The February reporting season presented one of the most dynamic market environments in recent memory. Earnings results triggered sharp movements, with investors swiftly adjusting their positions based on performance. This created significant shifts in valuations, with certain stocks experiencing price swings of -20% or more in response to earnings surprises.

Portfolio Positioning & Strategic Adjustments

For sophisticated investors, navigating this environment requires a proactive and disciplined approach. Identifying companies with strong fundamentals while managing risk exposure is critical in volatile conditions. Where businesses show genuine structural weaknesses, it is prudent to reassess positions and reallocate capital strategically. At the same time, market overreactions can present opportunities to build on high-conviction holdings at more attractive valuations.

A well-structured portfolio should emphasise quality, resilience, and long-term growth potential. Investors who maintain discipline, refine their asset allocation, and capitalise on market dislocations will likely be well-positioned for the months ahead. Some of the key themes and opportunities in focus are discussed in this report, with further insights to follow.

Market Correction: A Natural Part of the Cycle

Since mid-February, both Australian and U.S. markets have undergone a healthy reset, experiencing a -10% drawdown. This adjustment has been driven by a combination of policy shifts under the new Trump administration and broader economic recalibrations.

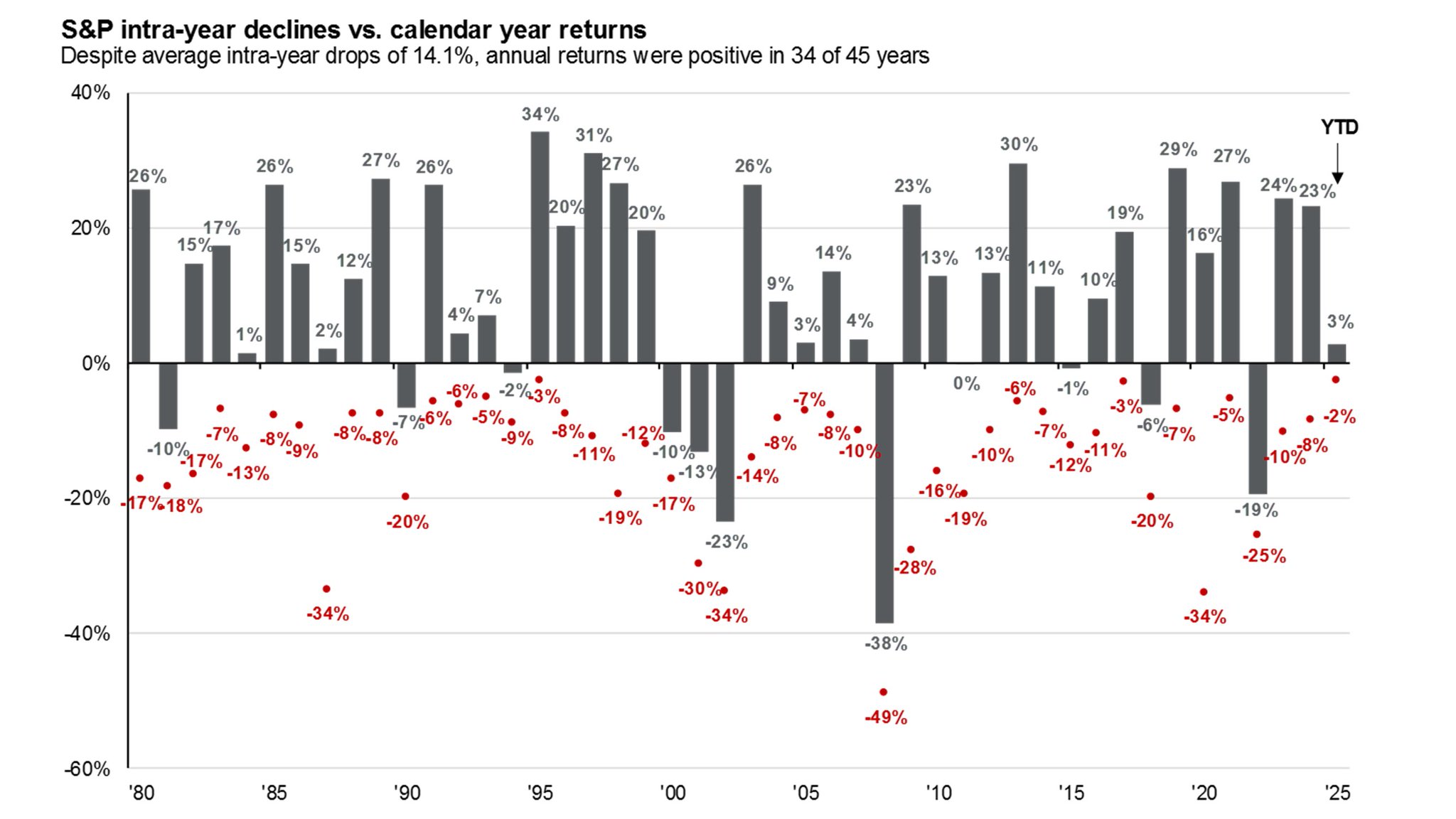

History has shown that such periods of adjustment are common and often necessary for long-term market strength. Notably, the recent drawdown from the February 19th highs represents the fastest -10% correction since the COVID recovery in 2020. Understanding these cycles provides important context for long-term decision-making.

The Trump 2.0 Administration: A Structural Shift

The current administration is implementing key structural changes aimed at strengthening the U.S. economy. The focus is on balancing government spending while fostering private sector growth through pro-business policies, tariff realignments, and strategic incentives.

A pivotal figure in this approach is Scott Bessent, the newly appointed Secretary of the Treasury. With a distinguished career in financial markets, his expertise in economic strategy and capital allocation is expected to drive meaningful, long-term improvements. By streamlining regulations and encouraging domestic investment, these initiatives set the stage for a more efficient and resilient economic environment.

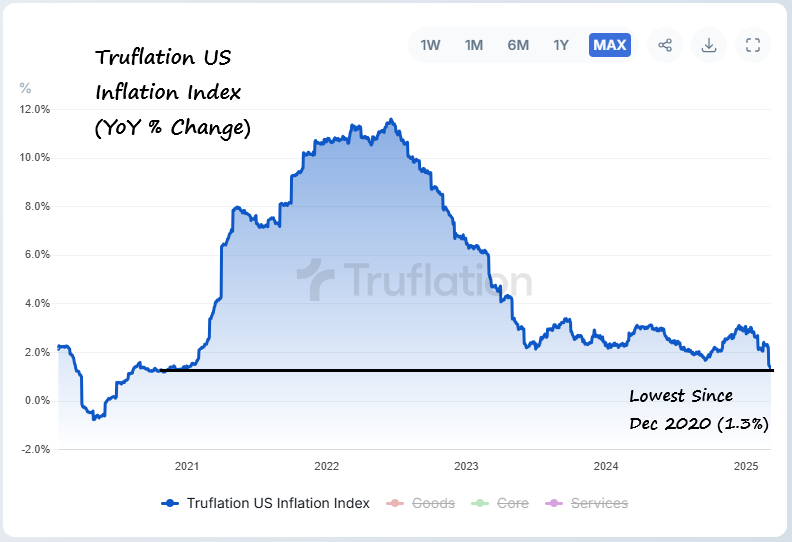

Additionally, with true inflation tracking below 1.5% (according to Truflation), the Federal Reserve is expected to adjust interest rates more quickly than current market projections suggest. As the economy stabilises post-adjustment, a supportive rate environment combined with policy-driven expansion could provide a robust foundation for market performance in the coming years.

(Source: truflation.com)

Market Trends & Historical Context

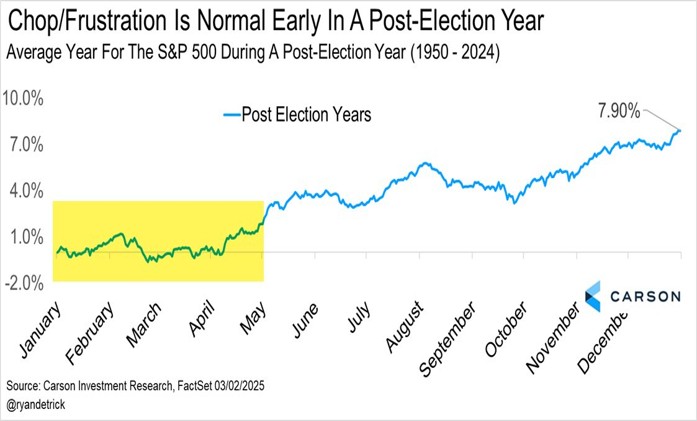

Short-term volatility is a natural feature of evolving markets, particularly in the first year of a new U.S. presidency. Historically, policy transitions introduce uncertainty in the first half of the year before stabilising as frameworks become clearer.

1. First-Year Presidential Cycle: Historically, the first year of a presidential term sees early volatility, followed by greater market clarity as policies take effect. We are seeing this pattern play out now.

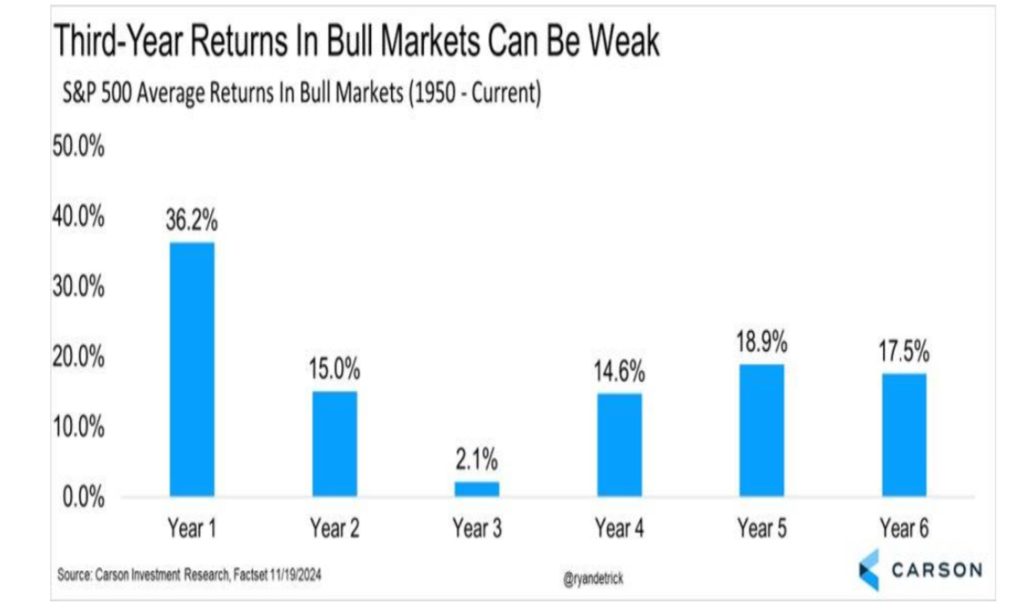

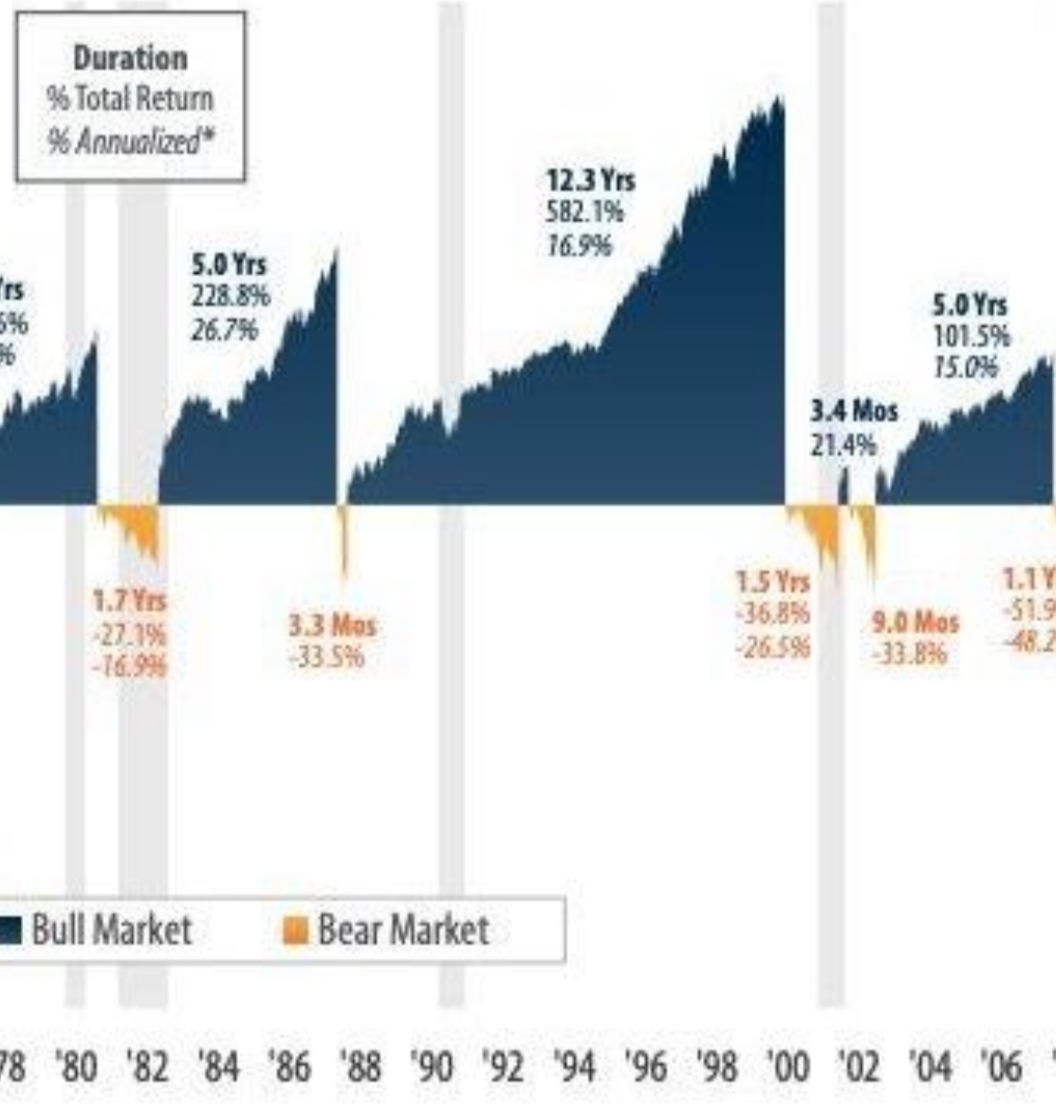

2. Bull Market Trends: We are currently in the third year of this bull market cycle. Historically, the third year tends to be a period of consolidation before the stronger performance typically seen in years 4-6 of an extended market cycle.

3. Intra-Year Corrections: Market cycles regularly include multiple intra-year pullbacks. These drawdowns, often averaging around -14%, have historically been part of broader growth cycles.

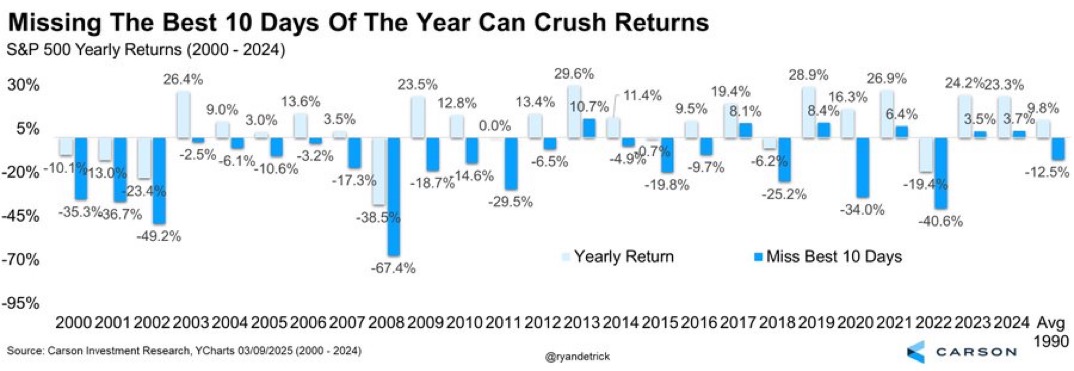

4. Long-Term Market Participation: Market history illustrates that sustained participation is key to capturing growth. Missing even a handful of the best-performing days each year has historically had a significant impact on long-term returns.

The TAMIM Takeaway: Looking Ahead with Confidence

Periods of recalibration often provide valuable insights into market direction and structural shifts. With a balanced economic strategy, a measured interest rate outlook, and long-term growth drivers in place, we see the current environment as part of a broader trend of innovation-led expansion.

As we move forward, the interplay between fiscal policies, technological advancements, and shifting economic frameworks is expected to create a dynamic environment for strategic positioning. This cycle closely resembles the early 1990s, which preceded a decade-long period of economic and market growth, offering strong potential for disciplined investors.

(Source: First Trust Advisers)