APRA’s quest for an unquestionably strong financial system continues

Penned April 6, 2017

It has been a good week for APRA and the RBA. Their announcements surrounding the expansion of the use of macro-prudential policy tools and warnings around slow growth in rents and the outlook for property prices have had the initial desired effect of maximum media coverage. They would hope that lenders and potential property investors are getting the message.

The head of APRA yesterday, further weighed in on the debate surrounding banks’ loss absorbing capital buffers. Mr Wayne Byres had already bought into the key recommendation from the Financial System Inquiry (FSI) that Australia’s financial system should be unquestionably strong due to the fact that Australia has historically been a net importer of financial capital, and the high concentration of residential mortgages on banks’ loan books. To that end, the FSI suggested that Australia’s banks’ capital positions should be in the top quartile globally. APRA hasn’t committed to this hard edged quantitative aspiration or target and it is at their discretion which capital ratios they focus on.

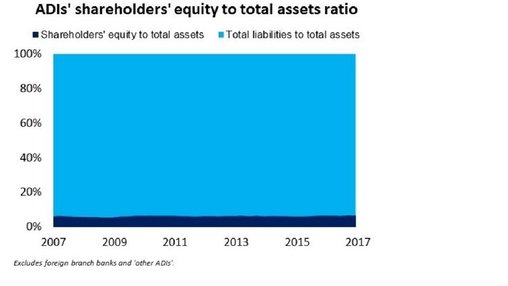

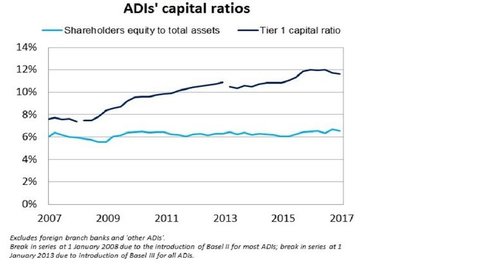

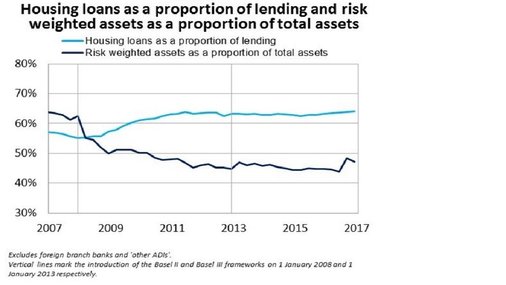

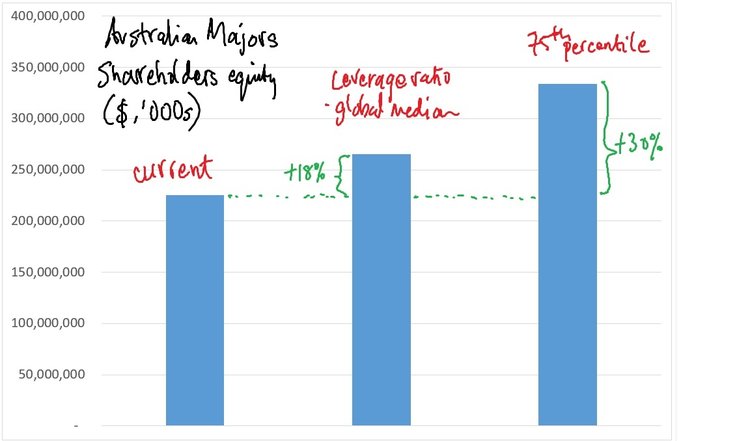

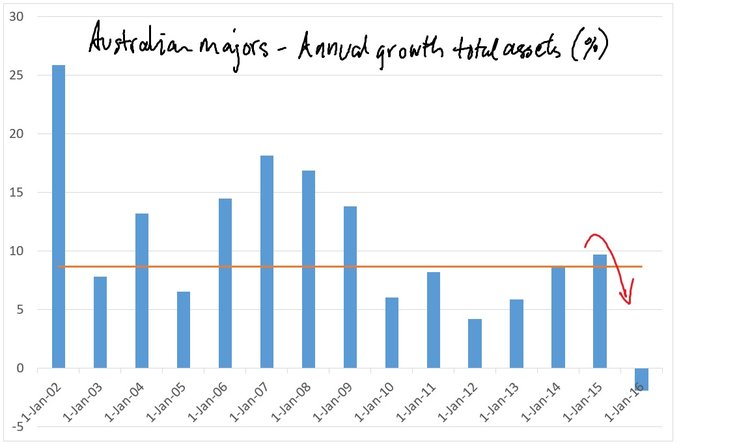

In mid-2016, APRA lifted the risk weights used by banks with internal risk based models (ie. larger banks) by 50%, from 17% to 25%. In yesterday’s speech however, Mr Byres took a more glass half empty approach by drawing attention to the fact that Australia’s banks had indeed lifted their risk weighted capital ratios since the financial crisis, but their leverage ratios had remained little changed during this time. The leverage ratio, the ratio of total assets funded by shareholders’ equity, has increased marginally to around 6.5% from 6% in 2007 (see chart).

Against this backdrop, Mr Byers announced that it would release an issues paper later this year, outlining a road-map on how it intends to further strengthen banks’ loss absorbing capital ratios, and hinted at the prospect of a further lift in the risk weight for residential mortgages used by the larger banks.

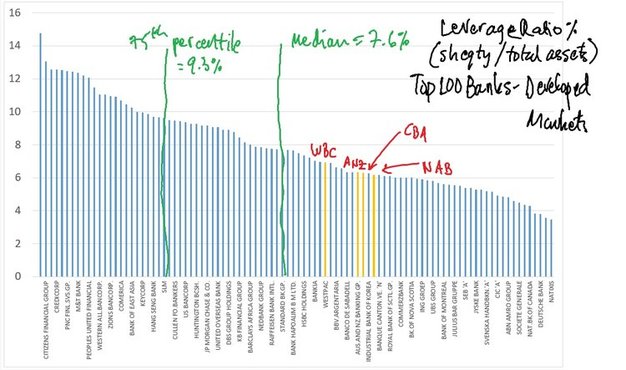

The key development in Evidente’s view is the focus on the leverage ratio. APRA has left itself plenty of flexibility at this stage, and I am not suggesting that that APRA intends to target a desired leverage ratio. But as a guide only, we undertake a global comparison of leverage ratios and a sensitivity analysis. At present, the leverage ratios for the Australian majors range from 6% to 6.5%, which puts them below the median of the largest 100 developed market banks by over 100 basis points (see chart).

Evidente is an independent financial consulting firm managed by Sam Ferraro that delivers innovative financial advice to wholesale investors, including active long only funds, hedge funds, pension funds, and sovereign wealth funds, in Australia and globally. Drawing on academic research in asset pricing, behavioural finance and portfolio construction, Evidente provides wholesale investors with commercial solutions to stock selection and asset allocation decisions across equities and other asset classes.

Sam writes as a freelance journalist for The Age, Sydney Morning Herald and Australian Financial Review, was a member of the advisory board of API Capital, teaches business finance and international finance courses to undergraduates at RMIT, and most importantly Sam is a well respected source of information and friend of TAMIM.