2023 Review: Market Surprises, AI Evolution, and Geopolitical Strains21/12/2023

A recession seemed even more likely following the U.S. banking crisis that emerged in early March. Significantly higher interest rates had enticed depositors to withdraw their money en-masse from many of the U.S. banks and place it instead into government bonds or money market funds. Several banks with particularly susceptible deposit bases (cryptocurrency, venture capital, high-net-worth clients) that had made the mistake of investing in long-term bonds were found out, with Silvergate Bank, Silicon Valley Bank, Signature Bank and First Republic not making it through the year. Across the pond, 167-year Swiss banking giant Credit Suisse also failed. Fortunately, however, this appears to be the extent of the damage and a wider banking crisis has thus far been avoided. The next major theme was undoubtedly artificial intelligence (AI). The launch of OpenAI’s ChatGPT received a furore of attention, reaching 100 million active users in only 2 months–the fastest ever application to achieve this status. Microsoft (NASDAQ: MSFT) used its investment in OpenAI to integrate ChatGPT into its range of products and services, laying down the gauntlet to Alphabet (NASDAQ: GOOG), which launched its own AI tool named Bard. The enthusiasm then spread to semiconductor giant NVIDIA (NASDAQ: NVDA), which is set to be a major beneficiary of the secular transition to AI. It wasn’t all smooth sailing for the AI beneficiaries though, with CEO of OpenAI Sam Altman unceremoniously fired before returning several days later in a tumultuous twist in late November.An alarming deterioration in the geopolitical environment was a more unwelcome trend during 2023. The Russia-Ukraine war entered its second year, and Ukrainian President Volodymr Zelensky has been fighting an ever-greater challenge of securing further aid from both the U.S. and Europe. The European Union did, however, approve the start of negotiations for Ukraine to join the bloc, one glimmer of hope for Ukraine as its counteroffensive struggles. Heightened conflict also returned to the Middle East, following an attack by Palestinian-based Hamas on Israel in October and a subsequent counteroffensive from Israel on Gaza, which remains ongoing. Not only did real estate prices remain resilient in 2023, but U.S. homebuilder and building materials stocks performed incredibly well. Housing shortages are currently a common theme among developed countries, fuelled in part by the smaller household sizes brought about by fewer children per family, higher divorce rates and work-from-home arrangements (that have encouraged larger homes with better amenities such as heating/cooling). In the U.S., this is greatly exacerbated by a dramatic level of underbuilding since the Global Financial Crisis (in response to a dramatic level of overbuilding beforehand) and the large proportion of homeowners that secured long-term, low-cost fixed-rate mortgages during the early stages of the pandemic–disincentivising them to move and thus making less homes available for sale. 2023 was also the year we said farewell to investing legend and former Vice-Chairman of Berkshire Hathaway (NYSE: BRK.B), Charlie Munger. Falling just shy of his 100th birthday (which would have been on January 1), Munger will be fondly remembered as the lifetime friend and consigliere of Warren Buffett but also for his sharp wit and direct speech. In a statement released on November 28, Buffett credited him with a significant part of Berkshire’s success: “Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation.” While not as widely known, Munger is also well-known for his stoicism having faced the death of a child, divorce, financial hardship and the loss of an eye earlier in his life, and for his exceptional investing track record in his own right, having generated an exceptional 19.8% per annum return between 1962 and 1975 (compared to 5% p.a. for the Dow Jones Industrial Average over the same period).

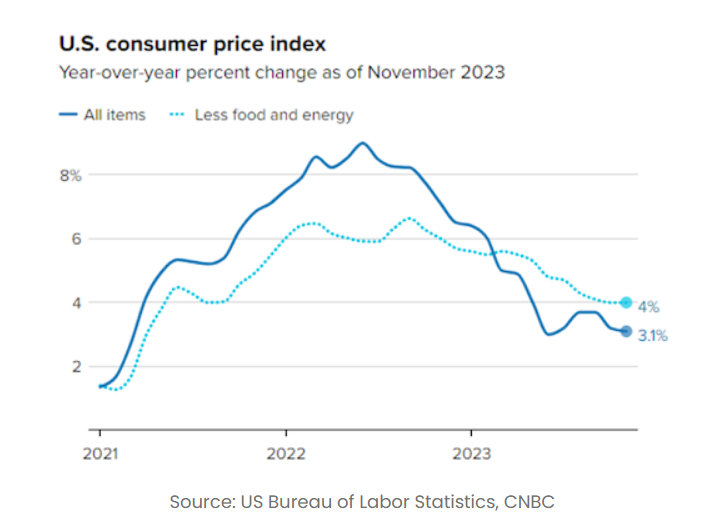

2024: The Year AheadInflation has been the topic du jour since the most severe impacts of the pandemic subsided, causing near-daily concerns about the cost of living. In response, central banks around the world (including the European Central Bank, Bank of England, U.S. Federal Reserve and Reserve Bank of Australia) implemented monetary tightening that had not been seen in decades. Increases in these respective prime lending rates appear to be having an impact. In the U.S., inflation has moderated from a high of 9.1% YoY in June 2022 to a more reasonable 3.1% YoY in November 2023 (or 4.0% “core inflation,” which excludes the more volatile food and energy components). The Fed Funds Rate has now been left on hold for three consecutive meetings (at a range of 5.25%-5.50%), and recent commentary indicates that the Fed may in fact begin to lower rates in 2024, with three projected cuts based on the most recent ‘dot plot.’ While price increases put in place over the last several years will likely prove sticky, weaker inflation and lower borrowing costs would be a welcome relief to most consumers.

The other major theme for the upcoming year is elections, with 2024 set to be a historic year. Elections are scheduled for 50 countries involving more than 2 billion of the world’s population, including the likes of India, Mexico, the European Parliament, South Africa and of course, the United States. The stage appears set for a rematch between democrat President Biden, aged 81, and former President Donald Trump, who remains under indictment for several unrelated crimes across different jurisdictions. Russia, too, is having a presidential election in 2024, which could see Vladimir Putin remain in power until 2030.

|

2023 Review: Market Surprises, AI Evolution, and Geopolitical Strains

2023 Review: Market Surprises, AI Evolution, and Geopolitical Strains

Written by