Author: Sid Ruttala

We remain in an environment where leverage continues to grow at a considerable pace. This was perhaps best illustrated by the Archegos fiasco which showcased that, despite the GFC and the regulations that followed, risk was transferred from one area (i.e. namely the banking sector into the shadow banking and non-financial sector). This, combined with a whole generation off new investors seemingly driven by FOMO, should give us pause to take a step back and take time out to think.

Context

Despite the rhetoric coming out off most central banks across the planet (including Stateside), who continue to maintain a view that any inflation is rather transitory and normalisation of policy is unlikely, we would like to take a contrarian approach. No, its not the “this time it is different” line that is a surefire way to pain but rather understanding what has been happening. For the investors amongst you who have lived through the last great recession, you are probably aware off the doomsday-sayers who, at the time, predicted runaway hyperinflation when non-conventional policy was first implemented. But where the so-called pundits got it wrong was, I believe, a fundamental misunderstanding of the way and manner in which QE actually works. So, let us begin with that.

QE is simply put a mechanism by which the central bank effectively buys longer duration assets in return for liquidity into the financial system. For those off you not quite aware of how the financial plumbing works, please refer to my previous article where I did my best to explain in simple terms how the central banking system works and how cash rates are set in practice, you may be in for a surprise (I did get one particular call about the cash rate being taken to zero wrong though).

While QE does increase money supply in theory, it is not in the way in which you’re thinking. When you deposit cash with say ANZ or CBA, the bank is required to pay you interest. The bank has two options in this instance, the first is to lend against said deposit or alternatively buy interest bearing securities, say treasuries for example, which are still considered risk-free, and pay the differential in that. The problem occurs when commercial banks choose the second option and accumulate treasuries since the central bank will effectively swap them again in return for liquidity. And so, the cycle continues and money accumulates within the financial system as opposed to being seen as credit growth in the real economy. This is the reason credit growth across the EU and Japan has been stagnant through much of the last decade, as shown was shown by the first negative mortgages underwritten in Denmark a few years ago.

Unfortunately, what is required in this instance is the continued expansion of deposits despite the low rates. Although money supply seems to grow on face value it is in fact trapped in the financial system, the ultimate liquidity trap that also creates deflationary pressures. Ironically, Australia has avoided this scenario in many ways given the uniqueness and centrality of the property market to our psyche. We arguably created the ultimate “too big to fail” asset bubble, but it got the liquidity out of the commercial banking system.

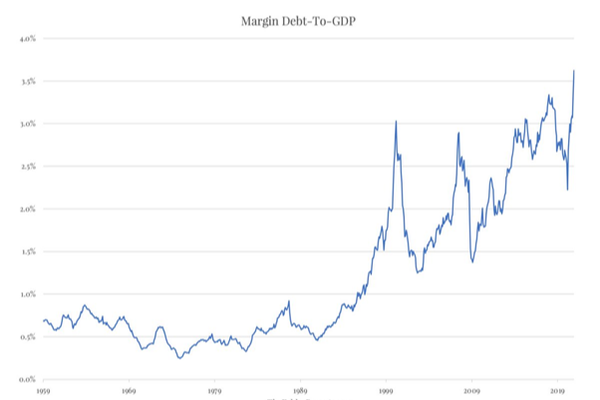

So, what has this got to do with equities and what we are talking about here? For one thing, this context has also created some rather unforeseen headaches. Ironically, in their fixation to avoid inflation at all costs, the design of QE has created another problem: asset price inflation. More particularly, the lack of return in risk free assets has in many ways pushed liquidity into riskier asset classes. This is perhaps the reason why Credit Suisse and Nomura, both institutions that are domiciled in jurisdictions which have seen this happen, were so willing to take outsized bets on a single entity in Archegos (apart from the magnitude of the counterparty risk not showing up on the balance sheet). The lending, apart from showing up in the real economy, has shown up in margin lending and swaps to date. The below graphs shows margin debt-to-GDP. In Australia’s case this has shown up in household debt-GDP (more important metric given the centrality of property).

So Where to Next?

The case till now sounds as though I am arguing against equities but here is the kicker. It was covid and the related selloff that has made me rather more bullish. Not for the reason you’re thinking, Personally, I’ve never believed in the V-shaped recovery and I don’t kid myself into believing that the world fits such idealised textbook models but rather my argument is predicated on what liquidity is doing and inflation is likely to do. Remember that the central part of my argument is that QE ended up trapping liquidity in the financial system, it did so because there was no mechanism for MS (Money Supply) to enter the real economy which is why we didn’t see core CPI pick up. What happens however when, because of say a pandemic, governments start to enter the spree?

A spree that, given current electoral and geopolitical imperatives, is unlikely to see financed by tax increases (at least on an income tax basis)? When direct stimulus, whether through infrastructure or legislation, puts upward pressure on wages? All this at a time when the biggest deflationary catalyst of the past century (not innovation), China, not only moves up the wage curve but is flexing its geopolitical and economic muscle? So, “we have a localisation of supply chains, increasing share of labor in GDP and liquidity that enters mainstream, including a lot of the new generation of leaders asking for a “bailout” of “mainstreet”. If these aspects aren’t inflationary, one must really ask what is.

Combine this with loose monetary policy, remember central banks (aside from ensuring the stability of the financial system) are also their respective nations’ bankers and (increasingly) primary lenders, and we might have a rather changed investment environment. Why does this make me bullish on equities? Simple, show me a better option to preserve wealth.

Across most of our portfolios we have pivoted away from growth and toward a reflation trade. The high growth stocks that we have become used to might not have it in them to 1) substantiate their valuations; and 2) to continue their trajectory in the face of increased government intervention. The liquidity will continue to grow (there is not much of a choice for the central banks) but it will flow in different directions.

The likely uncertainty around corporate tax (not income, corporate), anti-trust, increasing share of labor in profits and government scrutiny will probably impact the top-end of the market disproportionately, which may just answer the question as to why Mr Bezos was so forthcoming in arguing for a higher tax rate. What looks particularly attractive, even from a valuation perspective, are the so-called old-world industries – sectors like Energy, Real Estate, Consumer Discretionary and Infrastructure – which should not only benefit from the tailwinds of increased consumer demand but are a tried and tested way to hedge inflation. Additionally, they are usually a great way to generate consistent dividend yields. Having said all that, here are a few Energy companies we own.

Exxon Mobil (XOM.NYSE)

With a dividend yield of about 6.3% and P/E of x10.3 Exxon not only looks cheap but, given my conviction on a continued rebound in oil prices through the rest of the year along with supply constraints across US shale production, this is one stock that should be on the radar of any dividend hunter with substantial upside as the company continues to prove its emissions and green credentials (essential for institutional flows with the continued rise of ESG).

Enbridge (ENB.NYSE)

For those of you unaware of the company, Enbridge owns and operates the largest footprint of crude oil and liquid hydrocarbon systems in North America. It has been caught up with some recent political grandstanding with the Governor of Michigan seeking to decommission Line 5, which crisscrosses the Great Lakes, despite Enbridge’s exceptional track-record in safety (it has been operating it since 1953). However, given the support it has received from Trudeau in stating that the issue was non-negotiable we think it is somewhat de-risked, even with the change in the US’ administration. The dividend yield stands at a stellar 6.3% and, perhaps more importantly, a growth rate of 7% for the past ten years (we expect this to continue).

This one’s mainstay is a humungous natural gas pipeline network that now extends to over about 93,000km and transports close to 27% of North America’s LNG demand. It also accounts for 20% of Western Canada’s exports. More importantly, TC Energy has a dividend yield of 7% and a growth rate in the high single digits (9.34% p.a. over the last 5 years).