Quanta Services (PWR.NYSE)

With operations throughout the United States, Canada, Latin America, Australia and select other international markets, Quanta has the manpower, resources and expertise to safely complete projects that are local, regional, national or international in scope.

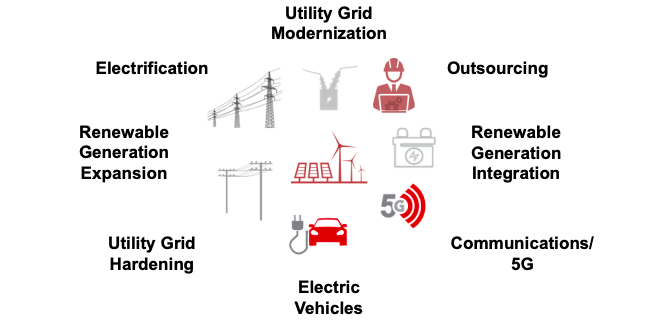

Levered Towards Favourable Long Term Trends

Quanta is well positioned to benefit from the energy transition toward a carbon neutral economy. They offer investors exposure to favourable long-term trends such as utility grid modernisation, system hardening, renewable generation expansion and integration, electric vehicles (EV), electrification and communications/5G.

US: Bipartisan Infrastructure Spending

As part of a broader $1.2tn infrastructure stimulus package, the Bipartisan Infrastructure Law is aiming to upgrade US infrastructure (in dire need of this) and develop the infrastructure needed for a carbon free economy. The bill will also create plenty of jobs in the US and help stimulate the economy. Quanta should be one of the biggest beneficiaries of this bill as it is targeting areas that Quanta has developed a strong foothold in. The Bipartisan Infrastructure Law includes the largest investment in clean energy transmission and grids in American history. It will upgrade power infrastructure, building thousands of miles of new, resilient transmission lines to facilitate the expansion of renewables and clean energy while lowering costs. The legislation will also invest $7.5bn in building out a national network of EV chargers. Quanta’s management did recently note that the stimulus package will only add to growth and the company was not dependent on the deal, already working on multi year contracts to modernise the energy grid.

Q4 to Full Year Results

Despite the global pandemic, Quanta has continued to deliver for shareholders having delivered four years of record adjusted EBITDA and EPS. Q4 revenues rose nearly +35% to US $3.9bn, Quanta’s renewable energy segment was a key driver in Q4 with revenues up +113%; expected to more than double in FY22. Quanta also saw continued backlog growth driven by record high demand in communications services as a result of 5G build out. While FY21 was a better than expected year for Quanta, it would still have been a tough operating period due the impacts of Covid. With international travel yet to fully recover, labour markets and supply chains have been problematic. The labour shortage impacts contracting companies in particular and we see this as a tailwind heading into a more normalised environment.

Outlook

On the back of energy transition tailwinds, we continue to see strong earnings and revenue growth for Quanta. Quanta will be a significant player in America’s move towards renewable energy and the utility industry’s heavy spending programs on grid hardening. This exposure to renewable energy goes beyond just solar and wind, also including renewable diesel, hydrogen, and carbon sequestration. In addition, Quanta also participates in the rollout of 5G and in the building of necessary infrastructure for EV charging stations.

Quanta has a diverse but high quality portfolio of clients including American Electric Power, AT&T, Verizon and BP. We are seeing these companies grow their investment in capex and infrastructure. Quanta has one of the best reputations in the industry and has long term relationships with their clients, contributing to repeat work.

|

Revenue

|

$16.25bn

|

|

Adjusted EBITDA

|

$1.64bn

|

|

Free Cash Flow

|

$750m

|

|

Net Profit

|

$567m

|

|

Adjusted Diluted EPS

|

$6.25

|