Author: Robert Swift

We recently made a plea which fell on deaf ears.

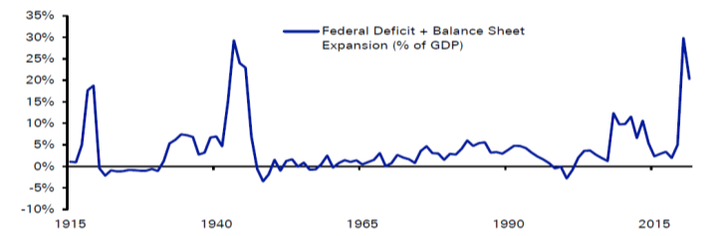

Instead of some precautionary monetary tightening, for which we pleaded, we got an additional stimulative policy aka a large pro cyclical fiscal boost of up to $6 trillion (Yes, TRILLION) some of which may go on productivity enhancing investment. The combination of fiscal and monetary stimulus in the USA is now at a level not seen since WW2.

Not surprisingly this is having inflationary consequences and these are now getting harder to conceal from the ‘great unwashed’ with hedonic pricing and ‘transitory’ arguments. The more geeky should also concern themselves about how big the output gap actually is in the USA. Large output gaps tend to mean one can be relaxed about inflation in periods of easy money and loose fiscal policy and vice versa. Those in favour of this extraordinary stimulus argue the output gap is large. Recent studies from the Congressional Budget Office would indicate the opposite and that we should be concerned if we don’t change course soon by tightening money. Essentially there is a lot less room to manoeuvre; time is running out if we wish to avoid inflation or stagflation.

Inflation is unlikely to be transitory and we have invested as such. Add in temporary(?) supply chain problems from Covid, permanent supply chain changes from National Industrial Policies (aka a dismantling of the global trade just in time system), and the supply side reductions caused by the “Green Revolution” and now hot weather, wet weather and not enough wet weather, and we will see the commodity complex, both hard and soft, on a strong upward trend. Wages are going up too and so we are looking at quite a well-entrenched bout of inflation and inflationary expectations. This will have consequences for companies with stretched balance sheets, and for those companies who provide goods and services with elasticity of demand and high fixed costs.

Companies can either take the inflation in input prices as a hit on margins and keep retail prices where they are, and/or they can raise retail prices and try to preserve margins. We believe that the latter is more likely. Prepare for persistent inflation. If we’re wrong and it’s the former, prepare for lower returns and profit growth from equities. Neither is particularly great for equity markets and the discount rates that will be applied to future earnings and dividends.

Consequently one needs to invest in companies with quality balance sheets, low elasticity of demand for their products, and not in danger of being targeted for regulation.

The Biden administration has recently introduced a potential 3rd policy tool in its attempt to generate sustainable economic growth, where sustainable means a reduction in wealth inequality, wage growth relative to profit growth, and a reduction in corporate pricing and employment power (monopolies and monopsonies). This policy tool is the use of anti-trust legislation to break up ‘Big Tech’ and more recently an Executive Order directed at the rail roads, and has been accompanied by the appointment of Big Tech critics to the Federal Trade Commission which oversees policy toward protecting consumers.

The FTC is a bipartisan federal agency with a unique dual mission to protect consumers and promote competition

While the USA dithers about monopoly power and is “putting out the (inflation) fire with (fiscal) gasoline”, elsewhere in the world a set of policy makers is acting in a more orthodox manner by moving counter cyclically to reduce the build-up of inflationary expectations consequences; squeeze moral hazard out of its financial system; and prevent monopoly power from building early by applying regulatory pressure. Yes, and ironically, it’s the Chinese who seem to be doing what the “Imperialist Running Dogs” used to do? It is a topsy turvy world when the Chinese adopt the capitalist play book?.

Namely:-

- Be countercyclical in monetary and fiscal policy – China 1 USA 0

- Let owners of the risk capital be at risk – China 1 USA 0

- Prevent state sponsored monopolies and encourage competition such that capitalism serves the consumer – China 1 USA 0

Some of the regulations seem somewhat draconian, capricious and counter-productive and we have been somewhat caught in our portfolios by the severity of the Chinese regulatory crackdown. We own Ali Baba (9988.HKG) and some collateral share price damage has been seen in other large Chinese dual-listed companies such as Ping An (601318.SHA, 2318.HKG). On the other hand we are underweight Tech in our global portfolios; own none of the likely targets of the FTC in the USA and so from a portfolio perspective are underweight this risk. Additionally and crucially, any increase in regulation is typically aimed at large companies and not smaller ones. As at end July, 6 USA stocks constituted about 25% of the market. We won’t get badly hit by any USA legislation against large “Tech”. Our portfolios have a substantial underweight position in the risk factor known as ‘Size’. Small is (once again) beautiful?

We will shortly be running a risk based analysis of the inflation protection properties of the listed infrastructure stock universe. There isn’t a lot of long term data on this and much of the promotion of listed infrastructure as an inflation hedge is opinion. Fair enough, but we’ll do an ex ante risk analysis of the properties of these stocks and publish shortly!

We would also suggest investors consider Asian and Japanese smaller companies. Inexpensive, improving governance, and operating in an environment of prudent macro-economic policy, we believe prospective returns look very good. We have managed a portfolio successfully for four years here and have many more years’ experience than that in Asian and Japanese equity markets.