Author: Sid Ruttala

Before proceeding further, we will put a disclaimer in saying that when it comes to property we have a tendency toward the Buffet school of thought in saying that economics and broader trends are nice to have but, when it comes down to the actual investment, has very little sway in the decision making. A good company is a good company, a good property is a good property. Almost always, the viability and return of a property investment comes down to the price at which you buy and, secondly, the way in which you manage said asset (this second aspect often determining capital growth).

This is perhaps the reason why TAMIM has historically gravitated or been attracted to so called industries in decline. Retail for one. Starting with our community shopping centre in Elermore Vale, our Fairfield Heights asset anchored by Woolworths or the more recent large format retail addition in Rutherford. Just listening to the headlines would’ve turned most investors off looking at these particular assets but it is precisely this tendency which enabled us to buy at what we feel are reasonable (if not) strong yields. If one cared to drill down into the details and past the headlines, it may have been rather evident that perhaps staple stores such as your local Woolies may still have a place. Or that consumers may still rely on physically inspecting big-ticket purchases such as home and contents (i.e. Rutherford) and this may still lead to higher foot traffic. This is all to say that we can’t simply rule out the entirety of a sector (i.e. retail) based on a broad trend, there are good assets out there for those with the patience and expertise to find them. Buy smart and manage well.

Similarly, when it comes to commercial offices, we feel that there are dislocations becoming increasingly evident.

Commercial Office Space

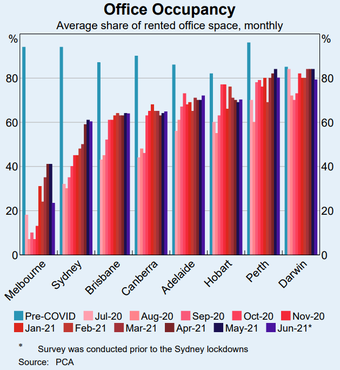

Let us begin by saying this, the headlines are right. Covid-19 has been momentous for the commercial office market in Australia (and globally). We do in fact agree that we will continue to see dislocations in the market and longer term declines in the demand for office space. Most office staff shifted to working from home during the early days of pandemic (and associated lockdowns) with the event acting as a broad catalyst in moving toward work-from-home or flexible working arrangements. There have been some, especially in technology like Atlassian, which have gone even further in effectively letting 100% of the workforce go to a flexible work-from-home arrangement. Currently, occupancy rates across Australia remain at 10-30% below pre-pandemic levels.

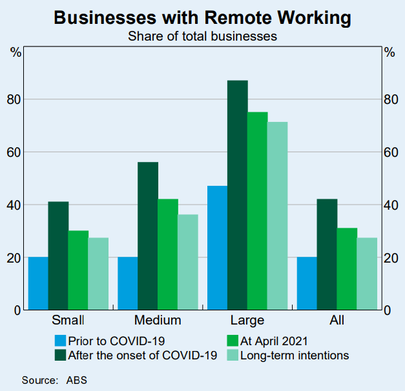

A recent survey by the RBA, for example, found that a majority of firms were looking to reduce floor space by around 25% and make increased use of hybrid solutions. All this might suggest that I’m arguing against exposure to commercial office space but here is where the nuance comes in. Let’s actually look at the previous statements and untangle it a bit. The key word is hybrid, that is businesses were by no means looking to get rid of physical presence but operate through a combination of work from home and office. By extension, the question then becomes whether there is excess supply. Secondly, what are the types of businesses looking to make these arrangements? For some greater detail, have a look at the chart below which shows the proportion of businesses with work from home arrangements broken down by size. The fact of the matter is, large enterprises have by far the highest proportion of remote working arrangements. This occurs for a plethora of reasons but it usually comes down to capacity constraints. Think then about what type of spaces are used by large enterprises (generally owner occupied, think Westpac or CBA) versus medium to small (rented).

So herein lies point number one, there will be substantial differences in the impact of the changing dynamics, contingent on the profile of the properties in question.

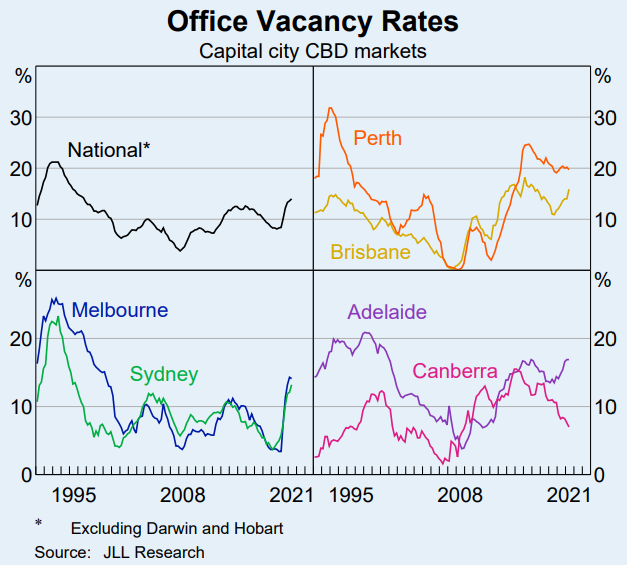

Arriving at our second point and declines in office space demand. There will certainly be particular industries that are more amenable to a remote working dynamic than others. Tech being one example that comes to mind, but what about others? Say, for example, financial services or legal services? Based on our own interactions and primary research, we remain of the view that this may not be quite so simple. Clients, for example, still require physical interaction (I highly doubt any of our investors would be quite comfortable knowing that there is no physical presence or address) or industries which still require training, a point that was recently relayed to us by one in the legal profession. This has broader implications and that is in the nature of employment in relevant cities. Most technology businesses in Australia, for illustration, have their headquarters in Sydney or Melbourne. Moreover, the nature of the labour market in these two cities suggests to us that this is where the greatest amount of dislocation may eventuate. The graph below shows the vacancy and occupancy rates across Australia’s major metropolitan areas. The outlier appears to be Canberra, which has seen consistent declines even despite the pandemic. Why? The proportion of the labour force employed in government (one area not so amenable to remote working).

Looking at the second chart, showing occupancy rates in comparison to pre-pandemic, what becomes immediately evident is that Melbourne and Sydney remain outliers. This is what arguably matters more for pricing. First, a slower recovery indicates excess supply and bargaining power remaining with the tenant as opposed to the landlord (whereas a better implies the opposite). An excess supply may indicate that there are deals to be had aplenty but, given the nature of the property markets in Melbourne and Sydney, the higher vacancy rates may not be baked into the selling price. The dislocations and real opportunities are likely to come outside of these two cities. Looking at Adelaide, we see some consistent momentum behind it towards pre-pandemic levels of occupancy yet lower in absolute terms which, all things equal, should provide some attractive pricing for buyers.

This may seem like a post-hoc justification but the rationale remains solid.

So, with that, let’s recap. Firstly, yes, commercial office space is a segment facing some long-term headwinds but this is precisely what creates the opportunities for the discerning investor. Especially so in a property market that seems excessive to say the least. Two factors that remain important are location and nature of the tenancy profile. Office spaces that are suitable for flexible working, priced more economically (catering specifically toward SMEs, not for profits, government and quasi-government and services) are likely to sustain themselves over a longer period of time. This doesn’t sit well with the investor who potentially equates larger or higher profile tenants with lower risk, however it is precisely that profile which lowers the bargaining power of the landlord and makes themselves amenable to look toward remote working. Assuming that the market continues on this trajectory and we see declining supply (we will start to see it eventually), we use the same logic in looking at this market as we did with the energy markets.

Digging deeper, we believe that a greater degree of “value add” will need to be provided by property owners to fit into the changing profile of the rental landscape. Physical offices, for example, could adopt creative propositions such as green spaces, exercise rooms and specific attributes, such as natural light, could play a greater role in the value of assets. Similarly, we also see the nature of the landlord-tenant relationship changing; aside from bargaining power, a more nuanced approach to rental contracts (including those that reflect uncertainty around end usage) will increasingly become a factor aside from compression of WALEs (increase in break points). As with anything, these changes cannot be written off by the investor as risks but potential opportunities. A compressed WALE also gives the owner some flexibility in being more active in order to potentially increase rents through more aggressive campaigns than would otherwise be the case. Similarly, a multi-tenant approach, if done properly, could certainly provide for some lift in overall rental yields.

To conclude, we shall say this: be careful what fixation on a theme or headline may cause you to miss! In fact, a bear market arguably presents the best opportunities. In this case market pessimism to a particular sector or category can also be an incredible investment opportunity. After all, going back to our first point, the best investments usually come down to simply the price an asset was bought at.

Once again, buy smart and manage well.

Sidenotes

- Some may think that the comparison above when it comes to the major metropolitans may not be fair given the variance and degree of lockdowns and policy implementation. The point here is that, even taking this into consideration, we are not seeing the fall in occupancy which is not necessarily being reflected in the asking price for sales.

- And! We have a policy announcement from the RBA. Surprise, surprise! The cash rate stays put at 0.10% with an abandonment of yield curve control (interesting times ahead for the traders). This implies that the central bank will let the long end of the yield curve rise while using the short end to maintain its target till 2023-2024. Somehow we continue to be of the opinion that rates will remain compressed for longer (except only targeting the short end). If you follow that train of thought (and this is in no way advice), every time there are jitters about rates going up (we’re quite sure the pundits will point to the long end) just buy! Balance of probabilities, they’re not. We neither have a Volcker nor the demographics to stomach it.