In the wake of the recent U.S. election and Donald Trump’s return to the White House, global market sentiment remains cautiously optimistic; however, there is widespread speculation regarding the potential impacts on international trade and diplomacy. While many investors focus on the potential shifts in U.S. policy, we turn our attention to an equally significant subject: China and the Hong Kong (HK) stock market following recent stimulus efforts, especially in their relevance to Australia and global growth. Despite the geopolitical changes in the U.S., China’s economic challenges persist, including declining growth rates and mounting bad debts issues that will require innovative, homegrown solutions. Here’s where we believe investors should focus.

Key Observations for Today’s Market Environment

- Diversification is Essential

With markets swinging between growth and value, small-cap and large-cap, sector rotations have become more pronounced. In our view, market volatility is unlikely to remain at the low levels of recent years, and diversification is crucial to navigating increasingly turbulent markets. - Consumer Cyclicals Under Pressure

Sectors such as automotive and luxury goods are under strain, with companies facing swift market punishment for disappointing earnings or guidance. Recent examples like ASML and certain U.S. healthcare stocks show how quickly sentiment can shift. This trend is likely to persist, as no sector is immune from these waves of volatility. - Inflation Shouldn’t Be Purged at All Costs

The U.S. and U.K. are now spending more on interest payments for government debt than on defence. Inflation hedges are becoming increasingly attractive, and well-capitalised companies that pay dividends could benefit in this environment. - The Dangers of a Concentrated Market

A market focused on a few giants (often dubbed the “Mag 7”) is inherently vulnerable. Looking beyond these big names is essential for a healthy market and balanced portfolios.

China: A Stimulus-Fueled Pivot for Australia

Australia has long been economically tethered to China, and any shifts in Chinese policy are quickly felt across Australian investor sentiment. We recently summarised the implications of China’s latest growth package, noting the market’s misinterpretation of its goals. Any stimulus from China is likely a preliminary move, hinting at future adjustments. The fact that China has implemented any stimulus at all is positive for China and by extension, for Australia.

The Hong Kong market, often overlooked in recent years, is now positioned as a laggard with potential resilience during liquidity shifts. The sudden surge in Chinese stock markets in September caught many off guard, but it marked a potential buying opportunity rather than a rally to chase. With asset allocators beginning to take notice, we believe this represents a turning point that could elevate global interest in China.

A Changing Relationship with Capital Markets in China

Historically, the Chinese government has largely ignored its domestic capital markets, focusing instead on growth through state-led initiatives. However, we believe this stance is beginning to shift. China’s authorities are starting to see the stock market not just as a financial instrument but as a vital mechanism for long-term investment.

This shift signals a key opportunity: Should China’s capital markets stabilise, asset reallocation could begin as early as the New Year, driven by Chinese authorities’ role as new, long-term investors. This is a step toward establishing a truly functional savings and investment system, one where China’s capital market might finally play a pivotal role.

China’s Unique Approach to Economic Health

Western commentators often argue that China’s stimulus “risks disappointment” by not meeting typical expectations. However, this analysis overlooks the fundamental differences between Western and Chinese economic mindsets. China’s approach is not designed to stimulate merely for stimulus’ sake; rather, it adopts a more austere, disciplined strategy, akin to the Austrian school of “creative destruction.”

China’s economic mindset differs because it isn’t shaped by the pressures of Western-style capitalist economies, where the billionaire class and stock market performance often dictate policy. While American economic growth has largely been driven by equity markets, China’s growth is sustained by capital expenditure, bank lending, and self-sufficient investment rather than reliance on foreign investment or stock market dynamics.

Toward a Chinese Capital Market

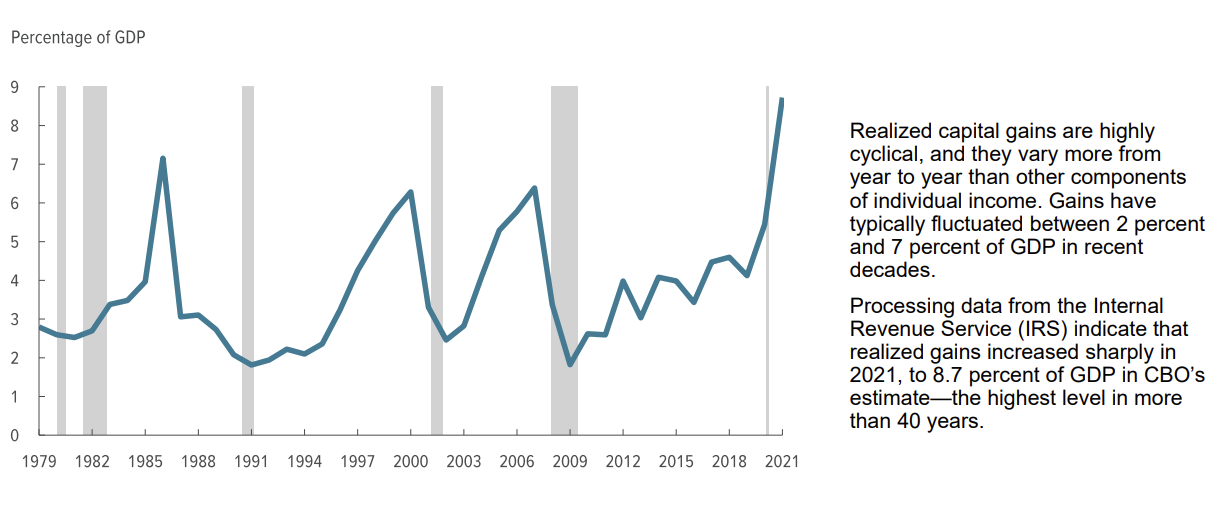

(Source: Congressional Budget Office)

In the U.S., capital markets play an outsized role, directly influencing wealth creation, government revenue through capital gains taxes, and even retirement savings. In China, however, capital markets are nearly irrelevant to the average citizen, with under 5% of household wealth invested in stocks. Instead, China’s households hold their wealth in real estate and cash, leaving a significant gap in the financial ecosystem.

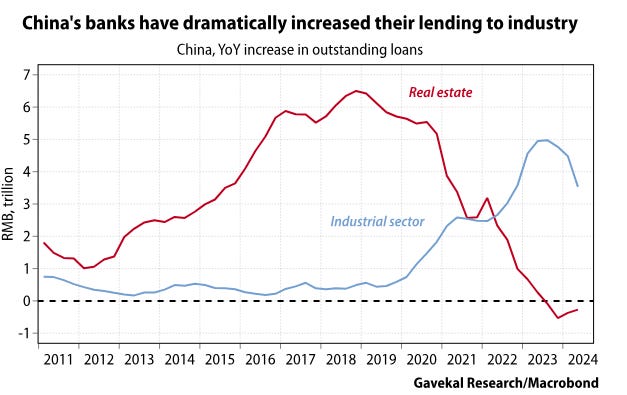

The Chinese government’s policy in recent years has deliberately shifted focus from speculative property investments to sustainable industrial growth. Capital, previously funnelled into real estate, has found its way into sectors like AI, automation, EV production, and manufacturing innovations. Notably, much of this investment is funded domestically rather than through equity markets.

The Long-Term Vision: From Speculation to Stability

Rather than an immediate growth booster, China’s latest stimulus package is about building long-term stability in its capital markets. If China can balance a mix of traditional bank lending with a growing stock market, the benefits for investors could be substantial. As China moves toward a stable and participatory capital market, it opens doors to those seeking long-term growth, not speculative gains.

As long-term investors take notice, we anticipate that asset allocations toward China will likely increase. Those with a focus on quality, income, and cash flow may find themselves ahead of the curve, benefiting from the stability that China’s market is working toward.

The Tamim Takeaway

The recent “stimulus” is more than just a short-term boost; it’s the foundation of a transformative economic strategy. China’s capital market is becoming a viable investment, especially as asset allocators start to engage in the coming months. This shift could prove advantageous for Australian investors closely linked to Chinese growth, especially as China’s long-term market potential finally unfolds.

In the end, this isn’t about China bailing out excess producers or driving up consumer debt. It’s about building a sustainable economic model that favours steady growth over rampant speculation. For investors, the lesson is clear: Don’t just do something – wait, watch, and be prepared to act when China’s markets find stable ground. The opportunities may just be starting to take shape.