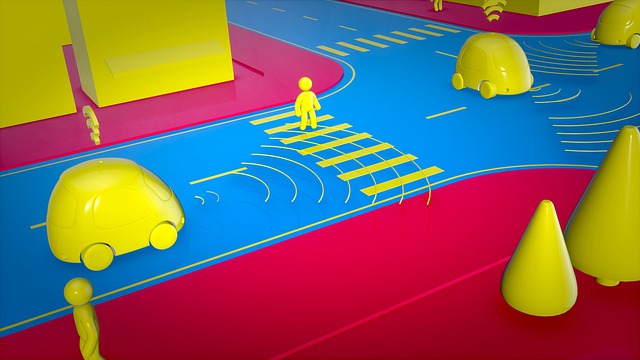

Autonomy and shared mobility, which we refer to as ACES (Automated, Connected and Shared Vehicles), has already had a tremendous impact upon the border economy. Just think of the more well-known Uber and Lyft IPO’s and, in emerging markets, companies such as Ola. The way I try to contextualise this trend is to think about the evolution from the simple mobile phone to the smartphone, trends that are mutually reinforcing. Where the hardware (in this case the Electric Vehicle) is evolved into the fully autonomous vehicle (in this case software that enables connectivity in the same way as the iOS or Android systems make up the vast majority of the underlying interface that enables the features of the smartphone). As of today, the market for automotive software has been silently growing at about 7% annual CAGR with the market expected to grow to over $469bn USD by 2030 (Source: McKinsey). This is the first thing that the discerning investor should be aware off, the overall automotive market (characterised by end-user sales) is, in contrast, expected to grow at 3% p.a. over the next decade (assuming current trends are not changed). Simply put, the best opportunities do not necessarily lie in access to final producers or downstream so to speak, but rather in the components that make it up. As if that were not enough, it is more than likely that we will see the same creative destruction trends that we saw in other markets. Think about it in the same way that Apple revolutionised the smartphone market and now the market share of Nokia today.

Aside from software, we will continue to see advances made with regards to sensors. One can reasonably expect to reach double digit growth in this market as incumbents scramble to perfect the segment. These include shared mobility players and the more traditional auto manufacturers. Looking more in-depth, the backbone for the technologies can be categorised into two segments, ECUs (Electronic Control Units) and DCUs (Domain Control Units), which underpin VxV (Vehicle to Vehicle communication). The relevant leaders within these segments currently include Nvidia (NVDA.NASDAQ) and QualComm (QCOM.NASDAQ). We expect that high-voltage harnesses within ECU to increase whilst the converse is true for lower voltage (i.e. EV vehicles).

That said, major players have already made certain headways including Volkswagen, which plans to adopt a unified automotive architecture, and BMW, introducing a central communication services and service-oriented architecture (SOA) providing a certain level of scalability. To date, the issues remain the security of the underlying software, the efficiency and efficacy of VxV communication and circuit level complexity. Rather than going into detail that might very well bore, think of it like the problems associated with making an iOS system communicate with Windows. The alternative could be open source and a centralised system with regulators effectively operating as the middle-man. For the more impatient investors, the companies that currently dominate the DCU market are Visteon (VC.NASDAQ), Continental AG (CON.ETR), Bosch (a private company other than their Indian operations) and Aptiv PLC (APTV.NYSE). The upcoming contenders include Chinese player, Huawei (not publicly listed), Desay (part of Huizhou Desay SV Automotive Co Ltd, 002920.SHE), Shenzhen Hangsheng Electronics (HSAE is also not public) and Neusoft (600718.SHA).

What is perhaps interesting about the incumbent players vs. the upcoming players is the geographic segmentation and it adds a secondary consideration for the discerning investor. The first group are domiciled in the EU and US whilst the second are all domiciled in China. This is where we must consider geo-politics, as the Huawei situation has undoubtedly shown with regards to 5G, there will be lines drawn that makes the supply chain and investing a little more complex (and perhaps more profitable for the same discerning investors) since companies are not necessarily competing on a global landscape but within particular spheres of influence.

To conclude, recognise the following:

1) There is a developing and evolving ecosystem of companies within the broader AV thematic;

2) The industry is still in its infancy and, if the past is anything to go by, then the winners are not so easily discernible, hence it is best to diversify at this stage;

|

3) Find market-leaders but with the caveat that it might be best to also diversify geographically since the macro political situation warrants and creates a scenario whereby the winners are not necessarily best of breed. For the older generation or the historians amongst you, think back to the creation of keiretsu firms in Japan (which now encapsulate the likes of Toyota and Mitsubishi) or chaebol firms in South Korea (think companies like Samsung, Hyundai and LG) which eventually became best of breed by economic rent-seeking, thus enabling the profits to be reinvested and allowing them to move up the value supply chain. Or, going back even further, American protectionism and policies that created the industrial giants of the late 19th and early 20th centuries. To put it even more simply, take the example of aeroplane manufacturers and ask yourself the following question: If I were to invest in aeroplane manufacturers, would it be more reasonable to choose Boeing or Airbus? Personally, I would spread the investment either equally or proportionally based on market share and it would help me mitigate the risk of regulatory intervention or tit-for-tat scenarios based on the vagaries of politics. Assuming of course that all I care about is a return on my investment and not normative questions.

|