As is customary, every quarter our partners on the TAMIM Global Equity Growth Individually Managed Account – Calamos Investments – publish their economic outlook.

Introduction

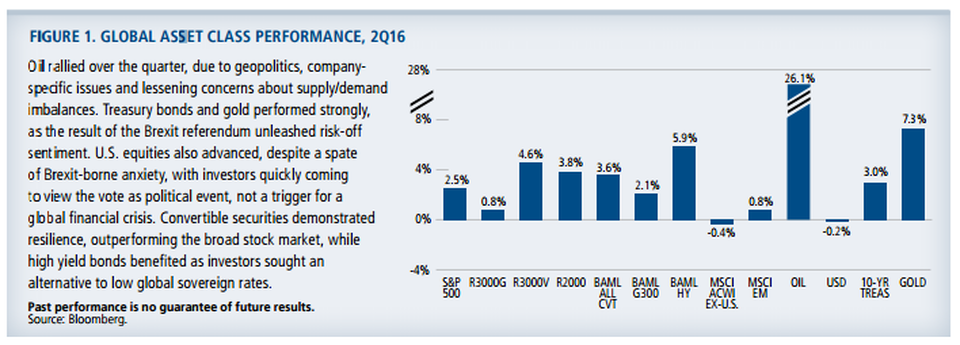

Entering the second half of the year, market participants find themselves facing many familiar unknowns: whether the U.S. and global economies can maintain their muted pace of growth, the potential ramifications of a strong dollar, and the extent to which monetary policy can influence the markets. The political landscape remains a source of apprehension, as investors seek to understand the implications of Brexit and more broadly, global populist sentiment. Yet investor appetite for risk assets has been on the upswing. In this environment, we believe:

- Despite signs of deceleration, near-term global economic expansion should continue. The pace is likely to be slow overall and uneven among countries.

- Even as U.S. equities have rallied to new highs, downside risk management remains important given the political crosscurrents and macro environment.

- Across asset classes, securities with higher quality attributes remain most attractive overall. Growth is likely to outperform, with select opportunities in cyclicals.

- The global and U.S. economies are not facing imminent recession, but fiscal policy decisions will be crucial in defining the way forward. It will be hard to break out of a tepid-growth environment without policies and regulations that encourage entrepreneurship and responsible risk taking.

- After years of aggressive monetary policy, central banks have limited room to maneuver effectively.

US Equities

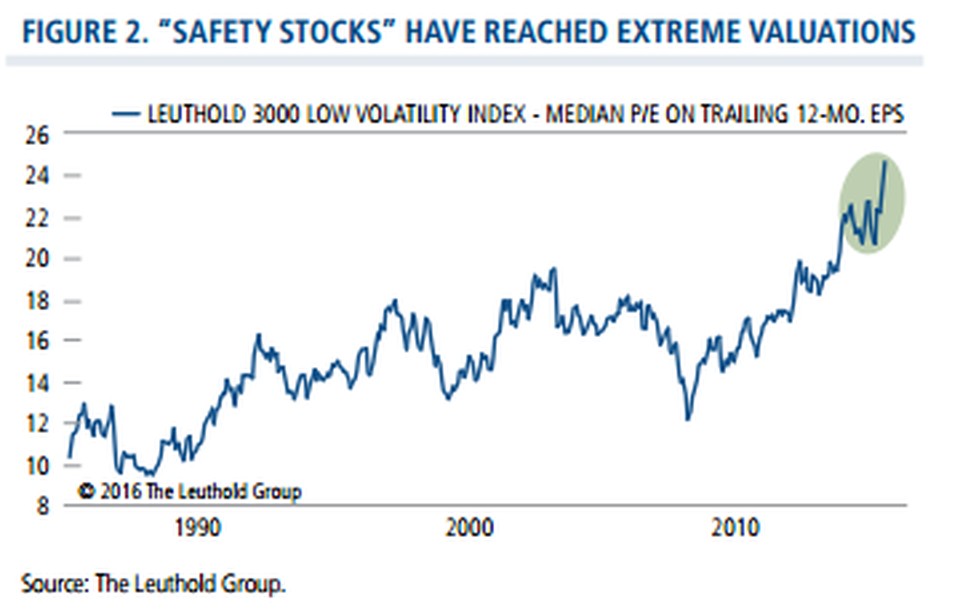

Employment and manufacturing data, as well as signs of wage growth, support our view that the U.S. economy can continue expanding at a pace consistent with recent years, albeit at a lower rate historically seen at this point of the business cycle. The direct impact of Brexit is likely to be contained and provided the dollar doesn’t spike, the U.S. economy should be able to maintain its course. We share in the view that the Federal Reserve is likely to forestall any interest rate increases for the foreseeable future, given the potential economic impact of Brexit and other related political uncertainties. The stock market is likely to remain highly sensitive to economic releases and announcements, as participants seek to make sense both of the data itself as well as how it is likely to influence Fed policy. As the next earnings announcement season commences, guidance is likely to be cautious, especially for currency-sensitive companies. We are devoting particular focus to trends in capex spending, where the impact of euro zone uncertainties is yet to be determined. Investors’ preference for cyclical stocks has faded in the wake of Brexit, with dividend-oriented stocks leading the rebound as investors seek income. However, we are concerned that many of these “safety stocks” are trading at stretched valuations (Figure 2), without offering the long-term growth characteristics we seek. Looking forward, we believe the combination of choppy global growth and lackluster yields worldwide will lead investors to increasingly differentiate between growth versus value. Conditions should support a sustained period of outperformance for U.S. growth stocks with quality attributes, albeit with opportunities for select cyclicals.

Global and International Equities

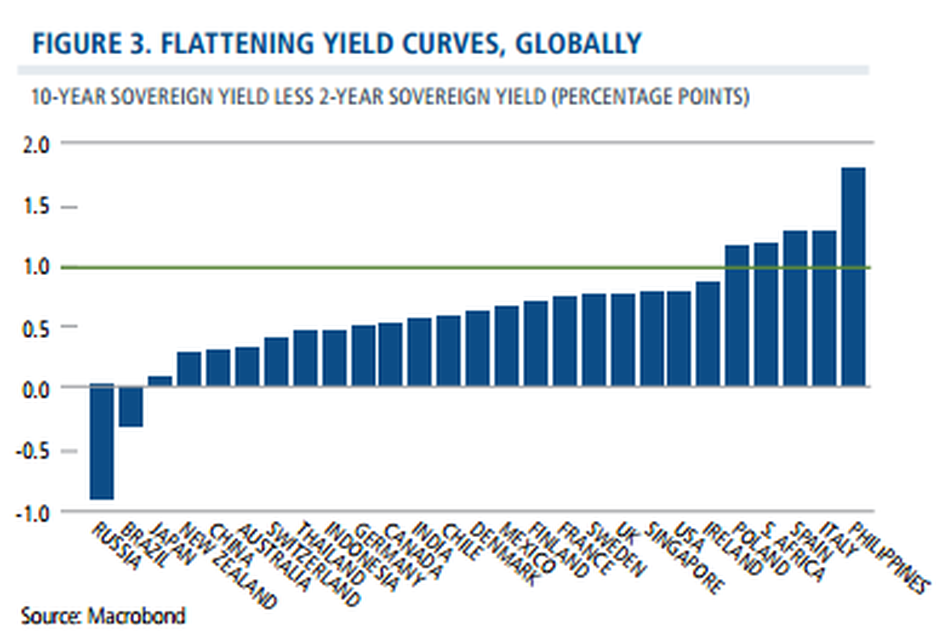

As we noted, we are not calling for a global recession, but do believe that risk management will be especially important in this environment. Although central banks remain committed to monetary policy as required, the efficacy of their actions has become increasingly uncertain. Global yield curves have become much more flat, if not inverted (Figure 3) and absolute yields continue to come down with negative yields for Japan and German 10-year sovereigns.

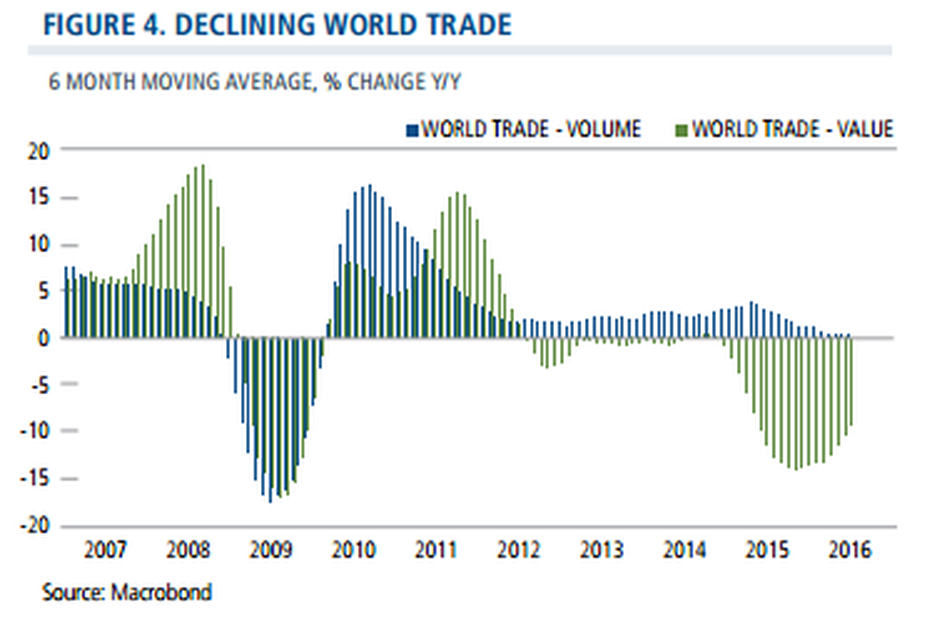

Meanwhile, muted world trade points to lower global growth (Figure 4). While Brexit is not shaping up to be the catalyst for a global financial crisis, we remain vigilant to a potential snowball effect of populist sentiment. These include already-scheduled elections and referendums, as well as calls for exit referendums in a number of other euro zone members.

However, the results of Spain’s postBrexit election suggest that populist momentum may be less than markets originally anticipated following the Brexit result, while the growing near-term economic concerns facing the UK may serve as a further deterrent. Additionally, we may see increased openness to compromises among euro zone members that give periphery countries more latitude. While we are concerned that conversations about the Italian banks haven’t gone particularly well, we are optimistic that an acceptable solution can still be reached. Our strategy in Europe has lately focused on companies with higher quality attributes, such as strong balance sheets and good returns on invested capital. While we have pared exposure to the UK and euro zone more broadly, we continue to identify opportunities in both, including technology, consumer and health care companies with well-recognized global brands and geographically diversified revenue streams. We’re more cautious on UK and euro zone companies that are more dependent on cyclical tailwinds to drive earnings growth, and those that would be more vulnerable to declining business and consumer confidence. We are maintaining exposure to European financials, but are generally underweight in banks, instead preferring beneficiaries of a low interest rate environment, such as real estate names.

In regard to Japan, economic surprises have been on the downtrend over recent months, and a strong yen is a headwind for an export-oriented economy. However, the potential for further monetary policy could help support export industries and beneficiaries of reflation, and we are more likely to see the fiscal policy we believe is essential for sustainable growth. Since the mid-February low, we have become marginally more bullish on emerging markets. Economies with lower-quality fundamentals have continued to perform well, but we remain concerned about the downside associated countries such as Russia and Brazil. We are maintaining our emphasis on countries that are less tied to commodity prices and those which are moving toward higher levels of economic freedoms. Prospects look relatively good in Indonesia and India, both of which have cut interest rates. We are also watching the Philippines with great interest, as new leadership looks set to continue with economic reforms. In regard to China, we continue to believe the government has the tools and levers it needs to prevent a hard landing in the near term. Our focus in China remains on technology and consumption, areas that we believe can benefit from the country’s transition to a more balanced consumer-driven economy.

Alternative Strategies

Volatility during the first half of the year affirmed the potential benefits of strategies that utilize complex volatility trades. For example, options-based strategies provided us with opportunities to capitalize on the conditions that the markets gave us. Given our view of continued volatility, we believe the return profiles of select alternative approaches (such as market neutral and covered call) may be compelling substitutes for traditional fixed income investments, where risk/return profiles give pause. Even though yields are low globally, interest rate risk exists in all environments, which we believe supports the case for strategies structured to avoid duration risk. Elsewhere in the alternative spectrum, long/short approaches may further overall diversification, without the associated risks of the most duration sensitive bonds.

Conclusion

We’ve seen U.S. markets reach new highs over recent days and believe there are continued opportunities for risk assets, globally. Even so, investors should remain selective and prepared for volatility. As we have observed in the past, periods of ebullience can give way to brisker sell-offs when sentiment falters. Whether markets are rising or falling, we encourage investors to let discipline, not emotion, guide decisions. By collaborating and drawing on our range of specialties, we believe our teams are well positioned to identify opportunities and manage the risks in the global economy.