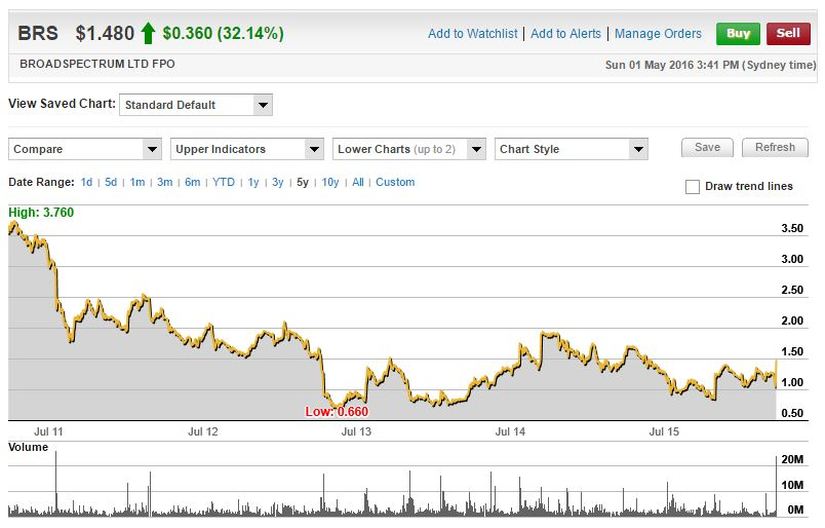

This week the portfolio finds itself exiting a long time holding Broadspectrum Limited. The company has seen its share price jump 32.1% to $1.48 over the last week, after the diversified services and contracting company decided to accept the takeover bid from Ferrovial. The company’s board had rejected the Spanish infrastructure and services giant’s advances previously, but have now unanimously recommended shareholders accept the $1.50 cash per share bid.

Broadspectrum says it has changed its mind due to increased uncertainty over its Manus Island contract. Manus Island is where the Australian gov

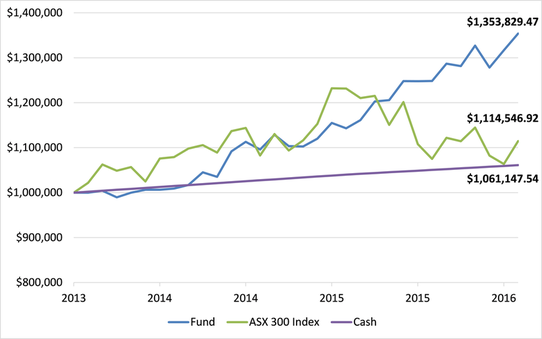

ernment has been sending illegal immigrants, but the Supreme Court of Papua New Guinea recently ruled that the detention of asylum seekers was unconstitutional.We would like to remind those who have been speaking to us about investing in this strategy, that we have TWO specific areas that we are confident in and where you’ll see us consistently making money from:

- Small-cap businesses where the management team hold a large percentage of the business, thus making it unviable for most fund managers to invest in. This means that these companies often have no broker coverage, and as a result can be materially undervalued. See our previous article on WLL that has substantially outperformed the market over the last 12 months.

- Stocks that have been oversold as they have disappointed (or more ideally embarrassed) investors the most in recent years. Many of these companies attract the attention of short sellers, and if we learn how the markets think and behave (which we believe we have a good handle on), can continually be taken advantage of.

Let us think about that last statement- “can continually be taken advantage of”. As professional share market investors, our clients pay for our expertise in understanding financial analysis and investor sentiment and behaviour; that is, they pay for the skills we have acquired over years that have taught us how to make your money work harder for you.

Not once, but twice we have bought and sold BRS. The company has a history of downgrades and bad news, but has been turning the company around quite nicely in recent times. We have used our investment expertise, to buy an undervalued business when the market didn’t want to know anything about it, only to turn around and sell it once the market woke up to the inherent value in the remaining assets. Similarly, our article on NPX two weeks ago, further demonstrates why you may want to have a conversation with us about managing some of your wealth.

We encourage you to read our original article and investment thesis for Transfield so that you too may learn how to spot such opportunities for yourself.

The share price performance of our largest investment, Transfield Services (TSE) has fallen dramatically declining -60% and -50% over 3 years and 5 years respectively, while the likes of Commonwealth Bank doubled. This negative performance brought TSE to our attention. After a brief period of averaging down our entry price, we are now generating a satisfactory return. More importantly, we believe this turnaround story is still pregnant with substantial upside for the patient investor.

We like to purchase unloved or underfollowed businesses which are being sold down by the market.

The Global Financial Crisis proved to be a rude awakening for TSE, leading to management changes and impairment charges. Unfortunately the acquisition binge culture did not stop with new management. The company completed the debt and equity funded drilling rigs business acquisition on peak earnings in late 2010 (Easternwell). Today profitability from the minerals and geotechnical drilling rigs acquired as part of the Easternwell acquisition have been wiped out with only profitability from the coal seam gas well servicing rigs remaining.

After this introduction to TSE you may be questioning why this company is considered one of our key investments. Firstly the share price has been one of the worst performing on the stock exchange in recent years and expectations for the company have been lowered considerably. In fact, you will be hard pressed to find any research analysts with a positive view on the company. We may well buy a lemon occasionally but hopefully only for the price of a lemon and without unrealistic earnings expectations.

Secondly, we think the appointment of Graeme Hunt as Managing Director and CEO was a step in the right direction. He has a good track record with over 37 years of industry experience, 34 of those years with BHP Billiton. More recently the appointment of Vincent Nicoletti as Chief Financial Officer (also ex BHP Billiton) and the election of wellregarded Diane Smith Gander as the non-executive independent director provides us some comfort that management and oversight of the company is in good hands. In a very short period of time Graeme has already injected life into the business by completely overhauling the risk management and tender process along with a rigorous approach to reducing costs and still unacceptably high gearing levels. The unwinding of some of the excesses of the past will still take some time but we believe TSE has turned the corner.

Thirdly, the core traditional services business in Australia and New Zealand (~70% of FY14 earnings) remains in good health and represents the bulk of earnings diversified across a number of customers and sectors. This includes managing commercial property & facilities management, operating large scale assets (i.e. Sydney Ferries), contracts on key infrastructure projects (i.e. Australia’s National Broadband Network) and responsibility for managing other government owned facilities (support services and welfare at Manus Island and Nauru more recent examples). Furthermore, earnings from the Easternwell coal seam gas well servicing rigs (~24% FY14 earnings) not only look secure but look likely to grow over time as the number of rigs in the market will have to increase to keep up with substantial demand over the next decade.

A perverse extension of human nature is to tend to see a company as higher risk immediately post a profit warning– surely the point of highest risk for an investor was prior to the share price plunge? High risk in our language is the increased chance of crystallising a loss. Along this line of thinking we don’t view TSE as a ‘terrible business’ or ‘high risk’ simply because it has disappointed investors. Frankly speaking TSE is a business with some good and bad qualities. At the current price we see TSE as a good vehicle to further enhance the value of your investment. However, when and if appropriate, from time to time we will take profits.With the federal budget upon us tonight, a federal election only a couple of months away, and period of global economic uncertainty (as there always is, don’t forget), investors often refer to attention seeking headlines. While some of these articles may be interesting reads from time to time, they add little value to our process. As the famous economist and author John Kenneth Galbraith said, “the function of economic forecasting is to make astrology look respectable”.

We will continue to focus our energy on variables we can control, researching one company after another until we have uncovered an investment opportunity that excites us. We are not in the business of buying fair value, but rather deep value.

We aim to invest in companies that in our view fall below their underlying value (often as we have a contrary view to the market for the reasons mentioned above) and sell when the price rises above our assessment of fair value. The key aspect of our investment process is determining the underlying or intrinsic value of the businesses. We therefore spend a great deal of time developing differentiated information that helps us determine the intrinsic value of a target company. This involves rigorous research and analysis of the industry and competitors, in order to construct a detailed picture of the dynamics of the market and investment being reviewed. By not limiting ourselves to any market capitalisation size or sector and by allocating more time to research and investing (rather than trading) we believe this strategy gives us a structural competitive advantage to generate returns in excess of our benchmark.

Happy investing,

The team at TAMIM.