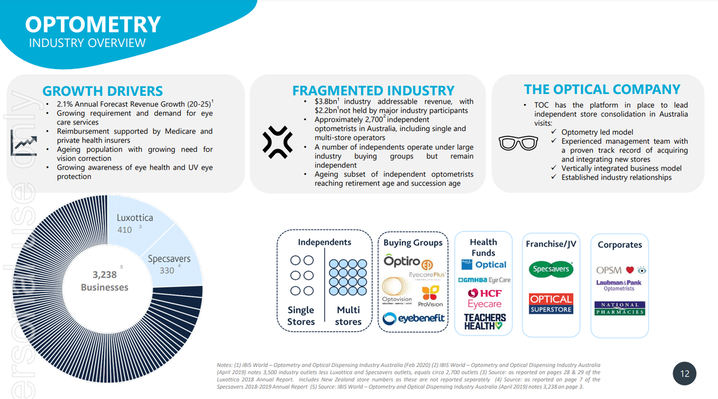

Healthia (HLA.ASX) announced a transformational deal to acquire the Optical Company for $43m. The business generated $36m and $5.7m EBITDA last year and diversifies HLA into the highly fragmented and defensive optometry sector. On a combined basis, the group is now a substantial allied health company with $180m of revenues and $30m EBITDA in FY22. Since listing, HLA management has delivered on expectations and has shown to be disciplined in its progressive acquisition of podiatry and physiotherapy clinics.

Pleasingly, the organic growth rate was 11% in Q1 showing that the business is not just growing via acquisition. The stock is currently trading on 5x EV/EBITDA, 8x PE for FY22 and has a 5% fully franked dividend. We believe the stock is now in the crosshairs of most fund managers based simply on scale and the market cap exceeding $100m. We expect a significant rerating of the earnings multiple in the next few months. HLA is a conviction holding and we value it at $2.25.

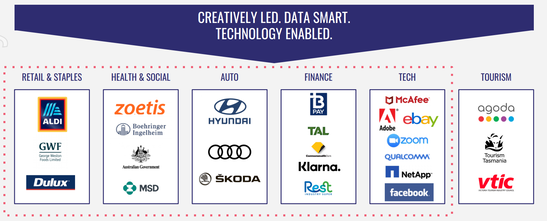

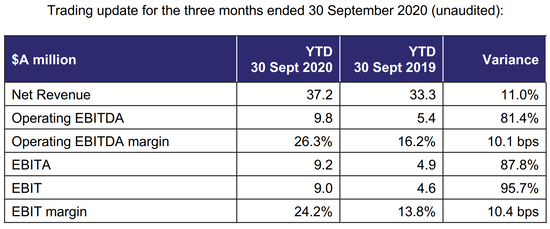

Enero Group (EGG.ASX) is a digital marketing and creative brand agency with offices in Australia, US and UK. The company is not being impacted by the reduced media and advertising spend experienced by peers as the majority of their customers are either in defensive sectors, such as fast-moving consumer goods (FMCG), and technology companies, which are prospering. The Q1 update released in October was almost jaw dropping with revenues up 11% to $37m but EBITDA up 81% to $9.8m (this number includes $1m of JobKeeper).

Source: EGG company filings

Underlying EBIT margins are now an industry best at 21%. Although revenue visibility for EGG is short, management expects Q2 to remain strong. The business is cashed up and we expect dividends and further acquisitions next year. We forecast 25 cents EPS and 15 cents of franked dividends. We took the opportunity to acquire shares as some long term stale holders have lost patience. We value EGG at about $2.50.

CML Group (CGR.ASX) provided a trading update and a digital rebrand to Earlypay. Management are trying to digitally transform the company from an “old world” invoice financing business to a “new world” fintech. The acquisition of Skippr has enabled the company to accelerate its onboarding capability of smaller sized clients from two weeks to 24 hours. This should see growth rates accelerate in future.

Pleasingly, the Q1 update is showing invoice volumes rebounding to FY20 annualised run rate levels of $1.7bn, although at a reduced margin due to customers repaying earlier than usual due to government stimulus assisting small businesses. The equipment finance segment is doing record lending of $3.5m per month with the loan book now at $100m. With their new fintech name and the business expected to return to growth mode in FY22, we believe CGR will slowly be rerated by the market and the takeover activity from earlier this year may resume. We value CGR at 55 cents.

Disclaimer: All stocks highlighted in this article are held in TAMIM portfolios.