Summary:

Profitability & cash flows:

The first deal breaker for us in the high quality search is whether a company is profitable and cash flow positive. In our minds profitability and positive cash flow generation are both core to what a business should be about, and thus we are not willing to speculate on loss-making companies which are aiming to more than cover their costs in the future. And it is not just the short term risks we are aware of: loss-making companies carry longer term risks far beyond the headline losses in our opinion. If a business is loss-making it often indicates an “empire building” mindset in management, poor strategic choices, structural problems with the business model, and cost mismanagement issues. This is obviously not always the case but in our experience the hit rate with these issues is high, and we are not willing to risk shareholders’ funds where these risks are high.

When looking at profitability we are interested in comparing a company’s reported earnings with its reported cash flows. In our experience, it is common to come across companies where their reported earnings are significantly higher than their reported cash flows. The difference is usually explained by the company’s accounting choices. For example, we recently did some work on a retirement village owner and operator which looks very cheap on statutory earnings at around 8x this year’s earnings. However, when we analysed the company’s accounts it became apparent that much of this year’s earnings are coming from expected property revaluations and thus the company’s cash flows, and the profitability of the underlying business, are likely to be significantly lower. We decided the stock was expensive as a result. We are looking for the contrary scenario whereby reported earnings are below reported cash flows reflecting conservative accounting strategies. Companies which fall into this category tend to be led by management teams focused upon under-promising and over-delivering.

STOCK EXAMPLE: Fiducian (ASX:FID) is a good example of a highly profitable stock in the TAMIM small cap portfolio which tends to report higher cash flows than statutory net profit reflecting its highly experienced and conservative management team. In its recent half yearly report operating cash flows was $3.6m versus a statutory net profit of $3.4m.

Visible organic growth drivers:

Next on our shopping list is companies which have clear and visible organic growth drivers which management can articulate.

We often come across businesses which are focused upon capturing a macro theme or trend. When we read through their presentations we generally find many inspiring charts highlighting the enormous growth potential of this macro trend/theme. However, after reading such presentations we are often left wondering what the company actually does and why it will benefit from these macro drivers. This is not what we are looking for.

We are looking for companies which have clear strategies in place to grow their businesses independent of macro trends. We’ll discuss business tailwinds later in this article (these are also on our high quality list) but we need to see clear organic growth strategies from management. And we also need to understand exactly what a company’s growth strategies mean in terms of day to day business activities.

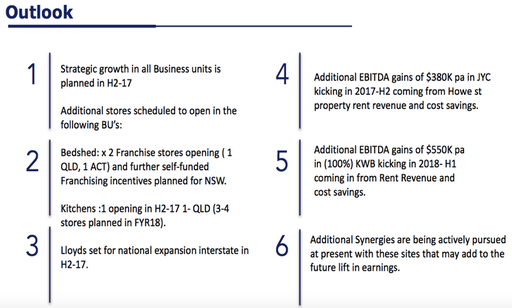

STOCK EXAMPLE: Joyce Corp (ASX:JYC) is an example from the TAMIM small cap portfolio of a stock with clear growth drivers looking forward. The following slide from the company’s recent half yearly presentation highlights 6 clear and visible earnings growth drivers in the year ahead – a big tick on our high quality list:

Aligned management & family companies:

Strong balance sheet:

There are many reasons why we like companies with strong balance sheets including:

- Lower financial risks – Companies with net cash surpluses don’t need to pay interest and are thus far less exposed to financial risks in the event of a business slowdown, rising interest rates, etc.

- More earnings to distribute as dividends – Management of debt free companies only need to think of equity holders since there are no debt holders ahead of them in the queue waiting to be paid. This means shareholders are well placed to receive attractive dividends payouts, and it also means management thinking is all about shareholders which in our experience is a good thing.

- Greater flexibility to expand when opportunities arise – Companies with strong balance sheets are well placed to make opportunistic investments when the opportunities present themselves. This is a significant advantage in our opinion since it is often hard to predict when acquisition opportunities are likely to arise.

STOCK EXAMPLE: A powerful example of a company with a strong balance sheet within the TAMIM small cap portfolio is Reverse Corp (ASX:REF). As at 31st December 2016 the company held $7.42m in net cash versus its current market cap of $8.6m. The market is currently valuing the company’s reverse calling and online contact lens businesses at a lowly $1.2m. We believe these two businesses are worth far more than this, and the company has the benefit of an extremely strong balance sheet which can be used to build the online contact lens business whilst paying very high fully franked dividends to shareholders.

Business tailwinds:

STOCK EXAMPLE: Paragon Healthcare (ASX:PGC) is a standout example within the portfolio. Paragon is a leading provider of medical equipment, devices and consumables to the healthcare market, and provides excellent exposure to the ageing population thematic. We believe the company’s organic growth drivers will be complemented and supplemented by this powerful tailwind in the years to come.

Capable, trustworthy & shareholder friendly management:

We spend a lot of time getting to know management in order to tick this final box on all our investments. We believe high quality management are even more important when investing in smaller companies than larger companies because each strategic decision tends to carry a higher relative weight in a smaller business.

As a result, we will only invest in businesses with management who are:

- Capable – We are looking for management teams who know the ins and outs of their business and industry. When talking with management we want to come away interested and inspired by what they are doing, not confused and bored.

- Trustworthy – We view this one as a deal-breaker. We need to be able to trust what management are saying at all times. This includes all financial accounts.

- Shareholder friendly – By this we mean management who will always act in shareholders’ best interests. For example, given the choice of making an expensive acquisition for the sake of empire building or paying shareholders a healthy dividend, we would aim to be invested with the management team which chooses the latter option.

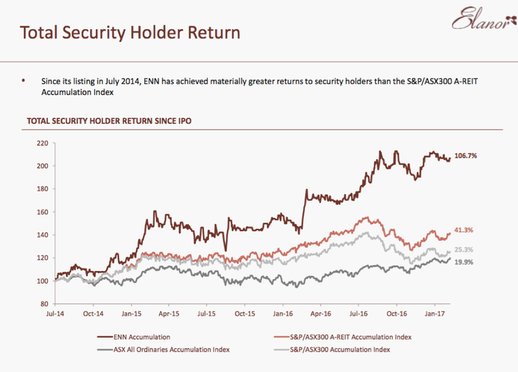

STOCK EXAMPLE: Elanor Investors (ASX:ENN) is an example of TAMIM small cap stock with highly capable, trustworthy and shareholder friendly management who are very conscious of total shareholder returns as per this slide from the recent half yearly results presentation: