Summary:

Not all IPOs and Capital Raisings are created equal…

IPOs and Capital Raisings are a sensitive subject for many retail investors who often view them as “closed doors” for smaller investors. And of course the more a door appears closed, the more it is natural for human psychology to want it to be opened.

However, we believe this way of thinking warrants caution since not all IPOs and Capital Raisings are created equal. In our opinion the vast majority should be avoided due to their lack of track record and evidence of sustainable moats, and their often unproven business models. We have previously written about our high quality shopping list, and we find the majority of IPO and Capital Raising opportunities fail to meet our criteria of a high quality investment.

We recently saw a cautionary tale when it comes to IPOs, as covered on The Lazy Dog blog.

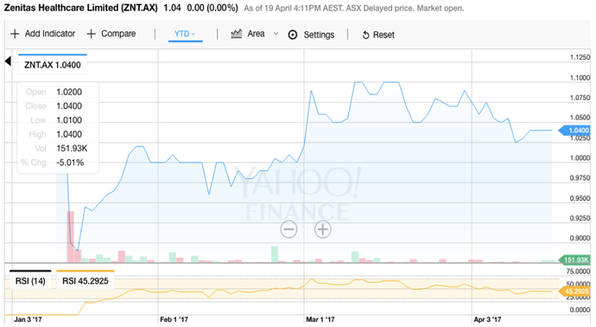

STOCK EXAMPLE: Zenitas (ASX:ZNT) is a good example of a recent Capital Raising which ticks all our high quality boxes. ZNT now operates from 54 locations throughout Australia, employing 700+ health professionals, providing services across allied health, home care and primary care; making it a significant player in the community healthcare in the Australian market. Community healthcare is expected to benefit from supportive government policy, as community-based health services represent a cost effective solution compared to high cost hospital care. We like ZNT as it is in a sector supported by strong tailwinds and encouraging thematics, it is priced on an undemanding multiple, has multiple and credible pathways to grow, and is run by an experienced management team. That said, the business still has work to do prove itself to the market, and to build out its model. As it does, there is ample room for the share price to re-rate.

Once you have identified the right ones – how to gain access?

We have generally found that competition is intense for stock if an IPO or Capital Raising does indeed tick all our high quality boxes. In small Capital Raisings that are in high demand, it is often the case that the stock available is bid for multiple times over by institutional and sophisticated investors, before retail investors are even offered an opportunity. As a result, it can be very challenging for retail investors to pick up stock in these cases. Conversely, it is often easier for retail investors to pick up stock in the lower quality IPOs we are aiming to avoid.

At this point it is worth mentioning that the IPO market largely remains under the control of the larger brokers who still generate very high fees for handling IPOs. So the main route to IPO or Capital Raising stock supply is through the broking community.

For smaller investors this means leveraging existing broker relationships, and showing yourself as a potential longer term client for that broker rather than an “IPO flipper”. If an IPO is in hot demand brokers will be very focused on the clients they believe will help build their business longer term rather than short term focused traders.

This is one of the areas where it is a major advantage to be invested through a long term focused smaller companies investment manager since these funds tend to move to the front of the queue for the reasons mentioned.

STOCK EXAMPLE: In the above mentioned example of Zenitas (ASX:ZNT), there was no public float or ability for retail investors to participate. And even sophisticated investors had their bids substantially scaled. However, we were able to use our existing relationship with the company through our long term shareholding in BGD Corporation to secure a strong allocation.

What is being done about it by the ASX?

Alternative strategy to gain access to IPOs: Onmarket Bookbuilds

It is positive to see the emergence of onmarket bookbuilds, a relatively new business model which aims to provide IPO access to retail investors. At present, this type of business is generally the secondary IPO broker behind a traditional primary broker so is generally only contributing a relatively small portion of the IPO fund raisings it in involved in. However, the key point is that this business is providing IPO access to retail investors who were previously locked out of the market, which is a clear step in the right direction.

We hope these bookbuilding models succeed in building their business longer term as their success will lead to greater access to the higher quality IPOs which remain largely inaccessible for retail investors at present. And hopefully other alternative access points for retail investors will emerge in the coming years.