Those of you of a certain age will know the next line from Edwin Starr’s 1970 hit song is “absolutely nothing!” He was talking about something far more serious, war. Nonetheless, the same sentiment is permeating markets after the recent performance of central banks.Let’s take a step back and look at what central bank forward guidance is and when it started. The Reserve Bank of Australia (RBA) defines forward guidance as “the central bank’s communication of the stance of monetary policy”. In layman’s terms, it is the RBA setting expectations as to its likely course of action regarding interest rates, through communication by its employees via speeches, interviews and other media engagements. If you recall hearing interest rates were not likely to rise until 2024 and are less than impressed by the rising cost of your mortgage in 2022; no, you didn’t imagine that. We will come back to that.

Forward guidance is considered an unconventional monetary policy tool and gained in popularity, following the Global Financial Crisis (GFC), from 2009. Many central banks had slashed interest rates to zero and were looking for other ways to stimulate their economies and provide confidence to markets, investors and consumers.

The aim of this is to influence the financial decisions of households, businesses, and investors by providing a guide for the expected path of interest rates. In the case of the post GFC period this was intended to spur economic activity and assuage fears of interest rates rises in the near future.

Forward guidance attempts to prevent surprises that might disrupt the markets and cause significant fluctuations in asset prices. This brings us to the most recent crisis which was cause by the outbreak of COVID-19. The RBA cut the cash rate, from 0.75% at the start of 2020, to 0.1%. With interest rates at zero and still seeking to provide stimulus it deployed unconventional monetary policies including asset purchases; the term funding facility and of course forward guidance.

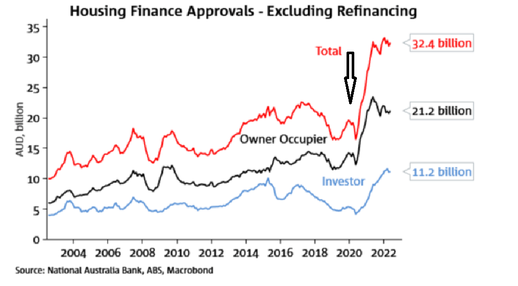

Specifically, the RBA, through Governor Philip Lowe, began communicating that they did not foresee raising rates until 2024 at the earliest. This communication continued through 2021 and had the desired effect, keeping consumer spending strong and spurring lending which in turn translated to an increase in house prices.

As 2021 wore on the RBA’s communication began to be at odds with market expectations which began to forecast interest rate rises initially in 2023 and eventually 2022. In a speech to the Anika Foundation on Tuesday the 14th of September 2021 Governor Lowe lamented “I find it difficult to understand why rate rises are being priced in next year or early 2023”. As late as the 16th of November 2021 he remarked at a business event that “It is still plausible that the first increase in the cash rate will not be before 2024”.

Australia subsequently joined the rest of the world on the inflation freight train and, in a somewhat embarrassing turn of events, the RBA began lifting the cash rate rapidly. First on the 4th of May 2022 with a 0.25% hike followed by 0.50% on 8 June 2022; 0.50% on 6 July and another 0.50% earlier this week to take the cash rate to 1.85%. How many borrowed based on the notion of flat rates to 2024? How many spurned historically low 2-year and 3-year fixed mortgage rates under the assumption rates weren’t going to rise anyway?

We discussed earlier how one of the goals of forward guidance is to elicit activity without actually moving interest rates. This worked but the Governor admitted in May 2022 that holding the 2024 commitment as long as the RBA did was an “embarrassing error” and that the bank “should have done better”. As a consequence, the RBA will conduct a review into the forward guidance used during the pandemic period and publish the results later in 2022.

So, central bank forward guidance. What is it good for? As it turns out, a lot. Studies have shown the effect to varying degrees but it certainly exists. As the saying goes “with great power comes great responsibility” and central banks must wield their forward guidance responsibly to ensure they don’t cause what they are trying to prevent which is surprise to markets and consumers. Many Australians are contending with higher rates and mortgage repayments much sooner than they anticipated which is causing significant distress for some. The RBA will say it never “promised” but members of the public can’t really be expected to be fluent in central bank speak. In that context, perhaps a little more than an embarrassing error.