Markets are always made up of at least 2 opposing views. This is what makes markets what they are. Trying to come to a price through the discovery of existing and new information and factoring all of this into future cash flow projections is what makes financial markets. That is why the team at TAMIM is passionate about what we do, we love the intellectual pursuit of finding out information that perhaps the market has not yet figured out. We use this knowledge in putting portfolios together. Because we know that different investment methodologies will work in different market environments, we work with a number of managers across a number of investment styles and asset classes, this allows us to always have a solution for the current investment environment.

European banks are in free-fall. The Stoxx 600 Bank index is down 42.5% from its high on the 20th of July 2015 to the low on 11 February 2016. This is largely driven by concerns over the ability of Central Banks to support markets globally. Mario Draghi’s policy of more and more quantitative easing is not working. Europe’s banking system is fundamentally weak. There is not enough capital supporting the mountain of debt on the banks’ balance sheets. In addition to this the ongoing weakness in oil prices causing worry about banks exposure to oil and gas corporates and the weakness in emerging market debt emanating from China continues to make the situation worse.

source: www.stoxx.com

On the surface, Australia’s banks are much stronger. But our love affair with residential property has resulted in housing dominating the asset side of banks’ balance sheets (as we all know, house prices never fall!). On the liability side of the balance sheet, it is believed that banks have a large reliance on offshore borrowing which to be fair is partially offset by a large and stable domestic funding base. The liquidity pressures on the global banking system mean that the cost of financing these liabilities will rise. The ASX Financials ex A-REITs index has fallen 24.9% since its peak on the 20th of March 2015 to the low on 12 February 2016. Is there more weakness to come. It is interesting to note that there is divergence in this index with CBA down 27.1% at is low (it has since recovered) while for example ANZ is down 41.3% from its high.

source: au.yahoo.com

Given the above global and local movements there has been a lot of commentary on the banks recently so TAMIM has done its research and has the following Bull and Bear summary of the issues for you to consider.

The Bear View

- Dependence on offshore wholesale funding is what’s having most impact on local bank share prices in the short-term. Despite a strong local deposit base funding pool there is still a reliance on offshore wholesale funding. With concerns around European banks and financial markets at present there are concerns on the Australian banks ability to continue to raise funding offshore in the short term.

- The risk of a recession in Australia has increased over the past year especially with the global resource led slow down. A recession and a resultant increase in unemployment would have a negative impact on the banks. Australian banks are highly exposed to lending to the household sector (over 50% of their loan books). Australia has the highest levels of household debt to income globally at 185% and any significant increase in unemployment would see the Australian banks profitability levels impacted.

- Concerns that bad debt provisioning especially that focused on residential house lending is low and bad debts in these areas are likely to increase in the face of a possible recession.

- Banks are increasingly being required to hold higher levels of capital to strengthen their balance sheets. The increased capital requirements are hurting returns on equity and earnings per share. As their share prices fall, the cost of raising this equity increases. This will suppress future returns from the sector.

- Negative fallout from the financial planning review which could result in class actions for the banks’ wealth management and financial planning arms.

- There is concern that the banks will not be able to sustain dividend levels especially NAB and ANZ.

The Bull View

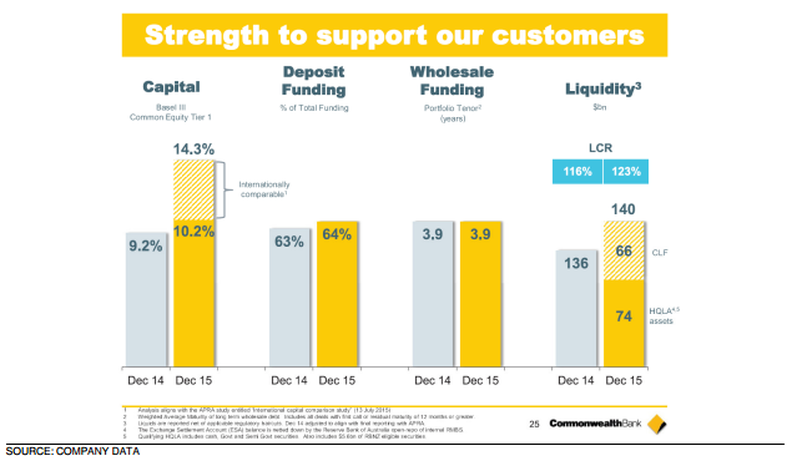

- Domestic funding capability continues to be strong with deposit funding in the 4 majors between 50% to 64% of total funding. Interestingly it seems that the banks have been able to extend the funding tenor for wholesale debt to longer terms. For example, the average wholesale funding tenor for CBA has been maintained at 3.9 years while liquidity coverage further improved to 123% of total net cash outflows. We wait with interest to see the results from the other 3 majors.

- Valuations on ANZ and NAB are at the best levels since the GFC when taking price to book values into account. Book value is the value of the tangible and intangible assets on a bank’s balance sheet. If you are willing to pay more than book, you are signalling that you expect ROE’s that are greater than the cost of equity required to fund those assets. In the first half of 2009, ANZ and NAB’s price-to-book multiples were 1.1x. While CBA was 1.3x and Westpac was 1.4x. Six years later CBA had bounced back to 3x, Westpac was 2.5x and NAB and ANZ touched 2 times. The last 12 month of regulatory-enforced de-leveraging and a string of global shocks have reduced ANZ and NAB’s price-to-book multiples to 1.2x and 1.4x, respectively. This would seem to suggest that on this measure ANZ and NAB are of interest.

- The sale by NAB of the Clydesdale business and ANZ retreating from its riskier Asian businesses are both credit positives.

- The current generation of bank bosses seem to be superior risk managers than their predecessors which will be required in this ongoing global debt deleveraging cycle.

- Dividend yields for the banks are now high (between 5.7 and 8.2% on a 12m forward yield) given the recent share rice falls which will bring buying from the retiree sector. This will provide a level of support to bank share prices.

- Credit exposure to energy is 1.1% for the CBA while the other Australian banks have exposures up to 2%. The exposure of Australian banks to this sector is about half of their global counterparts.

- Mortgage repricing on investment loan books took place in November and has not fully flowed through to the Net Interest Margins of the banks. This will be a positive for the bank’s profitability on a forward looking basis.

Source: CBA company filings

Should you own, buy or even sell the banks. The case can be made for all 3 situations and we believe the answer will largely be impacted by your circumstances and especially your time frame of investment. The recent correction in banks has vividly illustrated the risks of running portfolio’s that have a high level of concentration to 1 sector. In this case, the banks. It is even more important to be aware of this concentration risk when holding the banks because as Australians we are also highly leveraged in most cases to the property market. As always, consider both side of the argument, safe investing from the team at TAMIM.