In February 2016 Vocus merged with M2 to become a full-service vertically integrated telecommunications company that sells to consumers, businesses and government customers across Australia and New Zealand. In essence the merger brought infrastructure together with infrastructure. The purchase of NextGen in June 2016 further built out the infrastructure footprint.M2 was established in 1999 and developed, manufactured and distributed digital messaging systems for small businesses. Through a series of acquisitions and organic growth, the company became a national reseller of broadband, fixed voice, mobile, energy and insurance services to predominantly consumer and small businesses.

Vocus was in launched in 2008 and provided IP transit wholesale services to the Australia and New Zealand telecommunications markets. Through a series of acquisitions and organic growth, Vocus expanded to provide fibre, ethernet, internet, data centre and voice services to corporate, government and wholesale customers.Initial investment view:

This is a challenger telco story. VOC has grown organically and by acquisition to become Australia’s fourth largest telco. It now has scale and backhaul assets to compete on a level footing with the other majors and an efficient and lower than peer cost base which will boost its competitiveness.

The NBN will be an industry changing event whereby incumbents with their own networks will lose their competitive advantage. For consumers, NBN will provide the network and Retail Service Providers (RSPs) will sell on the basis of price and quality of customer service. This will be advantageous for challengers with lower costs to serve. While TLS is still likely to dominate the space, we expect them to cede some market share.

Broker estimates have EBITDA growing at a 3-year Compound Annual Growth Rate (CAGR) of 14% and EPS at 18% highlighting strongly ahead of market growth expectations. Even halving the expected growth rate would see VOC still grow ahead of market.

Despite the growth outlook, VOC trades in line with the market. VOC is now trading on 9.8x FY17F consensus EBITDA (8.1x FY18F) and 15.4x FY17F consensus EPS (13.0x FY18F) and offers a 3.3% yield.

Post the recent pull back, it looks to be cheap vs its own history and peers, especially factoring in the growth outlook. For comparison, the All Industrials ex financials is trading on 11.0x and 10.3x FY17 and FY18 EBITDA respectively (source: UBS) and 19.6x FY17 EPS (17.7x FY18F EPS), with 10% EPS growth.

While results in the short term are likely to be messy given the transactions undertaken over FY16, and risks remain over integration, we believe the core business is solid and VOC will be a strong competitor in a highly competitive market.

What is the industry outlook?

The telco sector is highly dependent on the regulatory environment and technological change. The rollout of the NBN in particular is set to change the industry landscape.

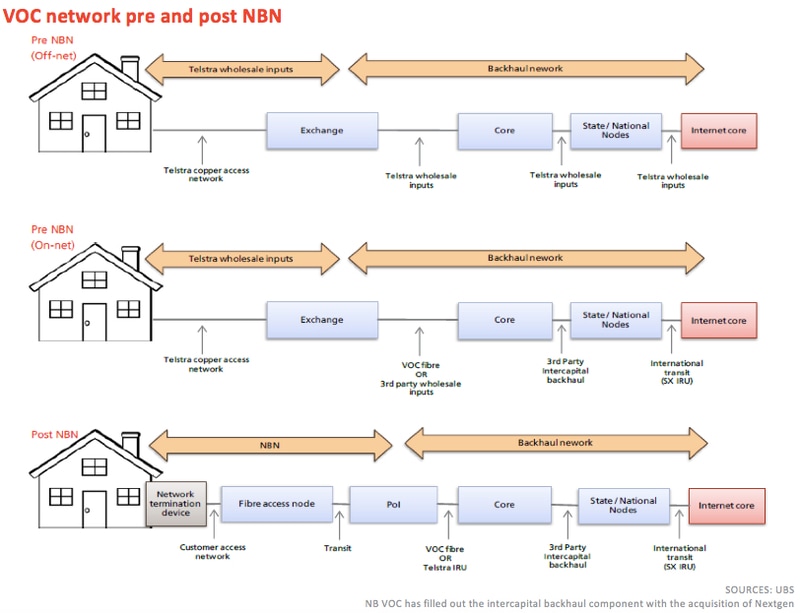

NBN will assume control of the ‘last mile’. This essentially removes the ability of existing RSP’s to differentiate on cost structure on the access network i.e.: i) the incumbent (TLS) loses ownership of the Customer Access Network (in return for NBN cash payments), ii) RSP’s with significant DSLAM infrastructure (e.g. TPM / IIN) will see costs rise from a ULL cost of c$15-$17 today to c$43 per user under NBN, and iii) even infrastructure-light RSP’s (e.g. VOC) will no longer receive scale discounts for last mile network access.

This suggests a more level playing field will exist post NBN with respect to network access. Of course RSP’s will also seek to differentiate via fixed operating costs, bundled content, differentiated offerings, service levels etc. This gives challenger Telcos like VOC a viable platform for growth.

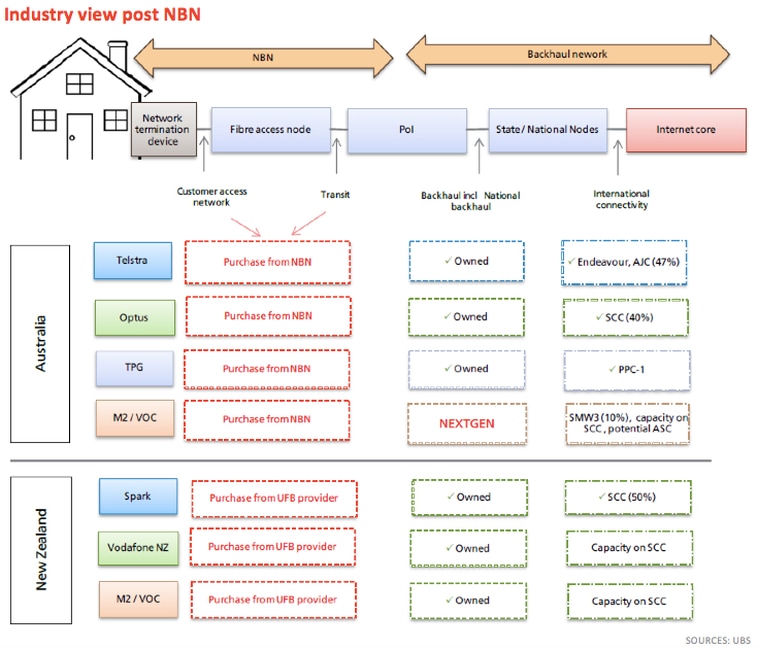

The Figure below from UBS illustrates the level of vertical integration in both Australia and NZ. It’s clear that players are now on a level playing field.

As NBNCo now assumes control of last mile network access: 1) Marginal cost curves lift materially for both the incumbent TLS, and RSPs which have been sweating DSLAM investments, 2) Industry competition may increase as cost curve differentials between RSPs narrow (at least for the customer access network), and 3) Decline of legacy revenue pools such as voice will accelerate.

One way falling industry returns are likely to manifest is via lower fixed margins: for both the previous owner of the last mile – TLS (compensated via government NBN payments), and for players with large ‘on-net’ subscriber bases (e.g. TPM / Optus). Margins will likely remain relatively more stable for resellers (VOC):

- TLS: fixed data margins sit at 41% today (DSL + NBN), and voice at 54%. At its Oct-15 investor day, TLS flagged it could feasibly see fixed margins dip to c20% in the long-term as a pure reseller, as it loses ownership of the last mile.

- TPM: TPM’s subscriber base is split c1,338k on-net, and 329k off-net. Based on revised ACCC pricing, on-net costs sit at $14.68 ULL, and $1.63 LSS today. These costs sit well below NBNCo’s average ARPU (and hence the average cost paid by RSP’s to NBNCo) of $43.

- VOC: VOC’s all-in off-net cost is likely at a meaningful discount to regulated prices given VOC is TLS’ largest wholesale customer (UBS estimates c$40). While the comparable all-in cost on NBN (A$43) is above VOC’s costs today, the blended NBN ARPU is also higher which should result in MTU’s $ gross margins remaining constant. Also, there is the potential that the all-in NBN cost declines.

What are VOC’s market shares?VOC has a relatively small share of the residential telco, business telco, and energy markets today. VOC’s competitive position in each product market is summarised below:

- Voice: Nationally there are c10m fixed line services (retail and wholesale) in operation, relative to total VOC voice services of c800k. We estimate VOC has c10% share of the business voice market and c5% share of the residential voice market. Voice is a market in decline.

- Data: Currently there are 6.4m residential and small business fixed data subscribers in Australia. VOC has 520k data services, implying c8.3% market share.

- Mobile: There are c30m mobile handset and mobile broadband services nationally. VOC has 167k mobile services, implying 0.6% market share.

- Energy market: There are 15.1m residential and business gas and electricity subscribers nationally (4.7m gas, 10.5m electricity), VOC has 141k energy services implying 0.9% share.

Bull points:

- Significant cost synergies to be generated from transactions – VOC has guided to A$13-15m from Amcom acquisition to be realised by end FY17 and A$40m to be realised by the merger with M2 by end FY18 driving a base of earnings growth.

- Better network quality means reduced customer churn – Gross consumer churn ratio of 2.6% per month is higher than competitors due to its younger customer demographic and sales-centric model, which usually attracts a greater mix of high-churn customers. However, post-merger, the consumer division can provide faster broadband speeds improving customer experience and therefore could see a reduction in churn levels. We estimate a 1% reduction in consumer churn would add 5k SIOs per month, $2.5m revenue. Lower churn would also see total customer acquisition costs decline. Finally, every customer brought on-net also saves A$15-17 per sub providing further upside (assuming 5% of 520k customers means A$5m pa) until NBN strands the assets. This is not included in the merger synergies outlined above.

- Increased penetration of on-net buildings – Over the last few years the company has been building out its fibre network but is now undertaking more in-building marketing to sell additional fibre services within its current fibre footprint. Further penetration within Vocus’ existing fibre footprint would incur minimal costs and so could lead to material margin expansion. Each additional customer has been estimated by the market to have a GM of 80%+ leading to large expected EBITDA margin improvement in this business (ie 500-600bps between FY16 and FY20). With lower capex requirements and strong margin improvement from incremental customers, FCF growth should accelerate. Indeed the Independents Expert report had Vocus’ margins improving from c34% in FY15 to 46% by FY21 in its DCF analysis. There is significant scope for increased utilisation with the network at 16% utilisation at FY15. This is likely the biggest value driver for the business with management looking to increase utilisation by 5-6ppts pa. They can leverage this underutilised asset (plus the asset can grow from the current 4000 buildings to up to 10000 buildings) to sell into the SME market.

- Large opportunity to grow in the SME market – Vocus has historically focused on corporate and government customers, while M2 mostly targeted the SME market. Now Vocus now has access to a significantly strengthened sales force to target the SME market with fibre assets. Indeed VOC is increasing its sales team by 35% in FY17 to capitalise on this opportunity (to 147). There is significant potential for the company to take share in the $2.9bn CBD SME market. DB estimates Vocus taking a further 10% share over the next four years in that market equates to an additional ~$300m of revenue.

- Potential for NBN-led market-share gains – As the NBN is progressively rolled out, customers will be required to sign up to new contracts and hence there is an opportunity for Vocus to take market share. Vocus improved its NBN market share by 80bps between Dec-15 and June-16, and management has an internal target to increase its share from 6% to 10% of incremental customers by Dec 16 and noted recently that consumer business has 15% market share of new additions vs 7% total market share.

- Strong earnings outlook – market has Vocus delivering an EPS CAGR of 21% for FY16-FY19. In a recent trading update they noted corporate & wholesale has exceeded new sales targets in 1Q17, active NBN consumer base has increased by 21.7% since June-16 (+15k vs base of 86k) and VOC’s average $ margin on NBN is consistent with DSL bundles. Management informally comfortable with consensus for FY17.

Key downside risks include:

- Merger synergies not being achieved – see this as a low likelihood given recent confirmation of expectations at the result

- Competition driving down ARPUs or market share – this is a risk but VOC is better insulated and confirmed recently that VOC’s average $ margin on NBN is consistent with DSL bundles

- Poor management of costs leading to margin compression – always a risk but these guys have done many integrations and have executed well to date.

- Value-destructive acquisitions – acquisitions are off the table for the short to medium term

- Unfavourable ACCC rulings on access charges

- Adverse changes in NBN access and usage charges – it is more than less likely that the CVC is reduced rather than increased.

- VOC has been sold off heavily recently for any one of a number of potential reasons including:

- Heightened NBN concerns which have hit the sector broadly stemming from TPG’s lower than expected FY17 earnings guidance. These concerns centre around margin degradation (as noted previously, less of a concern for VOC given reseller model) and increased competition

- Limited visibility into the shape of FY17/FY18 growth (especially with reduced KPI disclosures at FY16 result)

- Lacklustre delivered FY16 organic EBITDA growth (per UBS who estimated it to be c6% though the figure is masked by divestments in the period),

- Concerns over the pace of decline in voice revenue.

- Conservatism around integration risk / synergies.

- Resignation of CFO Rick Correll. This has led to speculation in relation to the cultural fit of the organisations as he was from Vocus while the CEO, Geoff Horth was from M2. There has been some churn in the management ranks given the number of transactions undertaken over recent periods.

- Selling by James Spenceley of 76% of his holding. Conversely other directors including Vaughan Bowen, Rhoda Phillippo, Michael Simmons and Craig Farrow have increased their holdings modestly.

Happy Investing,