As investors, we are often told to focus on the long term. But what happens when the long term collides with the present? That is exactly what we are seeing in the world of digital infrastructure, specifically data centres, the modern-day engine rooms of the internet. Their insatiable appetite for power, cooling, and connectivity is quietly reshaping the global investment landscape.

Behind every click, stream, chatbot, AI model, or Zoom call, there is a server somewhere, whirring away in a climate-controlled warehouse. And that server wants power, a lot of it. It also wants reliable fibre connections, physical security, backup systems, and increasingly, proximity to renewable energy. This convergence of demand and complexity is turning data centres into one of the most compelling, misunderstood, and urgent investment stories of the next decade.

Let us unpack what is happening and what it means for your portfolio.

The Rise and Rise of AI Infrastructure

For all the hype about AI, and much of it is warranted, one unsexy truth continues to underpin its trajectory. Infrastructure eats ambition for breakfast.

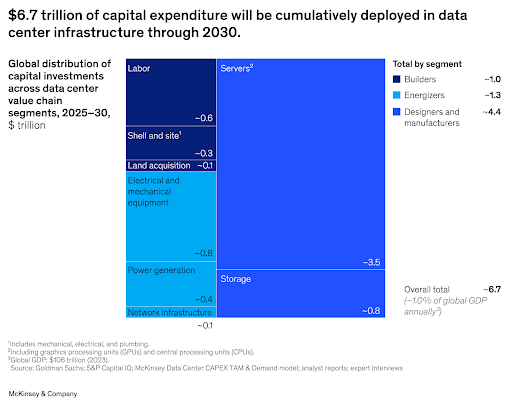

Generative AI tools like ChatGPT or image-generation models might seem magical, but their magic depends on compute power, storage capacity, and high-speed data flow. And the demands are growing at a geometric pace. Microsoft, Amazon, Google, Meta, and others are collectively pouring hundreds of billions of dollars into building, renting, or upgrading the data centre capacity needed to support AI workloads.

Why is this so intense?

- AI workloads consume far more energy and bandwidth than traditional computing.

- Training a large language model can take weeks on thousands of GPUs, demanding huge electricity loads and cooling.

- Inference, or using a model, requires lower but still consistent power, creating sustained demand at scale.

- The shift toward AI as a service is embedding these workloads into nearly every vertical, from banking to retail to healthcare.

This dynamic has caught policymakers, regulators, and energy providers off guard. Many believed digital demand would level out. They were wrong.

Electricity, the New Bottleneck

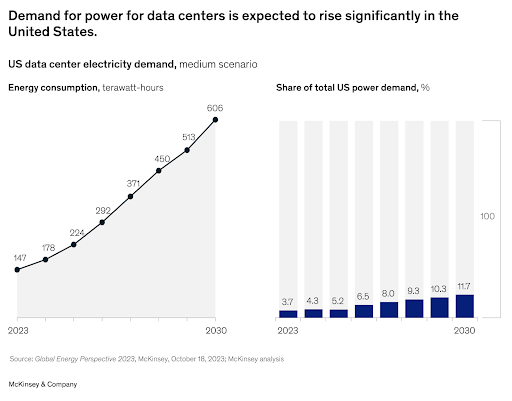

According to industry estimates, data centres already consume around 2 to 3 percent of global electricity. In some jurisdictions, it is far higher. Dublin and Northern Virginia have become cautionary tales of what happens when power demand outstrips grid capacity.

In Japan, new data centre builds around Tokyo are being paused due to grid constraints. In Singapore, moratoriums on new data centres have been imposed due to land and energy shortages. In Australia, power availability is already determining which locations can support new development.

If you think this is a niche problem, think again. The U.S. Energy Information Administration now predicts that electricity demand from data centres could double by 2030. And that may still be conservative if AI adoption continues to accelerate.

What does that mean?

- New data centres will increasingly be co-located with energy infrastructure, hydro, solar, nuclear, or even geothermal.

- Energy-intensive workloads may migrate toward regions with abundant and cheap power, such as Norway, Canada, and parts of the U.S. Midwest.

- Legacy grids, such as Australia’s, will come under pressure to modernise rapidly, or risk missing the AI and cloud transformation entirely.

From Warehouses to Mission-Critical Assets

It is tempting to think of data centres as just real estate, a bunch of warehouses filled with blinking lights. But this view is outdated.

Modern data centres are complex and high-specification infrastructure assets with characteristics more akin to airports or toll roads than commercial offices. They require:

- Redundant power and cooling systems

- Connectivity to multiple fibre routes

- High physical and cyber security

- Uptime guarantees of 99.999 percent or higher

- Ongoing hardware replacement and upgrades

Tenants, typically cloud providers, government departments, banks, and increasingly AI labs, sign long-term leases with significant upfront commitments. This makes revenue streams predictable, sticky, and well suited to long-duration capital.

Here is where it gets interesting. The capital intensity of building Tier 3 or Tier 4 data centres is rising, while the pool of capable developers is shrinking. That creates a supply and demand mismatch, and an opportunity for investors who know where to look.

The Investment Angle, Infrastructure, Energy, and Edge

We believe that data centre-related infrastructure now deserves a permanent place in the modern investor’s playbook. But it is not just about REITs or hyperscalers. There are several angles to consider.

The Energy Infrastructure Play

As data centre growth collides with grid limitations, companies building the underlying energy infrastructure, from transmission lines to battery storage to small modular nuclear, stand to benefit.

In the U.S., listed infrastructure names like Quanta Services and NextEra Energy have been standout performers. In Japan, we have identified nuclear utility plays with latent capacity that may see data centre co-location demand over the coming decade.

In Australia, we are watching the battle between rising power bills and net-zero targets. Data centre demand could become the tipping point that drives overdue grid investment and possibly unlocks stalled nuclear discussions.

The Edge Computing and Interconnect Opportunity

Not all data has to be processed in giant hyperscale centres. Increasingly, low-latency applications, such as autonomous vehicles, gaming, and AR or VR, require edge data centres, smaller facilities located closer to end-users.

This creates a new layer of infrastructure need, including micro data centres, 5G towers, and fibre routes. Companies operating in this space, or supplying the networking equipment, stand to ride a second wave of digitisation.

The Australian Angle

While much of the action is global, Australia is far from immune.

NextDC and Macquarie Technology are two ASX-listed data centre operators with exposure to this theme. Both are investing heavily in new capacity, including facilities in Sydney, Melbourne, and even regional hubs like Darwin.

Rising power prices, local planning restrictions, and energy availability are shaping expansion plans.

As global AI firms look for sovereign hosting options outside the U.S. and China, Australia could become a key secondary node, if the energy challenge can be solved.

We are also seeing more capital interest from superannuation funds, infrastructure investors, and global private equity targeting Australian digital infrastructure.

Risks and Headwinds

No thematic is without its risks. For data centres, the key ones include:

- Energy cost volatility, which can crush margins for operators with exposure to utility prices.

- Overbuild risk, where speculative building may outpace demand, especially if AI enthusiasm cools or model training becomes more efficient.

- Regulatory backlash, with community opposition, water use concerns, and environmental scrutiny possibly delaying or derailing new builds.

- Technological disruption, as advances in chip design or model compression could reduce compute needs per task.

That said, we believe these are risks to manage, not reasons to avoid the space entirely.

The Big Picture, Infrastructure 2.0

We have written extensively at Tamim about the evolving definition of infrastructure. It is no longer just roads, bridges, and rail. In today’s world, infrastructure includes:

- Cloud infrastructure

- Energy grids

- Semiconductor supply chains

- Secure data and compute capacity

Data centres sit at the heart of this transformation. They are simultaneously physical assets, enablers of innovation, and geopolitical chess pieces.

In a world where AI, remote work, cloud services, and digital sovereignty are colliding, data centres are quietly becoming the most important buildings on earth.

The TAMIM Takeaway

As investors, we do not chase hype, but we do follow the infrastructure. The digital world needs a physical backbone, and data centres are its vertebrae. While the headlines may focus on Nvidia chips and LLM benchmarks, the real leverage may lie in the quiet and concrete boxes that power them.

Investing in the data centre thematic is about more than server racks. It is about:

- Power grids

- Cooling systems

- Network fibre

- Land use

- Cloud migration

- Sovereign infrastructure

And it is a long game. As with ports, airports, or toll roads, the value accrues over years, not quarters. The current moment, where AI demand is exploding, energy grids are stressed, and capital is still relatively accessible, may represent a unique window to position for the decade ahead.

In our view, the digital industrial age has arrived. And just like the railroads of old, those who own the tracks may reap the greatest rewards.