Robert Swift explains his strategy and how the TAMIM Global Equity High Conviction IMA (or the underlying fund) has managed to achieve such impressive results over the years.

The VMQ Ranking System

Robert Swift – Head of Global Strategies

Robert Swift – Head of Global Strategies

Aside from being small and nimble, today’s report seeks to highlight the main reason for this out-performance: A well-executed quantitative scoring system that ranks each company in our universe on its Value, Momentum and Quality rankings. One of the many tools that a skilled stock-picker can use to justify their existence as an active portfolio manager, and break down the common misconception that active portfolio management doesn’t work.

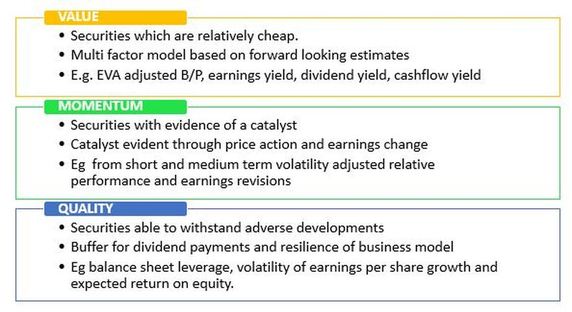

The three factors that make up our VMQ process are:

- Value – We seek to identify securities that look cheap (intrinsic value is less than the prevailing market price). Our measure of value is calculated through a multi factor model based on forward looking estimates such as EVA adjusted B/P, earnings yield, dividend yield and cashflow yield.

- Momentum – We like to see that price is moving in the right direction, indicating that the market sees what we see. This is highly critical as the market ultimately holds the power to stock-price movements. Catching a falling knife usually ends up with cut fingers, and there are many stubborn fund managers around the world who refuse to accept their mistakes, resulting in poorly performing investments where a stock price will languish for far too long.

- Quality – This is profoundly important, especially in market conditions like these where lending standards have been increased by regulators globally, resulting in funding pressure for a lot of poor businesses. We prefer lower leverage, more stable earnings and higher return on equity because only the truly strong businesses prosper in the long term. The other effect of holding high quality names is the reduced amount of risk within the portfolio. Risk is measured by the probability of capital losses. If we hold high quality companies who have a strong financial position, our investors’ capital is not exposed to as much risk as a traditional index fund is exposed to. At TAMIM Asset Management, capital preservation and strong risk-adjusted returns are what we aim to deliver, and focusing on quality businesses is one way in which we aim to achieve these goals.

Once this detailed process is complete, we then look at the equally important qualitative business factors and make a decision on the companies place in our investment portfolio. Keep an eye out for the full education course including access to our VMQ modelling spreadsheet, video tutorials on stock picking, and portfolio construction techniques on the new InvestorU education service.