Author: Robert Swift

We are at a very interesting juncture in capital markets. Equity markets have moved a long way up from the short term Covid induced nadir about a year ago. Profit taking always happens at some point and halfway through this February was that moment. Global Equity markets still rose c.2.5% in US$ terms. By way of comparison the Global Government Bond Index declined c.1% as long rates rose and the yield curve steepened.

It is still our view that for investors certain equities remain a better option than cash which yields nothing and government bonds which are fast becoming a return free risk as opposed to a risk free return. However, we want to make clear again that we are at a defining moment in capital markets and policy making.

Market participants have been told clearly and repeatedly by central banks, that there is no reason to raise interest rates. So much is clear but what is NOT clear is what the intentions are towards the longer end of the yield curve – an area which typically central bankers have left to market participants to set the price and yield. The defining moment is here because so much QE and now potentially another large fiscal programme (=8% of US GDP) has created a significant back up in the price of the 10 year US note. The SHAPE of the yield curve is steepening since investors rightly fear continued abuse of the fiat money system and continued inflation well over 2% (in some areas it is already here); and it is this and not the level of short rates that the equity market is now correctly focusing upon. What will the Fed do (they will say they are not concerned) about this?

So we will briefly make the following observations

- Steeper yield curves presage stronger nominal GDP and a shift in equity styles whereby Value will do better than Growth

- The time value of money with a steeper yield curve, means that it now matters WHEN profits and dividends are paid to investors. The longer you wait, the less value

- Central banks will have to shortly decide whether to let this rise continue or to intervene. At some point, quite soon actually, the SHAPE of the US yield curve will be the same as it was in May 2013 when we had a big ‘taper tantrum’.

- IF they decide to intervene to prevent this taper tantrum, then we will ponder how and how much AND whether they will return us to the 1950s when we had centrally directed capital allocation to buy government debt issuance. Do not rule this out. Much as the 1950s financial repression was necessitated by financing two wars, we have had a similar ‘war on Covid and have debt levels typically associated with wars.

- At some point continued expansion of the Fed balance sheet will itself call into question the value of fiat money.

- If they decide to return us somewhat to capitalism, and let the long end find a natural level given inflation expectations, then the long term benefits will be pleasing BUT SOME companies and bonds will not make it through. The cost of refinancing will be too high. Do not invest in loss making or companies whose multiples are stratospheric. (Scott McNealy’s words from 2001 should come to mind)

- This dilemma has been handed to Jay Powell by his predecessors. This has been about 25 years in the making and asymmetrical monetary policy (always cut more than you sometimes raise) and now fiscal incontinence make for a heady combination and typically mean inflation.

- Much like managing a forest – small frequent fires (recessions) are a lot better than letting the detritus build up and then having a MONSTROUS blaze (depression). Sadly we have had the latter over the last 25 years; and it has essentially been ‘monetary policy for rich people’.

- There is hope! A recent but somewhat unnoticed comment came from the New York Fed President, John Williams, when he said that a higher minimum wage would work best to support the economy AND that there is some evidence that low interest rates can move asset prices disproportionately held by wealthy households. It’s a start.

Significant price changes in the month occurred in Industrials, Basic Materials and Energy companies. Valero, one of the world’s most sophisticated refining complexes, rose almost 40% in February as the market reappraised the need for non-renewable energy sources and downstream products. In Texas there was a complete blackout caused by unusually cold weather, raising the obvious point that renewables should be a piece of the generating capacity, but not all of it, and that natural gas is both clean and easily stored and transported. Texas, needless to say, has a number of peculiarities about its power system but a need for better and more investment in USA infrastructure is clear.

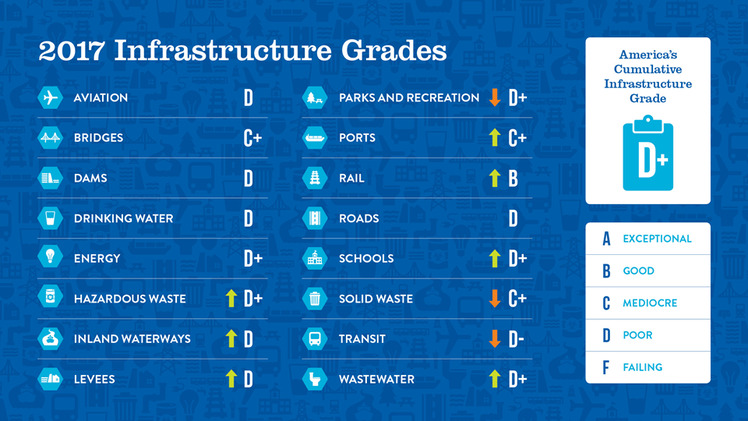

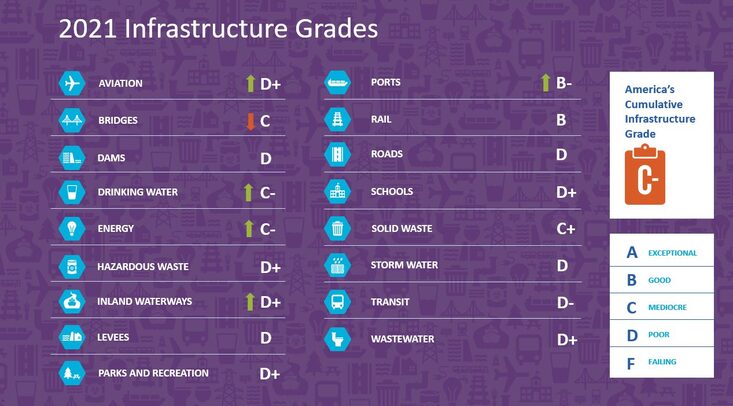

On March 3rd (US time) the American Society of Civil Engineers, releases its quadrennial report on the state of USA Infrastructure. Last time, in 2017, the grade was D+. Surprisingly, it went up and there will be a lot more interested readers this time.

Other significant company developments were Sony’s results (beat and raise) Quest Diagnostics (beat and raise) and Discovery A shares where the share price rose 25% as they announced strong subscriber growth for their streaming service. Over the last 1 2 and 3 years at the time of writing, Discovery A shares have outperformed those of Netflix.

We sold Nexon in Japan and reinvested in Kurita Water. We sold Legal & General in the UK and reinvested in Euronext the French based European exchanges owner operator. We took large profits in Hong Kong Exchanges where the share price had run up on the basis of the exchange receiving an infinite number of mainland China listings, no longer welcome via ADR in the USA. It is a large opportunity for HK in a region where other exchanges are lamentably short of large and quality companies, but everything and more is in the price. We reinvested into China Construction Bank H shares which are on a wide discount to the A shares and the Chinese financial system appears to be pulling back from wilder excesses. Some companies are allowed to default to the detriment of executives and bond holders. If only the USA was quite so enlightened.

In the medium term, infrastructure companies in the US especially will be subject to news flow surrounding the Green Energy Policy and thus volatile, but their revenue bases are stable and dividend yields attractive. The return of National Industrial Policy (also a nudge upward for inflation) will make logistics, storage and transport companies attractive – globally. Industrial companies likewise. Asia including Japan remains financially, economically and now geopolitically strong, and so is a favoured area.