The first emerging global leader to be discussed is Gale Pacific Limited (ASX:GAP), a leading global marketer and manufacturer of screening and shading products for domestic, commercial and industrial applications. Way back in the 1970s, GAP invented knitted shade-cloth, and today from their low cost manufacturing facilities in China, the company is one of the world’s largest producers of technical fabrics. The company’s products are extremely durable, do not react to dirt and moisture, and do not rot (like canvas). It seems fitting to us that an Australian company should aim for global leadership in the sun shading and screening market given our position as one of the sunniest countries in the world.

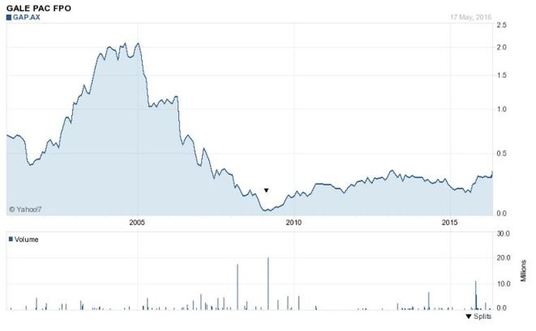

After a period of aggressive, and ultimately unsuccessful, acquisitions during the early 2000’s, GAP has in recent years refocused strategically on its core products and has made significant improvements in its working capital management. The company has been through a period of dramatic restructuring and in our opinion has emerged much stronger and well positioned to grow. The company’s listed journey has involved a dramatic period of under-performance between 2005 and 2009, followed by gradual recovery since then.

LOOKING FORWARD: STRONG FY16 EXPECTED AND ONGOING GROWTH

GAP should deliver revenue growth in excess of 20% for FY16. For the 6 months to 31 December 2015 total sales increased 22%, with sales in Australasia up 18% on the back of new product range wins and improved marketing campaigns. Sales in the Americas region grew 14% in local currency reflecting a broader product range offering and growing market share in both the retail and commercial sectors. Margins have improved through a focus on supply chain improvements (reducing the number of suppliers and improving supplier terms) and inventory management. Management believe there is good potential for ongoing growth in its core global markets in the Americas, Middle East / North Africa and Eurasia, particularly for GAP’s commercial fabrics as the dangers of sun exposure in regions with harsh environments become more widely appreciated. Climate change is likely to provide a tailwind for GAP’s end markets over the very long term as managing sun exposure will become a greater challenge at a global level. GAP’s commercial fabrics are also marketed for a variety of other professional uses, including architecture, horticulture, building and construction, agriculture, transport, water conservation and mining. The company has a multitude of long term growth drivers across its geographies and products.

BUNNINGS AS A MAJOR CUSTOMER: RISK AND OPPORTUNITY

In FY15, Bunnings contributed 35% of GAP’s total $148m in sales (60% of total Australian sales), thus there is an unusually high degree of customer concentration risk. However, from all accounts this relationship appears strong, with GAP taking pride in their ability to work collaboratively with all their customers, including Bunnings. These collaborative relationships provide GAP with consumer insights, new product development initiatives and improved forecasting/inventory management. In addition, Bunnings’ recent expansion into the UK through the acquisition of homewares retailer Homebase, may present an opportunity for GAP to sell product to Homebase which is not currently a GAP customer. We will be watching UK developments closely as this could present a significant opportunity.

COMPELLING VALUATION

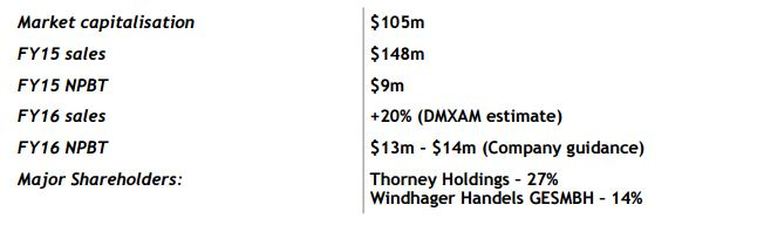

At the time of our recent purchase GAP was trading at a discount to its book value. Based on its FY16 guidance of NPBT of over $13m, it is currently trading at around 10x expected ’15/’16 eps of 3.5c, and at 5x ’15/’16 EV/EBITDA). With a 75% payout ratio, this implies a dividend yield in excess of 7%. We view this as significantly under-valued for a business with excellent management and solid growth prospects.

OUR VIEW

GAP is a great example of a smaller company achieving global success in its chosen niche market. We believe management are doing an excellent job of managing the business and we applaud their ambitious international expansion plans. Interestingly, there are currently no brokers covering the stock, but we expect this to change as GAP grows its market capitalisation and earnings, and the company’s market following subsequently increases. If GAP can maintain its current momentum, we expect a share price re-rating driven by both multiple expansion and continued earnings growth. The upside potential is significant, and we are happy long term shareholders.

Happy Investing,