Some of the best opportunities on the ASX in recent times have been microcaps. Companies where the business models are scalable, management have a track record of execution, and, more importantly, companies that are well funded. Altium and EML, as best-case examples, were sub-$50m microcaps just 7-8 years ago and are multibillion dollar businesses today.

Authors: Ron Shamgar

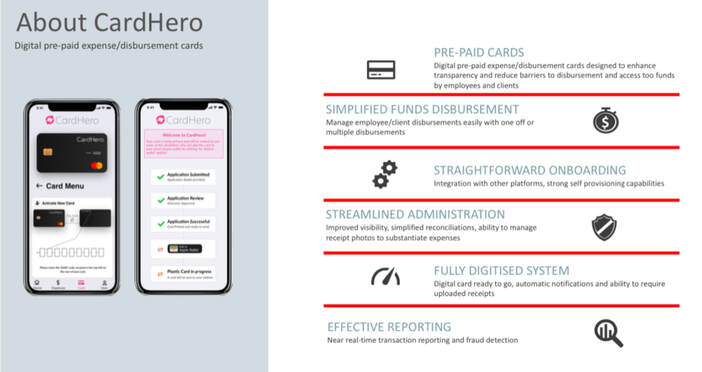

8common (8CO.ASX) is a software business in expense management, specialising in the government and not for profit sector. The software allows employees to claim work related expenses. It has 10% market share of the Australian market and an even larger share of the government sector. 8CO will be a beneficiary of the recommencement of travel and it has recently added over forty government departments to the platform. 8CO also recently launched a new card payments solution called CardHero, being utilised for segments of the $4.8bn National Disability Insurance Scheme (NDIS) program, as an integrated fund disbursement and spend management option. CardHero is designed to help prevent fraud by instantaneously accepting or rejecting transactions as they are made. CardHero is exciting for investors because the ARPU is 6x higher and the addressable market is significant. A broker recently initiated coverage on 8CO at a valuation of 50 cents.

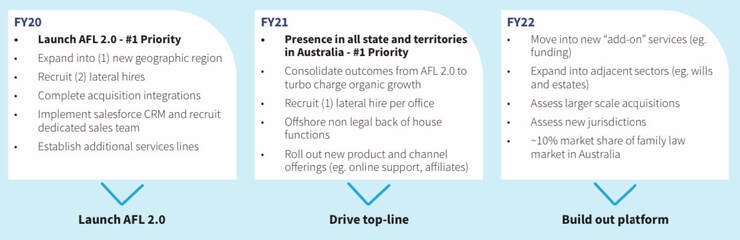

AF Legal (AFL.ASX) is a family law roll up story. In a defensive and highly fragmented industry, the company is aspiring to become the largest family law firm in Australia. AFL is growing laterally by both adding new recruits and through the acquisition of existing firms. The recent deal to acquire NSW based Watts Mcray adds scale with $6m revenues and we estimate $2m of EBIT post-synergies. We estimate that AFL is on track for EBIT of $5m in FY22. The company is very cash generative and capital light. On a decidedly somber note, there is little doubt that AFL has benefitted from the spike in divorce rates due to Covid hardships. On the lighter side, some investors regard AFL as a hedge against their own future potential divorce bill! If they can execute in line with our assumptions, we value AFL at $1.50.

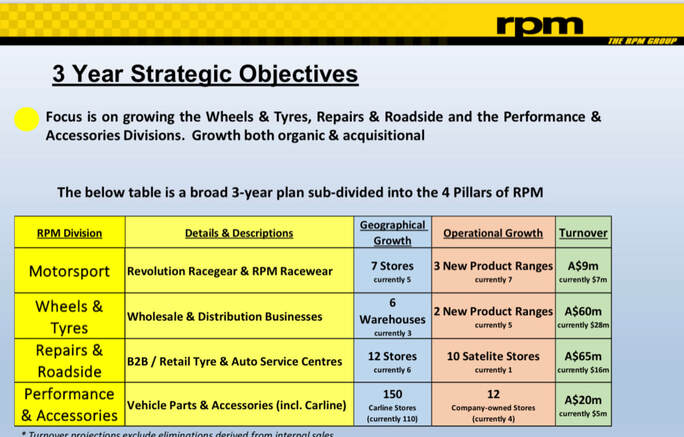

RPM Group (RPM.ASX) is an automotive group similar to ASX listed Bapcor. RPM business includes the selling of tyres, motorsport apparel and has mechanical repair shops. Similar to AFL, RPM is an acquisitive roll up story. Guidance this year is for revenue of $55m and EBITDA of $5m. The management has signaled three acquisitions currently in the pipeline that should take the group to $100m in revenue once completed. In the medium term, group aspirations are for $150m business and 10%+ EBITDA margin. RPM is a Covid beneficiary too. The domestic travel thematic, elevated due to national border closures, and the reduced public transport usage working in their favour. The founders of RPM have a track record of previously building a similar business and selling it for $35m (to Bapcor) in 2015. We believe their current ambitions are significantly greater than last time around. If RPM can achieve $100m revenue then we value the group at approximately 3x the current share price, putting it around the 90c mark.

Disclaimer: All three stocks are held in TAMIM portfolios.