Would you bet your retirement on predicting the daily weather forecast over the next five years? Just as that gamble would be absurd, so too would be the attempt to perfectly time the stock market.

Negative stories and the allure of market timing can be persuasive, often suggesting that a bubble is forming and a crash is imminent. Gloom seems to be what sells these days. After all, “If it bleeds, it leads” has been said in newsrooms across the world for a hundred years. When it comes to the world of economics and investing, negative opinions also get more attention. Focusing on the potential risks and things that could go wrong seems to add to one’s credibility.

In contrast, those with a glass half-full view can be mistaken for being overly relaxed. After all, could they really have done enough research if they hadn’t unearthed a looming crisis?

However, when it comes to investing, being an optimist pays off. Indeed, over the past 20 years, there have been sharp pullbacks, but the S&P 500 is up over 500% and the NASDAQ 1000% in that period.

It’s easy to see how investors could have been convinced to sell everything in 2019 or during the turmoil of early 2020. However, those who did missed the fastest market rebound of all time and a subsequent remarkable bull run, leaving them with cash on the sidelines. Sitting in cash waiting for another crash hasn’t been fruitful either – inflation has eaten away at your purchasing power while you tried to time the market.

To achieve long-term success, investors need to recognise the illusion of pessimism and avoid poor market timing behaviours.

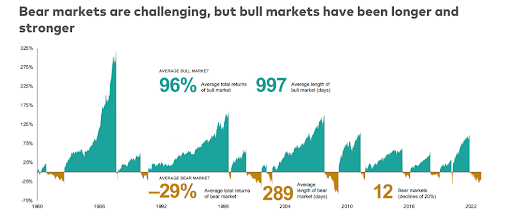

Bear Markets are Shorter, Bull Markets are Longer

Historically, bear markets tend to be shorter and less frequent than bull markets. The S&P 500 index has delivered an annual return of greater than 10% over the past 30 years, including reinvested dividends. If you ha’d invested $100,000 in 1994 and left it alone, it would have grown more than 20-fold, surpassing $2,000,000. Australian shares have delivered close to the same, just over 9% annually, and even the smaller New Zealand market has returned 8.5% annually over that period.

Source: Vanguard

Consider the myriad challenges the world has faced during that time: the September 11 terrorist attacks, numerous wars, a US housing crash, a global pandemic, and multiple recessions in the US and parts of Europe. There have been at least 14 occasions where the S&P 500 fell by more than 10%, including four instances where it dropped over 20%. Twice, the market was cut nearly in half. Despite these significant setbacks, those who stayed invested reaped substantial long-term rewards.

According to Invesco, using data from 1968 to 2020, the average length of a bear market was 349 days, while the average bull market lasted 1,764 days. Research indicates that over the last 92 years, markets have been rising 78% of the time, with only about 20 years spent in bear markets. This historical perspective underscores the importance of staying invested and maintaining a long-term optimistic outlook.

The belief that things will get better, mixed with the reality that the journey will include setbacks, disappointments, surprises, and shocks, is a fundamental principle of investing. Embracing this mindset helps investors avoid the pitfalls of market timing and focus on the sustained growth that historically always follows bear markets.

The Pessimism Bias in News and Investing

Negative news tends to dominate headlines, significantly impacting investor sentiment. Studies have shown that bad news is more likely to be reported and shared, a phenomenon known as the “negativity bias.” This bias can lead investors to make poor decisions based on fear rather than facts.

Famous bearish predictions, such as those forecasting extensive market crashes in the wake of events like the Ukraine war or a follow-on from the COVID-19 pandemic, often do not materialise. Even more pertinent is the fact that, beyond the relatively short and painful period of corrections and bear markets, bulls take over and drive markets to new all-time highs.

Investors who reacted to these dire predictions frequently miss out on subsequent market rallies. In late 2022, headlines were that rising interest rates would be the death of technology and growth. The technology-focused mega-cap leaders dubbed the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla), climbed 75.71% as a collective during 2023.

“Pessimists sound smart, optimists make money.”

– Nat Friedman

By focusing on the long-term potential rather than short-term volatility, optimists are better positioned to benefit from the market’s inherent upward trajectory.

Seizing Opportunities Amidst Technological Advancements

There is a lot of hype around AI, and it is understandable why some investors might think it’s best to “wait for a crash” before diving in. The market concentration in the top five stocks of the S&P 500—Apple, Microsoft, Amazon, Nvidia, and Alphabet—could easily fool anyone into believing the entire market is overvalued. However, this perspective overlooks the broader opportunities available within the AI sector.

The AI market is projected to grow at a compound annual growth rate (CAGR) of 37% through 2030, according to data from Grand View Research. Last year, the industry reached nearly US$200 billion, and this trajectory suggests it could achieve close to US$2 trillion by the end of the decade.

“Over time, AI will be the biggest technological shift we see in our lifetimes. It’s bigger than the shift from desktop computing to mobile, and it may be bigger than the internet itself. It’s a fundamental rewiring of technology and an incredible accelerant of human ingenuity.”

– Sundar Pichai (CEO of Google)

The AI value chain is extensive, encompassing everything from semiconductor manufacturing to cloud computing infrastructure. Companies involved in producing the essential components for AI, such as wafers, cables, sensors, and processing power, stand to benefit significantly. Additionally, the demand for AI applications necessitates energy infrastructure, robust data storage and cloud computing solutions, creating opportunities for companies in these sectors.

We never suggest investors blindly throw money into the market, nor do we think index investing is the best method for compounding wealth. However, we do know that the next phase of technological invention and innovation is really in its early days and attempting to perfectly time market entries and exits can lead to missed opportunities.

While large-cap stocks get most of the attention and some valuations may seem extended, there is a vast sea of opportunities in small and mid-cap companies. These smaller firms often fly under the radar but are poised to benefit from decades of growth in AI technology and energy innovation. By focusing on these areas, investors can position themselves to capitalise on the transformative potential of AI while avoiding the pitfalls of market timing.

The Classic Rules of Investing

Long-term investing has consistently proven to be beneficial. Historical performance data shows that despite periodic downturns, markets generally trend upwards over time. Common fears about staying invested during market downturns often lead to poor decision-making. Investors might be tempted to sell their holdings during a dip, but this approach frequently results in missing out on subsequent recoveries.

Two fundamental aspects are crucial for the long-term stock market investor. On the one hand, you have to trust that things will continue to improve in the long run.

The stock market is not the right place for pessimists.

One must have almost unshakeable confidence that the economy and quality of life will continue to improve over time. On the other hand, you have to be realistic. Conditions will not improve every day, every month, or every year. The path will rather be strewn with pitfalls.

Forecasts are often useless because most of the time, they are wrong.

There is no point in trying to predict what is coming; instead, we must prepare for any eventuality that could arise at any time. Saving like a pessimist allows for freedom and security when inevitable drawdowns occur. These are opportune moments to invest rather than run for the hills.

Additionally, with the beginning of a new era of technology and innovation, there is great cause for optimism when you take a long-term view. By maintaining this balanced perspective, investors can navigate market fluctuations and capitalise on the enduring growth opportunities the market offers.

____________________________________________________________________________________________________

Disclaimer: Alphabet (NASDAQ: GOOG), Amazon (NASDAQ: AMZN), Microsoft (NASDAQ: MSFT) and Tesla (NASDAQ: TSLA) are held in TAMIM Portfolios as at date of article publication. Holdings can change substantially at any given time.