Robert Swift

With all eyes on North Korea and growing tension in the region is this such a time? Is the current selling, particularly in Asia, offering a chance to repeat Rothschild’s success?

It is hard to argue that equities are in ‘bargain basement’ territory – or at least that USA equities are. Over the last several years they have risen substantially and depending on the definition of the earnings number you use trade between 18 and 22 x next year’s earnings.

On the other hand earnings volatility has been reduced and is likely to remain low, and it is unlikely that 10 year Treasury Note yields, from which we can estimate the fair price of equities, will go much above 3%. (They are currently just over 2%) Both of these help underpin USA equities at current levels and make selling frenzies attractive entry points.

So while not bargain basement they aren’t a bubble either. Looking at the average PE is misleading anyway in such a diverse universe of stocks. It’s a bit like saying “if I put my head in the oven and my feet in the fridge, then on average I’m comfortable”. It’s nonsense. Focus on stocks and try to pick those whose prospects are strong but whose share prices have fallen to where PE multiples are reasonable.

How can we be so sanguine?

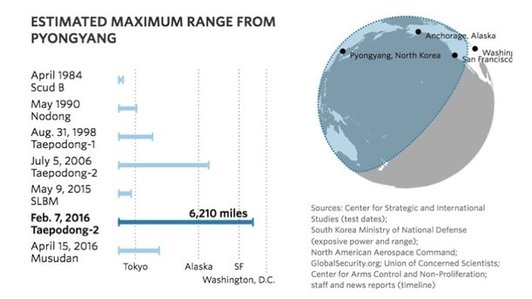

- North Korea is a side show and has done this shakedown before. Once it gets paid out then tensions ease.

- Trump might refuse to payout on such a shakedown, unlike past Presidents, and make bellicose gestures, but he has shown more restraint than expected.

- This tension gives him a chance to backtrack on his ‘abandonment of the region’ which should do wonders for its long term prosperity and stability.

- We can tell you from our connections in the USA that there is so much firepower trained on North Korea that it will be cinders in a second should it do something stupid. They aren’t stupid. Part of the opportunity to ramp up tension was created by the political corruption scandal currently engulfing the South and a perceived subsequent political vacuum. Clever stuff by the North in one respect?

- A much more interesting line of conjecture is what should you do as investors if North Korea re-engages with the South as East and West Germany did in 1990. We won’t do that here but can suggest unification would cost South Korea a lot more than it cost West Germany. Japan would also need to reconsider its source of unofficial cheap labour.

In what should you invest?

- Meanwhile back in the real world, certain USA financials we like have mostly reported good earnings and indicate stability ahead. JP Morgan beat (carefully massaged) expectations and with plenty of risk capital buffers is now starting to reduce risky loans.

- Another financial stock we like, AFLAC, trades on a PE multiple of 11.5 and grows slowly but steadily in the USA and Japan by selling policies to supplement health and medical care and loss of income protection.

- Part of our investment thesis for USA financials is that they are not the beasts of 2002 – 2008 and have much more control over what loans are being made, and are much more closely supervised. If anything, the problem is in hitting growth targets which was the root cause of the Wells Fargo accounts fabrication scandal? The next crisis won’t be caused by financial stocks.

- Directly in the ‘firing line’ in Asia is another cheap financial stock Sumitomo Mitsui Financial Group which trades on a PE of just over 9x. It has fallen about 10% in the last month and represents an attractive entry point now. Those of you who have been to our seminars or read anything we publish will know that Japan is not the economic basket case that the conventional wisdom would have you believe. The economy won’t implode and there is lots of innovation.

Now is not the time to reduce equity risk. If you are heavily invested in Australian equities then try to become more diversified. Be wary of the financial sector here which although not badly managed represents a single exposure to residential real estate. More legislation is likely which will reduce the potential for growth of that loan book and then where is the growth going to come from? Not overseas where NAB and ANZ have conspicuously failed and are now withdrawing, nor from investment banking. It won’t take much of a PE derating to make the franked dividends look a forlorn reason to own so much of the Australian financial sector.