|

Healthcare accounts for approximately 10% of the S&P/ASX 200 index and is widely regarded as a reliable and defensive sector that provides returns that are relatively uncorrelated with the rest of an investor’s portfolio and the economy at large–often with less volatility. After all, spending on healthcare is usually non-discretionary–when you need it, you need it–and health challenges occur regardless of the state of the economy. Unlike certain other sectors, such as consumer staples, it is also an area where consumers are willing to spend a greater amount as their wealth increases. An ageing population (as we are experiencing in Australia) is another tailwind for the sector, and technology advancements can also create new opportunities for both revenues and positive patient outcomes.

In addition to the other benefits described above, the healthcare sector is also one of the rare parts of the Australian share market where companies have proven their ability to compete on the world stage. One challenge for the Australian market is its small size, which can limit the long-term growth potential of companies in many sectors, particularly retail. (There is a limit to how many stores are needed for a population of “only” 25 million, especially when competing with global online marketplaces). However, many of Australia’s leading healthcare companies are not just a ‘big fish in a small pond’ but are also global leaders in their respective fields. This includes former government spinoff and biotechnology juggernaut CSL Limited (ASX: CSL), hearing implant specialist Cochlear (ASX: COH), sleep apnea device manufacturer Resmed (ASX: RMD), and disinfection device developer Nanosonics (ASX: NAN). Each of these businesses has successfully expanded its operations around the globe, driving much higher growth and profitability than investors would typically expect from companies in the healthcare industry. Not all healthcare companies on the ASX are global champions and not all have been successful in their overseas endeavours. Ramsay Health Care (ASX: RHC), for example, has had difficulties navigating the more complex and government-controlled economies in places like France, when attempting to replicate its private hospital model. Nor are all ASX healthcare businesses capable of producing high growth rates. NIB Holdings (ASX: NHF) has managed to deliver very attractive returns for shareholders based on a strategy of taking market share in the private health insurance industry, but Medibank (ASX: MPL) has generated a meagre 1.5% compound annual growth rate (CAGR) in revenue since its IPO, given how high its market share was 8 years ago. While capital growth has not been remarkable, Medibank’s total shareholder return has still been above the market over this time though, supported by consistent profitability and a strong dividend. There’s no doubt that the Australian healthcare industry can provide interesting opportunities for patient, long-term investors – if shares can be bought at the right price. To align with TAMIM’s principle of “buying well,” it’s important to recognise that investing in healthcare is not a free pass to buy at any valuation. A Pandemic Beneficiary Listed on the ASX in 1987, Sonic Healthcare (ASX: SHL) is a leading provider of medical diagnostic services. It was the first company to operate pathology/clinical laboratory services on a global basis and today is the world’s third-largest provider. It is the largest laboratory medicine company in Australia, Germany, the United Kingdom (U.K.) and Switzerland, the second-largest in Belgium and New Zealand, and the third largest in the United States (U.S.). Sonic is also the second largest provider of radiology services in Australia (with over 120 radiology centres and 300 specialist radiologists/nuclear physicians) and operates Australia’s largest medical centre network (under the Independent Practitioner Network brand) and occupational health network (under the Sonic HealthPlus brand), with over 2,000 general practitioners across more than 150 centres.

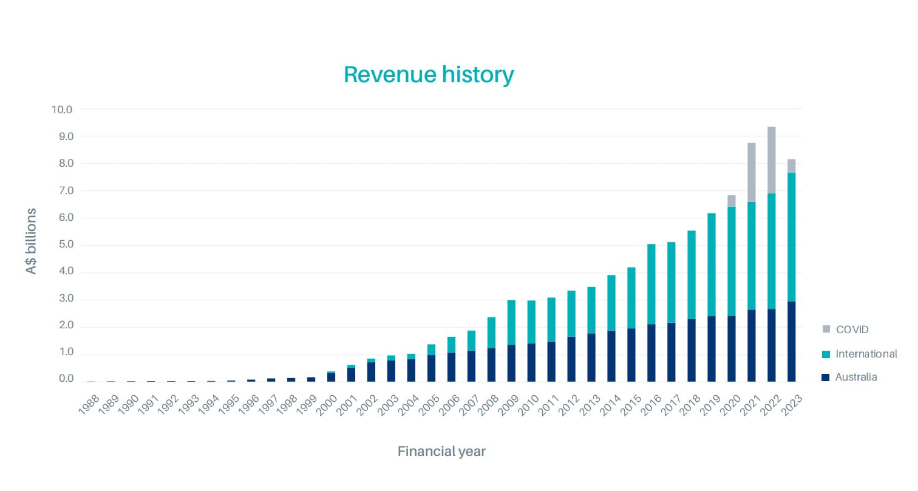

Demand for pathology services continues to grow as medical professionals request more testing, the type and availability of testing continues to expand, the population in Sonic’s target markets continues to age, and pathology testing becomes increasingly outsourced (there is some pressure from government price controls). Radiology services also have strong tailwinds from an ageing population and greater use in diagnostics by medical professionals. Sonic is the undisputed leader with ~37% market share for pathology services, which has caused it to expand into other services (such as radiology) and internationally, including in the large and highly fragmented U.S. market. Laboratory service providers were major beneficiaries of COVID-19 testing around the world and have experienced a “boom and bust” in their share prices. Investors enthusiastically bid up these companies on the back of extremely high profit margins from testing revenue, and investor enthusiasm has waned as this revenue has dissipated.

Source: 2023 Annual Report

|

Is Healthcare a Safe Haven for ASX Investors?

Is Healthcare a Safe Haven for ASX Investors?

Written by