MSL Solutions (MSL.ASX)

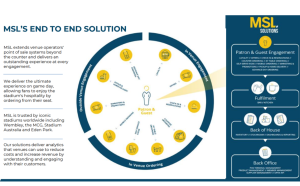

MSL is a global provider of software solutions to businesses in the sport, leisure and hospitality industry. MSL employs 160 staff and has grown its footprint to service more than 8,000 venues around the world. Only two years ago the serviced less than 1,500 venues. MSL develops and delivers fully integrated and modular systems that connect customers to venues through mobile and contactless entry, ordering and payment solutions. MSL’s solutions seamlessly connect front-of-house to backoffice, offering an end-to-end guest engagement platform which provides actionable insights on key success metrics to venues of all sizes.

Acquired in late 2020 after years of being their largest reseller, MSL’s centerpiece offering is point-of-sale (POS) software SwiftPOS which provides an end to end solution for venue operators. The software is fully integrated and covers the whole value chain in operating a venue. The solution manages your inventory, CRM, loyalty programs, check ins etc. When running big events at stadiums and arenas the organisers need a one stop shop platform that can help them shift inventory, staff and decide who gets discounts in a matter of seconds, SwiftPOS does just that. The market for smart stadiums is growing as stadium owners are looking to lift the experience of fans through a fully integrated system that can be accessed online to handle things such as merchandise and parking availability. The solution also collects all the data which can later on be used for analytics to increase efficiencies for the customers.

In October this year MSL acquired OrderMate for $5.5m in cash and $2.0m in MSL shares. To fund the acquisition MSL raised $4.5m from an oversubscribed share purchase plan (SPP) and issued a $4.5m convertible note with a 0% coupon rate to US based Taubman Capital. We will touch on this later. OrderMate provides POS services to Australian food and beverage venues, enabling efficient ordering, transactions and payments to over 2,400 customers. The focus is on restaurant, cafe and fine-dining venues with the business delivering normalised FY21 EBITDA of more than $1m.The acquisition will provide the group with synergies as they leverage sales and marketing channels and costs alongside aligned business development efforts that will help MSL benefit in sales growth by leveraging new sales channels in Australia, UK, US. There will also be efficiencies across combined cloud hosting / service fees.

In the recent presentation call, CEO Pat Howard noted a few times that the plan is to take OrderMate to the UK, leveraging their extensive reseller network to grow sales. The UK has been out of lockdown for a while now and entertainment/hospitality has been booming, making this a timely opportunity for MSL to enter the market.

OrderMate is fully integrated with over thirty providers. These include payment providers, CRM, accounting software etc; thismakes it more salable and removes the hiccups that businesses may have in integrating the software into their business.

The team have proven they are more than capable at executing M&A transactions that unlock strategic value for the business, realise operational synergies and create value for shareholders. As mentioned, they acquired SwiftPOS in November 2020. MSL was the largest reseller of SwiftPOS and the acquisition has now become the main focus of the business, seeing a 20+% increase in revenue in FY21 on a like-for like comparison to FY20.

Recently we saw OrderMate partner with Doshii to provide OrderMate venues the ability to connect even more of their hospitality apps. This partnership is the second agreement between Doshii and MSL Solutions after the announcement between Doshii and the MSL owned SwiftPOS in March 2021. An Australian scale-up, Doshii is a middleware platform that enables hospitality venues to seamlessly connect their point-of-sale with a wide range of hospitality apps, including pickup and delivery, in-venue ordering, rostering and reservations apps. Doshii helps venues eliminate double handling of orders, reduce mistakes, and find new opportunities to streamline their operations and increase revenue. The agreement is expected to be worth over $800k over the next five years. This is in addition to $1.3m+ over five years announced in March 2021.

Taubman Capital

As mentioned, MSL issued a convertible note to private equity firm Taubman Capital to raise cash for the OrderMate takeover. Looking deeper into Taubman’s operations and other investments, this is far more significant than first meets the eye. Taubman, a US based PE investment firm, has investments into leisure, venues and hospitality in North America. Over the last 71 years, the Taubman family has built Taubman Centres into a leading global owner and operator of regional and super-regional malls. Taubman Capital’s most recent investment, Venuetize (who have partnered with MSL to target US customers), is an e-commerce platform in the sports and hospitality sector in the US. Spanning nine US sports leagues, this includes customers such as Live! casinos, the PGA Tour, the NBA’s Memphis Grizzlies, MLS’ Los Angeles F.C.. Having Taubman as a shareholder is strategically huge for MSL given that their other portfolio of investments could provide significant material contracts for MSL’s POS systems. MSL’s relationship with Taubman is exactly what they need to strengthen their foothold in the US market.

US Opportunity

The US market represents a huge opportunity for MSL to capitalise on. American sports leagues are enormous and have a presence throughout the country both in top tier pro leagues and college sports. MSL’s strategic partnership with ParkHub, a parking management system, and Venuetize makes their overall proposal much stronger as these customers are looking for one system that can do everything. Given the number of venues some of their target customers run, it would only take a few of customer wins to substantially boost their recurring revenue. On the back of their relationship with Taubman alone, MSL should have a good runway to execute on their US growth plans.

This pipeline above represents real targets that MSL are aiming to convert on in the medium term. Venuetize has a strong relationship with ASM Global, who have 392 locations across the US including the likes of Soldier Field and Barclays Center (in Australia they own major venues like ANZ Stadium, Suncorp, RAC Arena, Qudos Bank Arena etc), which could provide a $30m opportunity for MSL. To put that in perspective, MSL’s FY21 revenue was $25m. A contract of that scale would more than double their revenue.

Golf

MSL also provides solutions to golf clubs that help them manage the club and the relationships with members. While this is a smaller part of the business, MSL have secured long term contracts that provide annuity like income with Golf Australia and other federations. The software also collects a lot of useful data about the members and can even tell you their score on the day, something that will become more and more useful as the field of data science grows. Revenue from golf products accounted for 35% of FY21 revenue but this will slowly become less important as SwiftPOS and OrderMate gain scale.

Outlook

MSL is a business that has made a number of strategic acquisitions and partnerships and is now well set up to take on huge addressable markets. Yet they haven’t received much attention, which is why there is an opportunity for investors. MSL ticks a lot of the boxes for us for in terms of a GARP (growth at a reasonable price) investment. They are currently trading on a market cap of about $100m and have a cash balance of around $8m. Their revenue is mostly sustainable and recurring subscription revenue, a key consideration for our investment process.

While MSL has integrated with payment providers like Tyro, they are unable to extract value from them. Given the role that payment providers play in POS, we think that MSL will look to do some more M&A in this area and maybe takeover an existing payment provider. There are quite a few payments businesses that have invested a lot of money building the business but have struggled to gain traction and the owners may be looking to exit. A transaction like this would make a lot of sense for MSL.

We also expect MSL to start leveraging the data they are collecting to provide businesses with deep analytical insights to create efficiencies going forward. Whilst payment providers can tell you where consumers are spending money, they can’t tell you exactly what items or products they are spending on whereas MSL’s solutions can; this is far more valuable.

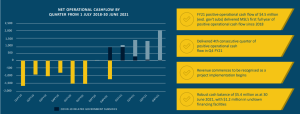

In a November update MSL saw Q1 FY22 revenue of $7.7m (unaudited), an increase of 40+% from Q1 FY21 (prior corresponding period), driven by UK business rebounding post-Covid and the positive contribution of the SwiftPOS acquisition completed in November 2020. MSL’s pipeline should look far bigger in a post lockdown environment. The timing of the OrderMate acquisition has coincided with the NSW and Victoria states emerging from lockdown seeing 85 sales orders closed, making October OrderMate’s highest sales month for 2021.

Finally, the big driver of the business will be expansion into the US. It only takes a few contract wins to add significant revenue to the business given how many sites it could add for SwiftPOS. MSL’s convertible note issue to Taubman, who are now well aligned to support MSL’s growth in the US, gives them a foot in the door and an opportunity to win contracts from Taubman’s other portfolio of companies.