Sky Network Television (Dual Listed: SKT.NZX & SKT.ASX)

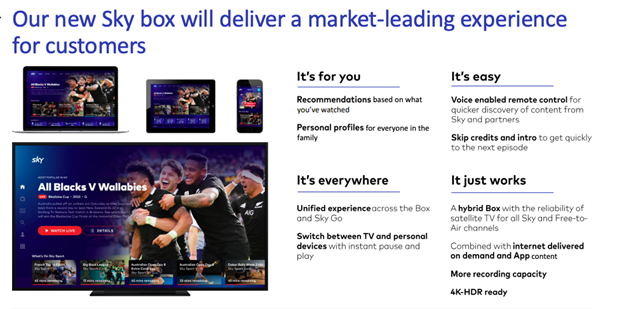

Sky box is NZ biggest pay television service with 566k customers. To get a Sky box you need to be a Sky starter member which costs $26 a month, from here you can stream these channels on any device and can add more channels, such as sport. Like Seven West Media (SWM.ASX), Sky Sport had rights for the Olympic games and provided a much more comprehensive coverage compared to free to air coverage; this would have been a big tailwind for Sky box customers, specifically increased sales of the sports package. Sky Sport also has exclusive rights for All Blacks and Super Rugby games, a huge draw card in NZ. Sky also became the owner of global streaming app Rugbypass which has a reach of over 40m people a month.

Broadband

Sky Network’s latest venture has been establishing a broadband service to provide households across NZ with high quality broadband. The broadband offering is a big value add and a huge cross-selling opportunity. The pricing structure will favour existing Sky customers at $80 a month. SKT is aiming to provide broadband to at least 8% of Sky box customers; if they achieve this it will add approx. 53m of ARR to SKT (that’s using conservative estimates). Sky made a strategic partnership with Vocus New Zealand to provide the internet network, with Vocus providing technical expertise and the network backhaul.

Improving Balance Sheet

Earlier this year SKY retired $100m of debt using existing cash reserves; this will increase bottom line earnings by about $5m. They have also been divesting assets. They sold their OSB assets (outside broadcasting) and are in the process of selling two out of three of their site buildings located in Mt Wellington, a smart move given the shift to working from home. These divestments should build a decent net cash position on SKT’s balance sheet.

Personnel Changes

SKY has changed up their management team, something that can really turn a business around especially in the microcap space. They have appointed Keith Smith to the board. Smith is chairperson for Goodman Group (GMG.ASX), one of the best performing REITs on the ASX. They have also appointed the Chief Commercial Officer, Sophie Moloney, as CEO. In addition, they have appointed a new Head of Investor Relations while Andrew Hirst has stepped into the interim CFO position as they look for someone permanent. Sky is in need of a big turnaround and the company looks to be heading in the right direction after these executive changes. They are now heading into a significant net cash position and are now debt free; the new management team should have a strong balance sheet to create significant shareholder value.

Capital Management

Given that Sky should be entering a huge net cash position, management will have some important capital management decisions to make and, with FY21 results released at the end of the month, we should have more clarity as to what they will be doing. We see a share buyback as the best way to return capital to shareholders, as opposed to dividends, given the share price is close to an all time low. Sky could retire a significant amount of shares for a small consideration. At a share price of $0.15, Sky can buy back more than 10% of the shares on issue for less than $30m.

Thesis

Sky has been unloved but we can see SKT being a great turnaround story. They have a fresh management team and, after they finish divesting their property portfolio, they will have a huge net cash position which can be used to drive the share price through share buybacks. They are currently sitting on an EV of around $230m (this does not include the sale of their OSB and property assets) and their guidance for FY21 is approx. $170m EBITDA which would put them at an EV/EBITDA of circa 1.35x, a figure that seems too good to be true for most investors. Another key development is that SKT has received a number of approaches around potential transactions. Sky has appointed Jarden as an advisor for these matters and we wouldn’t be surprised to see some corporate action here given how cheap SKT shares are at the moment.

Seven West Media (SWM.ASX)

Google and Facebook Deals

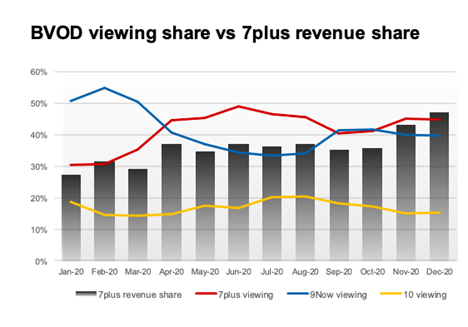

SWM has recently signed deals with Google and Facebook. The agreements bring the premium news content Seven produces from newsrooms across Australia to Facebook and Google. In their most recent trading update SWM said they expect their digital earnings to contribute $60m of EBITDA for FY21; with these deals in the bag they should add around $60m of incremental revenue in FY22.

Capital Management

Seven have been focusing on cutting costs, reducing debt and divesting non core assets. They achieved a $35m cash saving from the Olympics, existing content agreements and Cricket Australia. They have been retiring huge amounts of debt ($195 m in the second half to date) with more repayments to follow, substantially reducing their interest payments. They have reduced Net Debt from over $400m to approx. $275m. SWM have sold their WA newspaper business, Pacific newspaper business and their Osborne Park facility for $75m. SWM have strengthened their balance sheet position significantly and can now start to think about returning capital to shareholders, whether that’s through dividends or share buybacks remains to be seen.

Thesis

SWM have been a big winner from the latest lockdowns and benefited significantly from having Olympic coverage, growing their user base substantially. They have the winter Olympics next year and the Ashes at the end of the year to hopefully retain users. The management team have been very conservative and are focused on reducing net debt. SWM will soon be in a position to resume paying dividends and pursue M&A opportunities. They are trading at an EV/EBITDA of circa 4x. When compared to NEC (as above), Seven West looks like a far better opportunity with more upside.

NZME (Dual Listed: NZM.NZX & NZM.ASX)

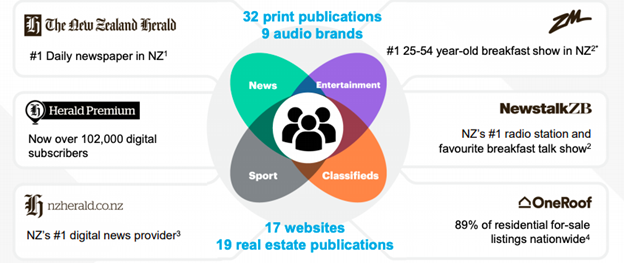

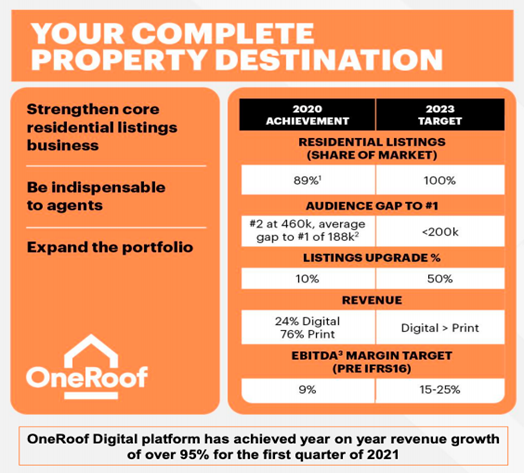

Unlike Australia, NZ has no truly dominant online players in property listings. NZM’s OneRoof is the number one residential listing site in Auckland, it has the potential to replicate the Australian success of Domain and REA Online in the NZ market. OneRoof is NZM’s hidden gem; they have been doubling their revenues. 89% of NZ residential properties for sale are listed on OneRoof. NZME are aiming to provide a complete property destination and are targeting an EBITDA margin for this segment of 15-25%. A business like this would typically trade at much higher multiples than what their parent NZM is trading at.

As mentioned, NZM’s print business is declining (as expected) but they have been aggressively cutting costs to maintain margins through a workforce restructure. NZM are in the process of selling their ecommerce platform, GrabOne, which could push them into a net cash position. They are focusing on converting their customers to digital subscribers which is not only cost effective but gives them an opportunity to add value. They are growing their audio brands and realising their opportunity to become the leading property listing platform in NZ through OneRoof. Their strategy doesn’t require any significant capex but if a value accretive acquisition opportunity were to come about they will consider it.Dividend PolicyNZME intends to pay 30-50% of Free Cash Flow in dividends subject to being within its target leverage ratio and having regard to NZME’s capital requirements, operating performance and financial position. The target Leverage Ratio of 0.5 to 1.0 times rolling 12 month EBITDA. NZM’s leverage ratio was 0.6x in H120 and we expect it to be within the range in FY21, allowing NZM to resume paying dividends. In CY2020 NZM’s free cash flow was around $40m (excluding government grants); if they were to pay 30-50% of this in dividends, their yield would be 6-10%.

Thesis

The thesis here is fairly simple. NZME are the market leader in news coverage in NZ, they have huge market share in all areas of media and are best positioned to be the market leader in residential home listings through OneRoof. They run a very profitable business, recording $67m of EBITDA in CY20. They have over 2.4m digital monthly users but only around 50k are monetised. Assuming they execute their strategy in growing digital customers and monetising them, they look like a steal in the current investment climate. They are trading at an EV/EBITDA of about 3.1x (which will be lower once they have sold GrabOne) with a Free Cash Flow yield of 21.5%, they present a great value opportunity and are likely to resume dividends this financial year.

|

Disclaimer: SWM and NZM are both currently held in the TAMIM Australia All Cap portfolio.

|