We now have the nasty problem of deliberately inflated asset values with which to contend as a result of this terrible and prolonged policy mistake of ultra low interest rates. In a mistaken belief in the need to get goods and services inflation, we have been delivered an asset bubble in certain assets.Deflation, which makes export prices more competitive, is no different from currency depreciation, which likewise makes export prices more competitive. No one thinks competitive depreciation is to be avoided at all costs?! Sometimes it can be useful. Just so with price deflation as long as it is not manifested in the collapse of asset bubbles but confined to goods and services. Deflation in goods prices makes companies invest to keep production costs down and to create new products. It is this private investment that creates wealth and real jobs, not government spending.

Actually the primary reason for low Japanese nominal GDP growth is the demographic aging of the working population. It really has nothing to do with deflation. Adjust for this demography and you have a very productive workforce and an increasingly wealthy economy. Japan has outperformed almost everywhere else on a per capita inflation adjusted basis. This is evident but widely overlooked by many investors. GDP can be as misleading as revealing.

So why has the stock market languished, until recently at least? As investors who focus upon stock specific risk, we think the market is very attractive. The spread of valuations and business prospects in Japan is very wide and will reward good stock selection. We also note that some Japanese companies are beginning to treat shareholders with more respect; are increasing dividends; and reducing wasteful expenditure on unnecessary plant and equipment. This will be good for shareholders. Not all Japanese companies will reward shareholders with change, but those that do will far outperform those that don’t.

We also agree that there have been, and still are, some poor policies adopted both by the government (which don’t look like changing) and by companies, some of which do look like they are in the midst of change. It is the growing evidence of corporate change that we think will drive the market higher. We think the stock market is in the process of being rerated and that we are on a multi-year period of Japanese outperformance. For those that actually have the experience of watching a Japanese equity bull market, this will be an opportunity.

Stay long or overweight.

Here are the reasons why; the evidence that corporate Japan finally ‘gets it’; and some stocks to ponder.

Japanese companies have been incentivised to overinvest and to skimp on dividends. This is changing. Higher dividends will improve corporate capital allocation, raise return on equity, and make Japanese equities more attractive.

Generous depreciation allowances encourage Japanese companies to invest too heavily. Appropriate for a time when Japan had a need to refurbish plant and equipment and prepare for an export drive, these overly generous depreciation allowances are no longer needed. Given their shareholders’ aging demography, Japanese companies should be investing less, and distributing more cashflow as dividends. They are – or some are.

In aggregate it takes about twice as much capital investment in Japan to generate a unit of growth as it does in the USA. One probably underinvests and the other overinvests, but Japan is a conspicuous outlier compared to all the other countries too. This relationship is known as the Incremental Capital Output Ration or ICOR. At the company level it means that there is a lot of ‘crapex’ or wasteful expenditure, driven by the desire to reduce the visibility of corporate profits and thus reduce taxes. It means you you can probably eat off the factory floor when you visit the company as an analyst, since it is so frequently refurbished to an incredible standard, but the flip side is that Japanese shareholding retirees are starved of dividends which they could use to spend and pay their (healthcare) bills.

Check out this chart for different ICOR for the G5 from Andrew Smithers. He is the first to have shown the worldwide misplaced obsession with nominal GDP in Japan with the root cause not as deflation, but as demography.

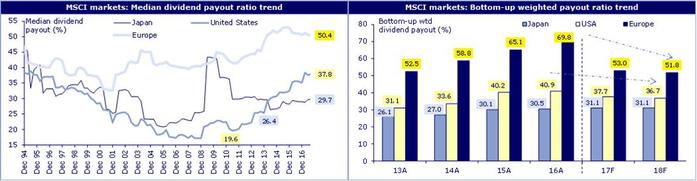

They have a long way to go. Check out these two charts from Credit Lyonnais.

Japanese companies are asset and cash rich. Japanese overall debt is high but owned by the Japanese themselves.

Japan is still a Net Creditor nation and generating current account surpluses. It will matter more what the Japanese think of your bond market before it matters what you think of theirs! Do not be too alarmed by comments about Japanese gross debt figures. It is the net debt figure that matters. In this regard Japan is ok. To be sure, there are some poor and wasteful policies, but fundamentally much of the corporate sector is possessed of good products, globally competitive, with a productive workforce.

The sum of corporate Japan’s profits is equal to the government’s budget deficit. Put another way, the government is mistakenly spending money to boost the economy and run up budget deficits, when all they have to do is remove the depreciation incentives for the private sector to over invest and consequently collect some more corporate tax, as the true profits are revealed. In other words the Japanese government budget deficits are huge but needless and more than matched by the corporate surplus. Under PM Abe. Japanese corporate margins are up by 50% from where they were. The pendulum has swung too far toward corporate profit RETENTION and too far away from dividends and wages. Rising dividends often mean higher share prices. More than 50% companies are net cash in Japan vs 19% in USA and cash to market cap is 23% versus 9% for USA.

From the IMF, the Net International Investment Position of:

Japan +63.8% of GDP

Germany +54.4% of GDP

Australia – 55.6% of GDP

Guess which country needs more inward capital from abroad to balance the books? This inward capital can also become outward.

Governance and Board reform is underway and will improve dividends and shareholder treatment.

Japan has had its fair share of accounting scandals (eg Olympus Optical) in recent years and its boardroom policies and board member selection positively antediluvian. This is however changing, and the Nikkei company and the Tokyo Stock Exchange, launched an index about 4 years ago, the Nikkei 400, to specifically include and weight companies based upon governance metrics, return on capital and profitability. Many Japanese listed companies are clamouring to be included in this new index, because some of the largest investment pools, such as the Government Pension Investment Fund, explicitly use this as a benchmark in preference to the other indices such as the Topix or Nikkei 225 which are not weighted toward ‘good governance’.

We attach the construction rules here:-

Quantitatively

3-year average ROE: 40%

3-year cumulative operating profit: 40%

Market capitalization on the base date for selection: 20%

Qualitatively

Appointment of Independent Outside Directors (at least one-third or a minimum of three. If one-third of the total number of directors is less than two, at least two.)

Adoption or Scheduled Adoption of IFRS

Disclosure of English Earnings Information via TDnet (Company Announcements Distribution Service in English

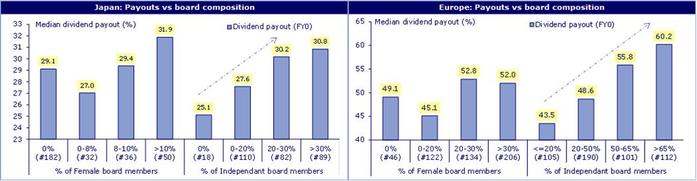

Better governance is strongly associated with better share price performance and dividends and fewer accounting shocks. We saw this trend in Europe and now expect this to occur in Japan. See that charts below comparing the payout ratio and board composition for Japan and Europe. It is quite possible that Japan follows Europe to the benefit of shareholders.

As we write this, the Japanese market has gone to 25 year highs. There may be an event known as ‘reculer pour mieux sauter” but use this as a chance to get further invested. We will be.