Scott Maddock

CBG Asset Management

Source: CBG Asset Management

Source: CBG Asset Management

We can deliver income in a portfolio both by crystallising capital gains (selling securities at a profit) and by investing in high yielding securities. When building an income portfolio, we aim to balance investing in higher yielding securities against those with the possibility of growth in value. Few strongly growing companies pay a high dividend – preferring to reinvest capital back in to the business. This grows value but doesn’t pay cash to shareholders. The obvious step for an income portfolio is to focus on high yielding but lower growth companies. However, this ultimately results in low total returns to investors as;

-

- Those companies often underperform the overall (growing) market.

- Risk is higher due to excessive concentration in similar sectors / businesses.

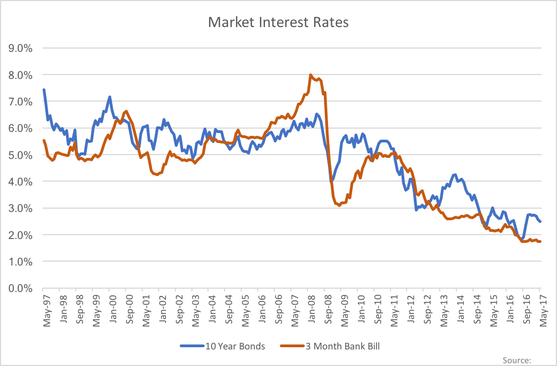

- Interest rate sensitivity is higher – demonstrated last year when the market withdrew the favoured status of property, utilities and infrastructure.

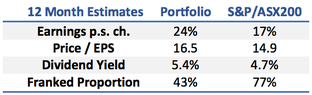

Our approach therefore has been to build a portfolio which has a yield higher than that of the broad market but also holds shares in companies capable of growing returns or asset values.

This provides the potential for a higher total return while ensuring the income stream generally exceeds that available from cash and interest rate securities. The trade-off means we hold some stocks with high yields, some with low yields but good earnings growth and some which fit in the middle of both ranges.

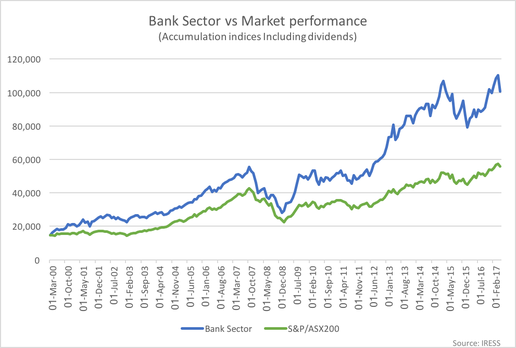

A fine example of this trade-off is the Bank sector. Banks have long been a no-brainer for investors looking for tax effective income (fully-franked) and capital growth Historically, high returns on capital, strong credit growth in the economy and the ability to restrict cost growth to a lower rate than revenue growth supported the sectors total return. Even with a step down in credit growth post the GFC, the banks have outperformed. Credit growth remained solid, reduced competition supported net interest margins and lower credit growth allowed the banks to increase dividend payout ratios. However, capital requirements have now risen, reducing the sustainable payout ratio for a given level of growth. Dividend payout ratios look stretched for NAB and Westpac suggesting little dividend increase is likely. We expect further slowing in housing credit growth and, combined with factors such as the bank levy, the result will be slower earnings and dividend growth. The sector has therefore become less attractive.

Two stocks we currently include in the portfolio which offer a bit of both income and capital growth potential are Charter Hall Group (CHC.ASX) and Regis Healthcare Limited (REG.ASX);

Charter Hall is a property funds management business with a successful track record of fund expansion and performance delivery. CHC shares are currently trading on a 12mth dividend yield of 5.2% (unfranked) while delivering strong earnings growth as commercial property values remain strong and demand for professional management of property portfolios drives increased funds under management. CHC also co-invests in the funds and so has a focus on increasing asset values as well as maintaining income levels.

Regis Healthcare is a high-quality operator of Aged Care facilities. Share prices in the sector have been depressed by changes to government funding formulae however REG has been less affected by these changes than the market expected. REG shares are currently trading on a 12mth dividend yield of 4.8% (100% franked) while maintaining a strong outlook for earnings growth in coming years.