Summary:

Investors love excitement!

Big win mentality: the driving force

So why are investors so attracted to the hype? Why does it attract highly intelligent people despite the seemingly obvious risks?

The fact of the matter is a very small portion of revolutionary business models will succeed over the long term, and thus create enormous wealth for their early shareholders along the way. As can be seen here, for example, if you had invested in Amazon at its IPO you would currently be sitting on a c.49,000% increase in value since 1997.

There are other similar examples of life changing gains in revolutionary new business models, and each story will have been told thousands of times over until it has reached near mythical status. And this is what is driving investor interest in “blue sky” business models; a belief that “this could be the one which creates life changing wealth for me”; often referred to as a big win mentality.

Putting a value on “blue sky” business models often irrelevant

At this point it is worth asking: how does one value a “blue sky” business model which is aiming to capture an emerging opportunity?

As a starting point, investors don’t have many financial metrics to focus upon since most of these companies don’t generate earnings or even revenues. As a result, investors will often look at the overall market size and work back to a fair stock value based upon successful market share capture by the business looking forward.

This backwards methodology of valuing a business pre-supposes that the business model is going to be successful over the long term, despite a complete lack of evidence.

Why “blue sky” investing doesn’t generally work…

It is obvious where we are going with this.

While a small portion of investors will benefit from Amazon like returns by investing in a revolutionary start-up, we believe there are a number of reasons which explain why investing in “blue sky” business models is generally a poor long term investment strategy:

- High risk of disappointment – By investing with a strong-held assumption that an unproven business model will succeed, and valuing the business on this basis, investors are very exposed to disappointment risk.

- When the disappointments come they are usually of significant size – When a new business model fails to gain traction as hoped, the difference between the expected financial performance and the actual financial performance is usually large. With large disappointments, come large share price falls.

- The hit rate of highly successful “blue sky” business models is remarkably low – Most investors’ chances of being exposed to the right business model is very low as a result.

- It is hard to invest with conviction in “blue sky” companies which means it is highly unlikely most investors would invest enough capital (if there is one successful “blue sky” company in their portfolio) to make the life changing gains they are aiming for. As a result, if a portfolio is exposed to one of the few successful “blue sky” business models, its positive returns will be from a low weighting, and are likely to be heavily diluted by the decreasing valuations across the less successful emerging companies in the portfolio.

Want to change lanes? Simple business models: a few simple ingredients

So what are the key aspects of a simple business model? Here is our list:

- Long term trading history, preferably as a listed entity – A company which has been listed for many years is far easier to understand than a newly listed entity as a long term listed history will reveal the business’s key growth drivers and risks.

- Earnings and cash flow positive – We view this as a key requisite of a simple business model. All businesses should ultimately be about generating a profit and positive operating cash flow. Rather than speculating if a business will achieve profitability in the future, we believe the true simple test is here and now.

- Understand-able business model and activities – This one is key. We always ask ourselves if we genuinely understand how a company is making money. And to be honest, the answer is often no with “blue sky” business models.

- Honest and competent management – When we meet a management team we want to walk away with a feeling of trust that they are running the business competently and are honest with their shareholders.

Stock example – an under-valued simple business model: PNC

Pioneer Credit Limited (ASX:PNC) is a great example from our portfolio of a simple, profitable business which is growing its earnings through sensible strategies from an excellent management team.

What does the company do?

PNC is a financial service business specialising in the purchase of debt ledgers.

Do we understand the business?

Yes, we do– the company aims to generate the highest possible pay back from each debt portfolio it purchases: i.e. the company may purchase a portfolio for only 20c in the dollar with the intention of generating as high as possible a payback in the coming years.

Does the company generate earnings and a positive cash flow?

Yes, the company recently reaffirmed its FY17 guidance of at least $10.5m statutory NPAT, while it also guided to an additional 12% increase in earnings for FY18 based on pre-announced FY18 EPS consensus of 24 cents (approx. 27 cents or $16m NPAT).

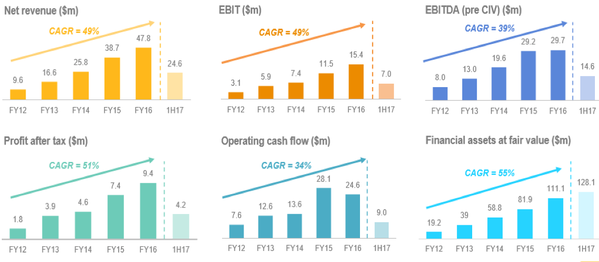

KEY PNC FINANCIAL METRICS: FY12 to FY17

Yes, the company has been listed for 3 years and had been highly successful for a decade prior to listing.We first invested in PNC in mid-2015, and have increased our investment in the company over time as we have become more comfortable with management, the business model and the company’s long term potential. Over that time PNC has also grown from being the minnow of the ASX listed debt collectors (after Credit Corp and Collection House) to being the second largest acquirers of ledgers in FY17.

Market awareness has increased over this time, as has broker coverage. Four brokers now cover PNC with price targets of between $2.00 and $3.05. FY18 earnings estimates are generally in line with PNC’s guidance (ranging from 27 cents to 28 cents) which puts PNC on a PE multiple of approximately 7x to 8x earnings at current prices.

Are management honest and competent?

In our experience, yes. We have met them a number of times and have always been very impressed.