The team at DMX, managers of the TAMIM Australian Equity Small Cap IMA, take a look forward to 2017.

2017 Outlook: Value well placed to shine

Summary:

As passionate value investors we believe buying under-valued and largely unknown smaller companies is a sensible long term investment strategy, and a key driver behind the significant out-performance of the All Ords since launch 21 months ago. We view the current valuation differential between value and growth stocks, as well as the global macro backdrop, as particularly supportive of value stocks in the year ahead. We believe our investors are well placed to benefit.

Value Investing at an Extreme:

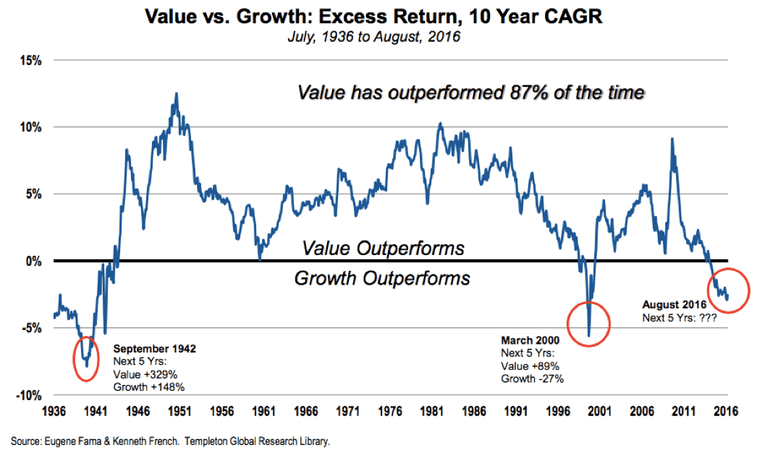

As a starting point let’s look at the very long term performance data regarding value versus growth investing. Value investing as a strategy has out-performed growth investing 87% of the time over the past 80 years as shown by the most recent Templeton analysis using 80 years of data:

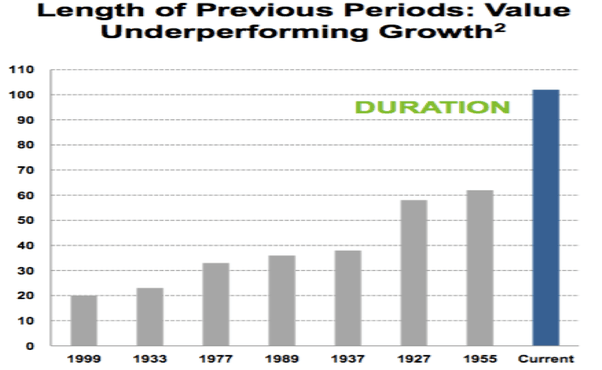

However, value investing has dramatically under-performed growth investing since the global financial crisis, and the recent under-performance of value versus growth has been extreme:

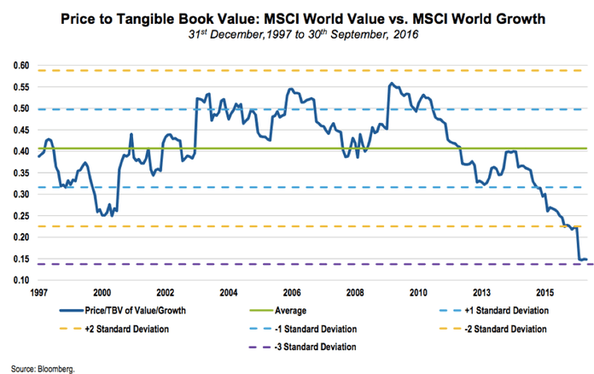

As a result, the valuation gap between value and growth stocks is currently at a long term extreme:

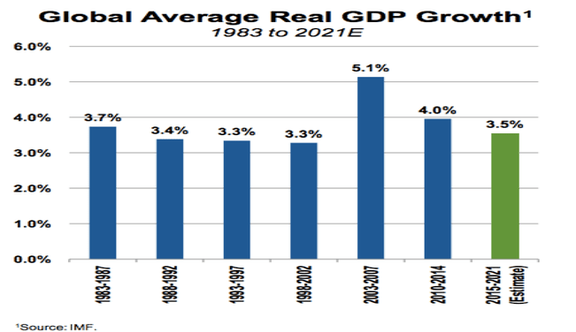

At a time when global economic growth is relatively stable/normal:

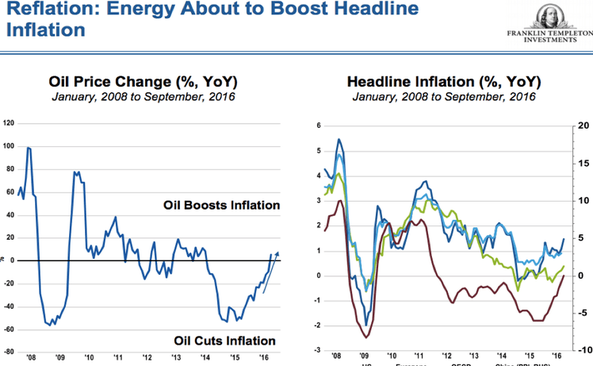

Inflation has started trending upwards (source: Templeton):

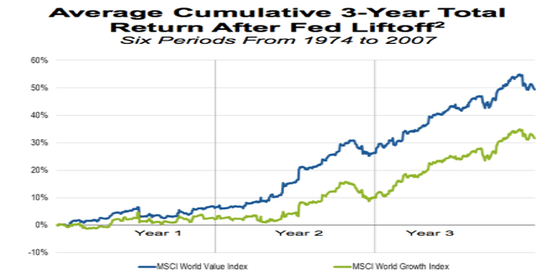

And interest rate risk is now clearly on the upside as highlighted on numerous recent occasions by the Fed. Historically, a rising interest rate environment has dramatic implications for value investing as growth stock valuations tend to suffer in the face of a higher discount rate which forces investors towards the cheaper end of the investment spectrum:

The unusually long period of growth out-performance versus value looks to have ended, which bodes well for value investing as a strategy looking forward. We view the current market environment as ideally suited to a disciplined and focused value strategy.

Conclusion:

We remain committed value investors in our underlying smaller companies’ fund and believe the outlook for value investing as a strategy is particularly attractive at this stage. With interest rate and inflation risk now clearly on the upside, investors are likely to focus more on underlying valuations looking forward. The outstanding out-performance of the All Ords over the past 21 months has been achieved despite the value investing headwinds evident throughout this period. We look forward to a period with value investing tailwinds behind us.