Written by Ron Shamgar Iress Ltd has emerged as a formidable technology provider in the wealth management and trading sectors, strategically positioning itself for significant growth through disciplined transformation and innovative AI-driven initiatives. Company...

Stock Insight

Gridlocked Growth: Why Australia’s Energy Transition Needs Infrastructure Urgency

Australia's Energy Tug-of-War Australia is at a critical crossroads in its energy journey. On one side lies the global imperative to decarbonise, driven by climate goals and investor pressure. On the other, the need to ensure energy reliability and affordability for...

Rebuilding Trust in Infrastructure: Why the New Global Order Will Be Made of Concrete, Code, and Cables

We’re living through a once-in-a-generation reset. The world is increasingly volatile. Institutions are mistrusted. Alliances are shifting. Supply chains are being redrawn. And in the background, something far more permanent is taking place: the rebuilding of the...

Trust in Rust: Why Industrial Stocks Are Gearing Up for a Renaissance

There are moments in markets where the noise becomes so loud, it drowns out common sense. Tariffs, geopolitics, inflation, central banks, and a US Congress with a taste for budgetary excess. And yet, despite all the reasons to panic, a certain type of company is...

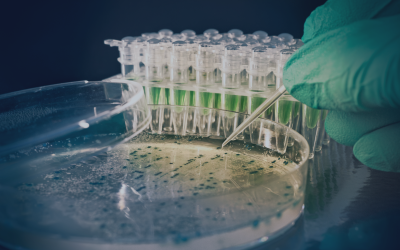

Growing Like A Weed: A Strategic Play in Pharmaceutical Manufacturing

In the rapidly evolving world of medical cannabis, one Australian company is quietly positioning itself as a potential industry leader. Bioxyne (BXN.ASX), a relatively young public company, is rewriting the playbook for medical cannabis manufacturing through a...

Powering the Future: Japan’s Nuclear Utilities and the AI Energy Squeeze

Let’s start with a bold premise: if we’re serious about building the infrastructure of the future, one that can support the exponential demands of AI, digital transformation, and decarbonisation, then we need to stop tiptoeing around nuclear energy. The power needs of...

Domino’s Pivot: From Flat Sales to Hot Prospects

When Pizza Meets Pivot Domino’s Pizza Enterprises (ASX: DMP) has long been a household name in Australia and beyond. From its humble beginnings to becoming a dominant player across the Asia-Pacific and European markets, Domino’s built its brand on one simple idea:...

Copper, Tariffs and Opportunity: A New Age of Resource Realignment

When Copper Becomes a Battlefield It has long been said that copper is the metal with a PhD in economics. As a bellwether for industrial growth and technological advancement, copper demand tends to precede major shifts in global economic trends. In this context, the...

SMSFs vs Industry Super: Is the Tide Quietly Turning?

In the world of superannuation, the battle lines have long been drawn between Self-Managed Super Funds (SMSFs) and Industry Super Funds. One side touts scale, simplicity, and passive investing prowess. The other champions control, flexibility, and tailored strategies....

EROAD: From Grit to Growth – A Telematics Turnaround Worth Watching

In a market environment where capital is scarce and investors are hunting for profitable, cash-generative growth stories, EROAD Limited (ASX/NZX: ERD) has emerged from the shadows. The company's FY25 results mark a turning point, not just for its financials, but for...

Brains, Brawn and Bandwidth: Three Unseen Giants Behind the Global Rebuild

Investing in the Backbone of the New Economy As the world rushes headlong into the age of artificial intelligence, electrification, and digital dependency, much of the investor focus remains fixed on the front-end winners: AI models, chip designers, and...

Global Energy Infrastructure – Investing Wisely into an Uncertain Transition

Embracing Uncertainty with Smart Allocations Global energy markets today sit at the intersection of volatility, policy shifts, and long-term transformation. From the unpredictability of fossil fuel supply to the growing (but not unchallenged) role of renewables,...