Guy Carson

If you were to travel back in time five or ten years ago and asked Australian fund managers to name some of the highest quality companies listed on the ASX, there would be very good chance that a number of them would name Woolworths. For a long period of time the company was so consistent with its store roll-out, earnings growth and returns on capital that it was hard to go wrong buying the shares. Unfortunately that has all changed. Fast forward to today and ask some of the same fund managers to name one of their favourite turnaround plays and you might get the same answer, Woolworths.

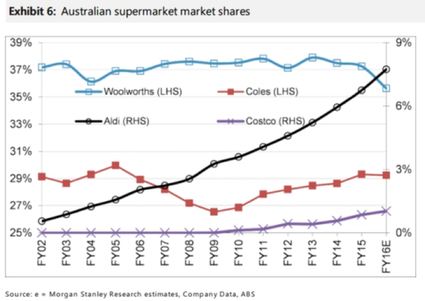

What caused this dramatic change in investors thinking? For the answer we need to look through recent history. Back in 2007, the industry structure was a cosy duopoly of Coles and Woolworths with a third player, Metcash, carving out a niche. Life was easy for Woolworths, particularly as their management stayed one step ahead of Coles in store layout design. The Coles share price was suffering and Woolworths was booming. However, the first major change to the industry was close and after rejecting two bids from private equity firm Kohlberg Kravis Roberts & Co, Coles was bought by Wesfarmers for $22bn. This was the largest ever takeover in Australian corporate history and many fund managers wrote the price off as too high and believed Wesfarmers would fail.

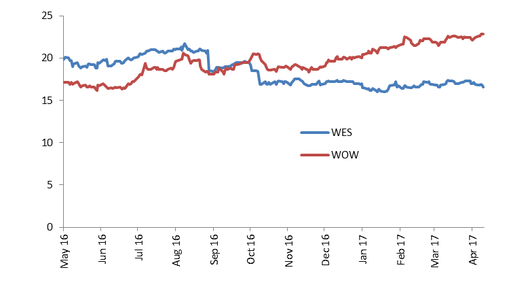

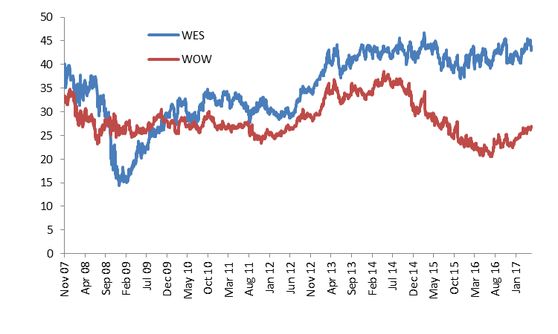

The initial share price reaction was negative for Wesfarmers (WES) whilst Woolworths (WOW), seen as “recession proof” by many, held up remarkably well during the GFC. Wesfarmers raised capital initially at $29 for the acquisition then was forced into another raising at $13.50. Investors in those capital raisings have done well with the share price sitting at $43 now.

The problem for Woolworths and Coles is that they are likely fighting for a smaller pool. The rise of Aldi is unlikely to be halted any time soon with an aggressive rollout plan. They continue to have significantly lower margins with lower grocery prices and smaller store areas (meaning lower overhead costs such as rent). EBIT margins for Aldi in Australia were 4% last year according to the ATO.

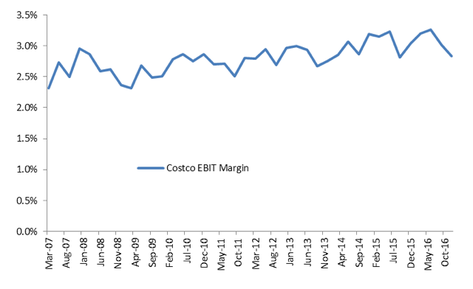

Another competitor set to gain market share is Costco, where their unique business sees them run EBIT margins of sub 3%. Costco make over three quarters of their profit from their annual membership fees (currently $55 per annum in Australia) and as a result can sell the goods to consumers near cost, hence the name.

Then there is the imminent arrival of Amazon into Australia. This is less of a worry than the above threats. Amazon has struggled to make meaningful headwinds into the US market with consumers still preferring physical stores for groceries. Their market share currently stands at around 1% of the US market and in attempt to grow that, the company is experimenting with physical stores in Seattle.

Whilst Amazon is currently grabbing headlines, the major threat for the major supermarkets remains Aldi. The constant of an aggressive low cost competitor means life will remain difficult. Despite that pressure we have seen a significant rally in the Woolworths share price since June last year. The rerating has been driven by two consecutive quarters of solid sales growth and a rerating in the Price to Earnings ratio from around 16x to 23x. Meanwhile, Wesfarmers has gone the other way and seen their P/E ratio fall from over 20x to 16x (driven by a flat share price and rising earnings from their coal division).

From the above valuation metrics, it appears the popular trade right now is to bet on a Woolworths turnaround. If we were running an index aware strategy, we would much prefer to take the 16x on Wesfarmers instead of paying 23x for Woolworths. In addition to a cheaper valuation, Wesfarmers has the added advantage of owning Bunnings. Bunnings is a very high quality business that represents 34% of Wesfarmers EBIT, is currently growing at a double digit rate and has a return on capital employed of above 35%.

One of the great aspects of our strategy is that we aren’t benchmark aware. A company that comes into our portfolio has to stand on its own two feet and not just be a better alternative that its competitor. Whilst we would be more likely to invest in Wesfarmers than Woolworths at this point of time, we don’t due to concerns that the market is underestimating the ongoing growth of Aldi on both businesses.