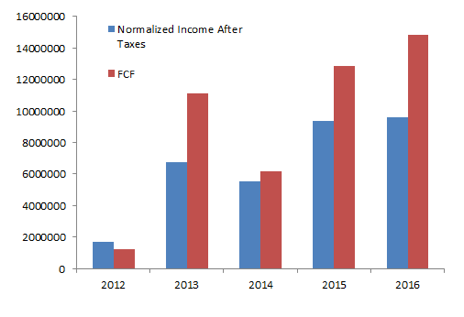

- A high level of recurring earnings;

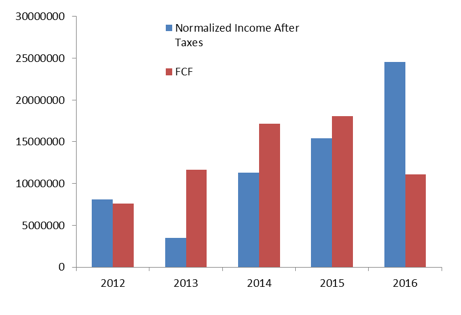

- A high level of Free Cash Flow;

- Increasing margins as new clients are added; and

- Increasing returns on capital.

Consequently companies with high quality software products can be relatively safe equity investments (not that any equity investment can ever been considered 100% safe). This is particularly true if they dominate or have a significant market position in a particular niche. Thankfully, several companies of this nature exist on the Australian Share Market and whilst they may appear small in market capitalisation terms in our opinion it would be a mistake to classify them as risky.

To illustrate the above points we will have a look through some of the major software companies listed on the ASX to see how we identify those high quality companies with the characteristics we have described above. The companies we have chosen are:

- Aconex: A company providing Software as a Service (SaaS) to clients in the construction sector. A recent IPO from US Private Equity investor Francisco Partners.

- Altium: Altium designs software for the design and manufacture of Printed Circuit Boards. They are the fourth largest player in the PCB software market globally, having grown from a 10% to 16% market share over the last year.

- Class: Class is the leading provider of software for the administration of Self Managed Super Funds.

- Freelancer: Freelancer is a platform that enables businesses to connect with independent (or freelance) professionals primarily in the IT space to complete one-off tasks.

- Gentrack: Gentrack is a software company specialising in billing for Utilities and Airport management software.

- Hansen Technologies: Hansen, like Gentrack, also specialises in billing for Utility companies.

- IRESS: IRESS provides software for financial market participants including the flagship market access product as well as wealth management platforms.

- Integrated Research: Integrated Research is a leading global provider of performance management software for critical IT infrastructure, payments and communications systems. The company has 120 out of the Fortune 500 companies amongst their clients.

- MYOB: MYOB provides accounting software to Small and Medium Enterprises.

- Technology One: Technology One provides enterprise software primarily to the local government sector.

- Wisetech Global: Wisetech is a software solution for supply chain management.

- Xero: Xero is a competitor to MYOB and provides accounting software for small and medium enterprises.

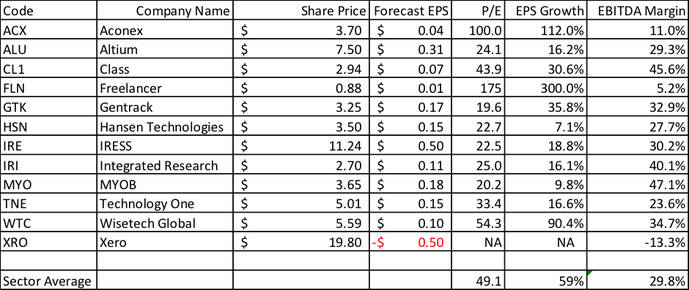

The first thing we have done is look across this selection of companies at the current consensus forecasts for Earnings per Share (EPS) as well as Earnings growth and Margins. Ultimately we want to see solid margins, good growth and a reasonable multiple.

Another group though is of more interest to us. These are companies that trade at reasonable multiples although still have impressive growth rates (Altium, Gentrack, Hansen Technologies and Integrated Research). They tend to operate in smaller niche markets and are leading players in them globally. Due to their market leading position, the profitability of these companies far exceeds the first group seen by the higher margins above. They don’t need to spend or price aggressively in order to attract new customers.

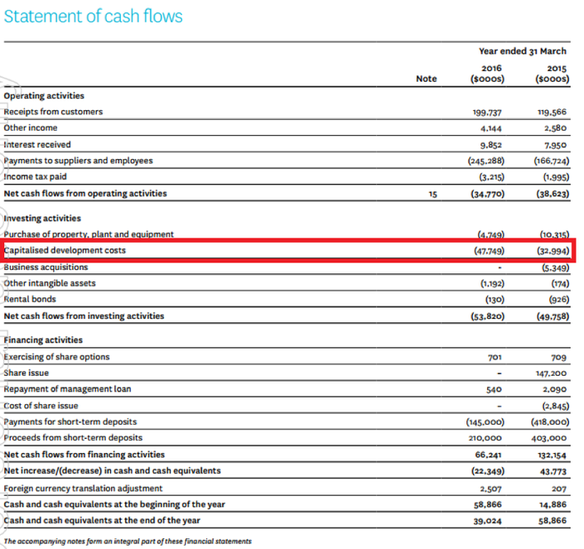

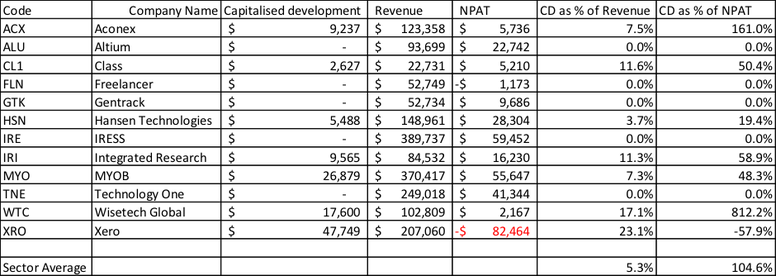

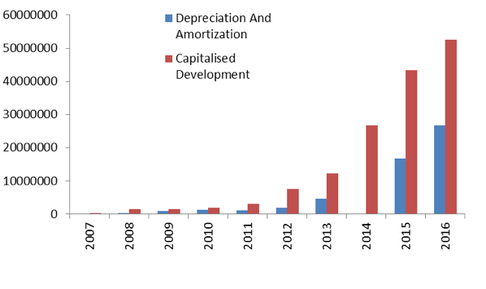

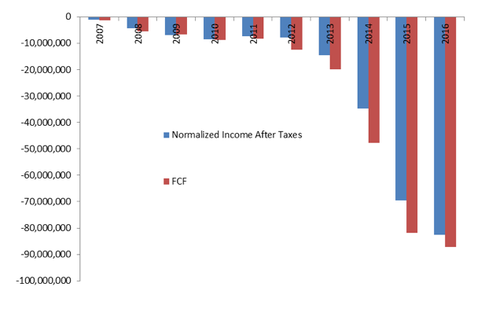

The next thing we need to highlight is that with software companies not all growth is created equal. Accounting standards give companies the flexibility to capitalise development costs of software. Essentially this allows companies to take the development cost of the software onto their balance sheet and amortise it over the expected useful life of that particular product. The effect this can have is to boost short term earnings growth and potentially reduce free cashflow relative to profit. Thankfully it is usually fairly easy to spot. The below extract is from Xero’s financial statement, where we can see the impact of capitalised software through the cashflow statement.

Of particular concern from this group is Xero, where the rate of capitalisation far exceeds the rate of amortisation on the Income Statement.