Author: Sid Rutalla

Before we proceed further, there are a few things to bear in mind. Secular growth does not mean irrespective of market environment. E-commerce and information technologies did undoubtedly change the way we do business, but that doesn’t necessarily mean buying Microsoft in the 2000 would have been a particularly great investment and remember that markets do create excesses, as pets.com did. Or for the history buffs, the tulip mania of 1637.

So, without further ado, what are the three secular growth stories that we think will fundamentally shift the way our planet (and investment markets) look over the coming decades?

For those of you that aren’t aware, this is one area that we feel is about to change and do so at a rapid rate. A technological revolution quite on par with Ford’s mass production during the infancy of automobile commercialisation. In our view, the changes taking place in Mobility can be schematised under four aspects 1) electrification; 2) autonomy; 3) connectivity and 4) shared mobility.

This is the beginning of an ecosystem, enabled and advanced as a matter of policy across most of the developed and developing worlds. While adoption might be at differing stages depending on context, there is a marked incentive for governments across the planet to adopt the technologies and commercialise quickly, especially on the electrification front. Ranging from the more aggressive targets set by regions like the EU, who as a matter of broader climate policy aim to move towards a ban of new combustion engine sales to the more aggressive outright ban of all combustion engines. The case is similar across densely populated South East Asia and the broader APAC region whose population density and energy dependence create an immense desire from governments to adopt more aggressive policies.

Take India as a prime example. The government and policy makers are not only considering a ban of new sales (as is the case in the UK) but rather an outright ban, how this will be implemented in practise is still somewhat of a question mark though. Nevertheless, that nation’s reliance on energy imports (its economic fortunes are arguably dependent upon the price of oil) make it imperative to transition towards more sustainable transportation methods. The case is similar across China, whose battle with pollution across the major cities is well documented. China has become the largest EV market in the world as of last year with government policy supporting and subsidizing the still nascent industry.

\

Shared mobility is arguably the furthest along of the four aspects we mentioned above. One just needs to look at ride sharing companies like Uber, Lyft, Ola etc. One just needs to extrapolate from where we are now to see the potential opportunities. Do these companies end up running their own autonomous fleets? In a similar fashion to Blockbuster vs streaming companies like Netflix, do these companies die because they are replaced by subscription services offered by automakers? By that we mean it is possible that, in future, you end up having a Daimler subscription and you order a car from their fleet when and if you need the Merc. If this is the case and car ownership plunges, then what happens to auto insurers? This is a nebulous area with plenty to play out and the opportunities for both long and short positions will be extremely interesting to monitor, precisely why our Global Mobility portfolio can take both long and short positions.

If all this is still not enough, below are a few figures that might help make up your mind:

- 2025, 2026, 2027 – The years in which, Norway, Belgium and Austria respectively are introducing bans on non-electric vehicles with differences across sectors. For example, the scope for Belgium only extends to new company cars.

- 2030 – The year in which the UK is proposing to ban outright the sale of fossil fuels based automobiles. India has gone further in targeting not only a ban of new vehicles but an outright ban.

- 2050 – The year at which the EU proposes to achieve a net-zero carbon target. With 2040 being the more aggressive base case in order to meet the targets set in the Paris Climate Agreement.

- With the US set to rejoin the Paris agreement, we see a marked incentive for that particular market to phase out fossil fuels based automobiles sooner than later (though we wouldn’t count on an outright ban stateside, maybe a tax on non-EV vehicle sales?).

- €5 billion – The amount of direct subsidies offered by Germany alone for auto-manufacturers to go renewable. We will continue to see more incentives within the bloc towards enabling and fast tracking the move towards EV, which remains a key pillar to achieve a net-zero carbon economy.

- The largest automotive market in the world, China, is currently undertaking a research timetable for an outright ban.

- €20 billion – The amount of penalties that automakers face going into 2021 if they don’t meet new stringent CO2 emission targets.

- $2.5 trillion – The minimum value of the new ecosystem of businesses and services that are emerging within the segment by 2030.

- $8 – 10 trillion – The overall opportunity set over the next 50 years.

- 62% – The percentage of automotives that are used as Robo-Taxis in China (think again about traditional automobile sales and private ownership).

- $1.1 trillion – The most conservative projection for market revenues generated by mobility services in China

So how do you play this?

As an investor, the best way to describe what is at play here is that it is analogous to the smartphone market in its infancy. Hindsight is an interesting thing for the investor, we would all love to say that we could have predicted Apple’s future market share and success back in the early 2000s. However, in that particular year, the mobile phone market was dominated by Nokia and Blackberry. The key is to understand that in a dynamic industry, perhaps the best way to invest is not to necessarily pick the winner of the final product but to make bets across the entire ecosystem.

After all, Apple did create a trillion dollar ecosystem ranging from semiconductors to third party component manufacturers including the likes of FoxConn, otherwise known as the Taiwanese listed Hon Hai Precision Industry. In a similar manner, mobility and the vehicle market is not only predicated on EVs per se but the software that is key to autonomous driving, the chips that go into the end product, the platform that is required to build out an increasingly autonomous and self-governing transportation network. Some winners that exemplify what we have been investing into are companies such as NXP Semiconductors (NXPI.NASDAQ) and Corning Glass (GLW.NYSE) who also happen to manufacture the gorilla glass that goes into the majority of modern smartphones, including the iPhone. Take a look at what has happened with Lithium prices and the companies that extract it in recent years, electric vehicles need batteries. This also ties in with infrastructure in the form of energy and renewables but, that said, we are a little bearish on lithium as we think the boom is mostly priced in now. You have to think blue jeans to miners in this space, not just Tesla (not currently owned in our Global Mobility strategy).

Within autonomy and sharing, companies include both traditional ridesharing platforms and e-commerce companies such as Just Eat Takeaway are particularly interesting for us. When it comes to autonomy, you will also want to research companies that are involved in things like LiDAR (light detection and ranging), RADAR, IMUs and odometry technology. Across both autonomy and sharing, cyber security will be a critical element and is well worth looking into (in today’s digital world, this is going to apply to all three thematics we are discussing). None of these aspects of mobility operate in a vacuum and we will see increasing M&A activity within the space with some of the more niche players being bought out by larger players. Take MobileEye, for example, which was bought out by Intel (owned) in the largest acquisition in the space to date. Additional firms that look particularly attractive from a listed space include UK based Aptiv, Alphabet, Baidu (for geographic diversification) and GM (owned). Another allocation that looks particularly attractive as the field consolidates is VC, in particular companies with unique ideas that target specific niches and look attractive from a takeover perspective. Many of the companies pioneering these technologies never make it to listing as the Googles and Apples of the world voraciously snap them up. One nation that is at the forefront when it comes to this space is Israel where we have historically been invested and continue to.

In addition to the above, we see an increasing scope for added investment returns by diversifying across geographies given the politically sensitive nature of this particular thematic. In fact investors in companies such VUL.ASX (Vulcan) would’ve seen astronomical returns that are in no small part to do with geographic and EU oriented supply-chains. We will similarly see additional barriers created and re-localization of supply chains which, while pushing upward pressure on manufacturing costs, could also see supply chains and profits protected. The best position for the discerning investor in our view is to bet on both sides. Irrespective of who wins or the future, the medium term should see capital benefiting from economic rent-seeking by portfolio companies.

Regardless of if you are bearish on any one of the four aspects mentioned above, this is a space undergoing a transformational period. That is, if you don’t believe autonomous vehicles are viable, electrification of mobility is already underway and being legislated. This is a space everyone should consider for inclusion in a well rounded portfolio. The roll out of the next generation of automobiles will require an element of adjustment (roads, storage, charging etc) that ties in nicely with our next theme…

Coming back to the topic of fiscal led growth, we arrive at our next thematic: infrastructure. What covid-19 has brought about (for better or worse) is fiscal deficits and questions of budgetary prudence taking a backseat. Across the planet, governments have continued to add more debt as a percentage of GDP than in the decade following the last crisis (GFC). This is a scenario that was a direct result of the extraordinary measures undertaken as a result of covid and we are not likely to see this reset perhaps as a result of path dependence. A significant aspect of spending going forward will be in critical components such as infrastructure. Indeed, this is one aspect that seems to have some much needed consensus across the aisle in the US and around the world.

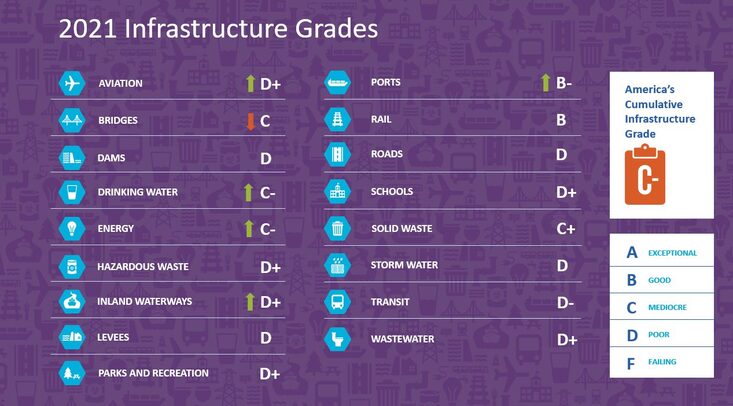

Take a look at the below graphic from the American Society of Civil Engineers who, amongst other things, grade the US’ infrastructure every four years. This graphic is a favourite of our own Robert Swift who sees it as a perfect illustration of the thesis underpinning his Infrastructure portfolio and elements of our Global High Conviction strategy.

Indeed, under current estimates, the infrastructure deficit over the next decade (if the current pre-covid trajectory was being kept) is set to grow to $15tn USD. That is, there is a differential of 15tn from what is required in order to maintain and keep up with population growth. One of the silver linings of covid, in a perverse manner, has been to make it easier for nations and policy makers to use this period as an excuse to expand budgets and tackle some of these challenges. The proportion of government expenditure (as a percentage of GDP) is likely to continue to grow with a substantial amount going towards direct stimulus.

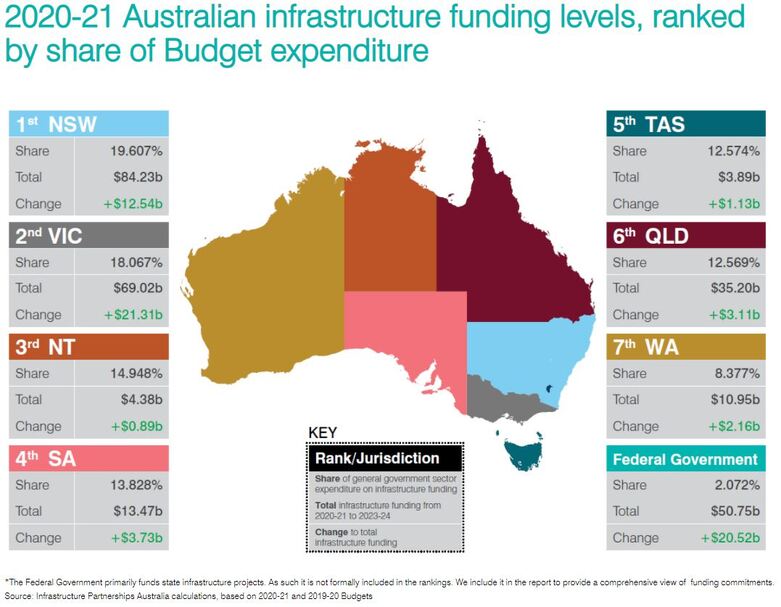

Looking locally, the below graphic from Infrastructure Partnerships Australia illustrates the opportunity nicely. Notice the sheer scale of the increases in spending; also worth noting is that the totals provided here are for spending from 2020-21 to 2023-24, not even the 10+ year timeframe we are looking at with these thematics. Take a look (see here) at the projects included in the Federal Government’s land transport infrastructure program ($110bn over the next ten years).

Within this space, there will be certain nuances though. Whereas developed countries might see greater emphasis upon upgrading the telecommunications and ailing road infrastructure (both sorely needed in Australia), we will see increased emphasis placed upon rail and energy storage (there’s those batteries again) in developing markets across Asia and Africa. A key aspect of our own exposure comes from companies like Verizon (VZ.NYSE, telecommunications), China Water Affairs (0855.HKG) and China Lesso (02128.HKG, a PVC pipe manufacturer). The obvious play on this thematic is companies that will be getting the construction work but we feel this a bit of a trap, this places entirely too much reliance on winning contracts for our liking. Much the same with picking the ultimate finished product winners of the mobility segment, you’re far better placing diversified bets across the entire space, up and down the supply chain.

Similarly, we also make the call that infrastructure is likely to play a greater role in global geopolitics. We have already seen increasingly ambitious projects by China such as the One Belt and One Road (OBOR) plan. OBOR has a considerable amount of its reason for existence rooted firstly in managing the de-industrialisation process that is likely to take place as its China’s populace continues to age and move up the wage curve (i.e. older industries are likely to transition towards South East Asia in search of lower labor costs) and secondly to extend Chinese influence outwards in order to maintain its own economic and protein supply chains. Take the case of energy. As the largest importer of oil, China faces what has been termed the ‘Malacca Dilemma’ which essentially refers to the fact that over 80% of her energy imports pass through the Straits of Malacca and, should instability occur in the region by a state or non-state actor, it could effectively paralyse the Chinese economy. A key rationale behind ambitious projects such as CPEC (China-Pakistan Economic Corridor) is to safeguard China’s strategic interests for imports from EMEA (Europe, the Middle East and Africa). By the way, these strategic imperatives have a large part in explaining the increasingly aggressive stances taken in the South China Sea. For the investors, one must also remember that this creates immense opportunities to profit, including exposure via Chinese infrastructure companies such as China Merchant Port Holdings (0144.KKG), China Railway Group (0390.HKG & 601390.SHA) and the inputs that go into it. For the Australian investors (iron ore or copper anyone?) companies such as BHP and Rio, we feel, have continued potential in what could be a multi-decade commodities boom.

On the other side, we are likely to see a counteraction to this by Western competitors. The Trans-Pacific Partnership was supposed to be a counterpoint to China’s plans before the Trump Administration pulled the US out. A significant aspect of the TPP was to build out energy infrastructure. We are likely to see increased cooperation from the US, as they seek to re-engage, and from a freshly independent UK (i.e. they need to find alternative trade partners following Brexit). Renewables are also likely to play a greater role in energy infrastructure and a changing energy mix is likely to be a priority role under the Biden administration. Closer to home, and regardless of the current government’s attitude, we are starting to see the established player pivot to this reality. Just this month Andrew “Twiggy” Forrest, founder and chairman of iron ore miner Fortescue Metals Group (FMG.ASX), brought Fortescue’s net-zero emissions target to 2030, a reduction of ten years and twenty years ahead of other larger miners. Part of this project is exploring the use of green hydrogen instead of coal in producing steel. Fortescue plans to develop green electricity, hydrogen and ammonia projects through subsidiary Fortescue Future Industries, chaired in Australia by Malcolm Turnbull. Australia itself, which has (in)famously refused to commit to zero emissions targets, is investing $300 million into hydrogen.

Across Asia, we have also seen China and India take great pains to implement policies pushing green infrastructure. For TAMIM, we still remain underweight India due to issues around access and equity market valuations, companies like L&T (LT.NSE) nevertheless look particularly attractive for those who are interested. Similarly stateside look to companies, even utilities (another favourite of Robert Swift), that are actively moving towards a greener energy mix such as Nextera Energy (NEE.NYSE, owned). For greater geographic exposure, research Canadian listed Brookfield Infrastructure (BIP.UN.TSX & BIP.NYSE), though the company has been trading at a considerable premium. For more growth exposure, Enphase Energy (ENPH.NASDAQ), which designs and manufactures software-driven solar energy solutions, may be worth looking into.

Domestically, our strategy has been to avoid top end players such as Transurban or Telstra but rather to focus upon niches such as Uniti Wireless (UWL.ASX, owned) which we consider to be a more credible alternative to the government run NBN. Tangentially, you also want to think about other players in the digital/data/IT infrastructure space. Our own Ron Shamgar likes Spirit Technology Solutions (ST1.ASX, owned) as a modern IT services and telco provider mostly to SMEs and corporate/government clients. Interestingly, ST1 entered the cyber security space at the tail end of 2020 via a pair of acquisitions (remember, cyber security will be critical for most industries going forward). Empired (EPD.ASX, owned) is another IT services company Ron currently favours. For utilities, we prefer the likes of Origin (ORG.ASX, owned) over AGL (AGL.ASX) despite the relatively cheaper valuation when it comes to AGL, the legacy coal business being a headache from a valuation perspective as much of institutional flows are diverted to renewables (which has the added problem off adding upward pressure on the cost of capital).

This is one theme that we are quite sure many people would have an immense amount of fatigue hearing about so we’ll keep it relatively brief. Nevertheless, it remains an area that will likely see continued growth. New payment methods, such as BNPL, have managed to generate phenomenal profits for Australian investors over the last half-decade. Luckily for us, Australia has been used as a guinea pig of sorts for these products before they are rolled out to the rest of the world. But where to next?

The world continues to move away from traditional cash and even the use of credit cards in payments transactions. New and creative solutions such as EML’s (EML.ASX, owned) VAN (Virtual Account Numbers) will continue to take market share from more traditional players. Along with niche providers, such as SMP (SMP.ASX, owned), that offer the more traditional terminals will offer significant growth potential to investors domestically. SMP recently caught a break with competitor Tyro’s (TYR.ASX) EFTPOS terminals experiencing major issues, also underscoring the importance of the infrastructure and technology underpinning these processes.

|

On a global level, we think BNPL remains very much in its infancy (remember Australia’s guinea pig status here). Sezzle (SZL.ASX, previously owned) remains our favourite when it comes to the US and Paypal is likely to make some headway given its recent entry into the market. Its ownership of p2p payments app Venmo and Honey Science give that particular business an edge in reaching to audiences that wouldn’t otherwise be reached. Square (SQ.NYSE), also a payment terminal provider, remains a service provider to federal stimulus payments (a decent business that we feel will likely continue to grow over the coming years, somehow we doubt this is the last set of stimulus measures we will see). Its cash app combines a digital wallet and enables p2p and b2b transactions. The most obvious risk in this space is regulation. Regulation is usually lagging and done post hoc, the segment is entering this phase. This type of thing will dictate the future prospects of the segment but you can rest assured, there will be winners coming out of this and, with global expansion or takeovers, there could be plenty of profit yet to be made for investors. For even greater growth exposure, continue to watch the Chinese regulatory approach with regards to Alibaba (owned) (the stake in Ant Financial makes it a rather attractive prospect). Ant Financial, by the way, also has investments in Paytm, India’s second largest payments provider after PayPal. There will likely be certain markets that don’t even let things like BNPL take hold, here we are thinking the likes of India, but that is the draconian end of regulation. It would be remiss of us not to at least mention the crypto space when talking about digital banking and payments undergoing change. That is only to say that there is definitely something happening there and it appears to be here to stay. Whether it is one of the established tokens or the technology/concepts underpinning them, there is a potentially transformational element sitting in amongst the noise somewhere. While big institutions are beginning to allocate to things like BTC, regulation is once again a big risk over the next few years. It remains a big question mark for us but definitely interesting to watch.

Conclusion

Ultimately, these three themes should see secular growth over the next ten to twenty years. Regardless of where we are at in the economic cycle, the changes happening in the mobility space will be going ahead. The beauty of this theme is that there are enough aspects under the mobility umbrella that it will see growth regardless of the issues currently facing any one of electrification, autonomy, connectivity and ride sharing. And that’s the pessimistic view. Optimistically, you only have to consider the tailwinds currently in place thanks to government legislation to see the upside. The infrastructure theme is primed because we are currently sitting in a perfect storm; a trifecta of “developing” nations still building out theirs, “developed” nations updating theirs and massive stimulus due to a global crisis accelerating everyone’s timeline. The digital banking and payments theme is probably the furthest along in terms of its development and as such we are currently looking closely at imminent changes to regulations, it is a space that has massive potential opportunities when it comes to global expansion and takeovers but much will be dependent on that.

|