Global Equities

Global Tech and Innovation Founders Class

Below you will find this month’s commentary and portfolio update for TAMIM Global Tech and Innovation Founders Class.

October 2024 | Investor Update

Dear Investor,

We provide this monthly report to you following the conclusion of the month of October 2024.

We continued to use the outsized pre-election volatility to ramp exposure in the new fund – hitting our target of ~full exposure right around the election in early November – with a particular focus on stocks outside of the Mag7/concentrated indices. As we highlighted last month, volatility was extremely elevated going into the US election given the perceived uncertainty. The official election results came in faster than expected – with Trump winning in a landslide (both popular and electoral college) and the Republicans taking the House and Senate. This immediate resolution drove volatility lower and led to an immediate deployment of risk – which we largely positioned for ahead of time, and will be reflected in November results.

With this increased policy clarity, we can now more confidently hone in on the best areas to invest and scale positions. Most notably, we remain focused on investing in Artificial Intelligence (AI) – which is a critical area for both deterrence and productivity – as well as US onshoring and reindustrialisation – which Trump plans to indirectly incentivise via tariffs. The Trump cabinet will continue to get built out ahead of the January inauguration, but what is quite clear is the focus on productivity and efficiency investment (i.e., Elon Musk) and hitting the ground running – we’ll have more on this in our November update. In the background, liquidity injections have continued, China has outlined various stimulus initiatives (but is seemingly holding back the ‘bazooka’ until clarity on Trump’s plan), and the Federal Reserve has continued its rate-cutting regime – though the pace may slow down post election results with the USD up and inflation still not contained. Overall, we are beginning to see signs of a selective emerging reflationary backdrop and increased opportunities across our universe. As expected, with uncertainty around the election now behind us, money has begun to flow back into risk assets – a trend likely to continue through the end of the year.

Delving into a quick update on the pillars of our strategy:

-

- Technology — most notably, AI — is our primary focus. We continue to believe this Technological cycle will dwarf the Internet, Mobile, and other preceding technological revolutions — and we are already beginning to see hints of this with step-function advancements in robotics, self-driving vehicles, and the automation of many white-collar tasks. With Elon Musk involved and Trump focused on general de-regulation, we expect areas like autonomy will accelerate in the coming years. While phase 1 of the AI buildout has been primarily focused on Compute infrastructure, we are beginning to shift into phase 2 — with a focus on Networking and Memory, two major bottlenecks that can unlock significant gains, notably on the inference side. With Nvidia’s Blackwell chips now shipping, and cloud data center roadmaps now largely finalised for the year ahead, we expect investment in these two areas to accelerate and have adjusted our exposure accordingly.

- Energy, another major pillar of power, is a critical input into any system — the base layer for both Technology and Money. In order to power the AI data center demand + reshoring in the US + electric vehicle proliferation, we need to both increase reliable base load power (i.e., nuclear and natural gas) and upgrade the grid. We are beginning to see signs of this cycle emerging in the US: Amazon buys nuclear powered data center to accelerate AI, Microsoft partnering to re-open the ‘infamous’ 3-mile island nuclear power plant to power its AI data center, Google to buy power from small modular reactor company, Palisades Michigan nuclear power plant potentially reopening supported by the Department of Energy. And under the Trump administration we expect ensuring cheap, reliable energy will be a key focus – as they fully understand that without reliable, inexpensive energy, you cannot have industry.

- Money – the final pillar of power – is critical but often overlooked, as it helps store energy and finance Technological progress. The US is in a uniquely powerful position with the US dollar as the global reserve currency — which is the foundation of the current interconnected global system. And to better leverage the system, the US is contemplating launching its own Sovereign Wealth Fund — which would potentially be a massive boon for Tech and Energy investment and progress. This is the base premise of our Fund and our three pillars of power – the West needs to accelerate investment (Money) in critical areas (notably key Technology and Energy) to maintain and/or expand its Power, which is being directly challenged by China. From the National Security strategy report (US):

“We must complement the innovative power of the private sector with a modern industrial strategy that makes strategic public investments in America’s workforce, and in strategic sectors and supply chains, especially critical and emerging technologies, such as microelectronics, advanced computing, biotechnologies, clean energy technologies, and advanced telecommunications.”

Overall, the above are positive signposts for our thesis and should provide further tailwinds for our themes and universe – and we believe the Trump administration will likely accelerate several of these themes (notably, US reshoring and AI). We are incredibly excited about the opportunity set that lies ahead given where we are within this technological innovation wave, and what must happen on the global landscape front.

Portfolio Highlights

Tesla (TSLA) is a pioneering electric vehicle, clean energy, and automation company that has revolutionised the automotive industry through its innovative approach to manufacturing and holistic vision of the electrification, automation, and robotics spheres. The company designs, develops, manufactures, and sells high-performance electric vehicles, solar panels, energy storage systems, and robotics. In the electrification supply chain, Tesla has vertically integrated many aspects of production, including battery cell manufacturing, to reduce costs and ensure supply (a similar approach as Apple in smartphones). For automation and robotics, Tesla heavily utilises advanced manufacturing techniques in its factories, employing sophisticated robots for tasks across the end-to-end process. The company’s commitment to automation extends beyond manufacturing to its vehicles, with Tesla a leader in developing autonomous driving technology (with a vision-first approach). Tesla now has over 5 millions vehicles on the road. These vehicles are essentially robots on wheels, gathering data. And, when they are ready, they can basically flip a switch and overnight these cars can become partial or full self-driving. Additionally, Tesla is expanding into humanoid robotics with its Optimus project, further solidifying its position in the robotics supply chain. Through these initiatives, Tesla has positioned itself as a central player in the intersection of electrification, automation, and robotics, driving innovation across multiple industries.

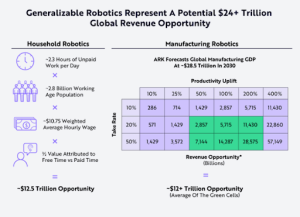

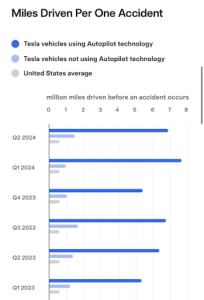

Only BYD in East, and Tesla in the West have cost structures that we believe will be competitive in this “new world” order. As we’ve laid out historically, we continue to think the majority of the other electric OEMs in the space will likely head toward zero — similar to what happened with internal combustion engine OEMs in the early 20th century. The legacy auto OEMs will also end up being displaced over time as well — as electric technology is simply superior to internal combustion and continues to improve. We are already seeing this with Ford recognising how far behind they are, and VW is shutting German factories due to under-utilisation. Further, both Tesla and BYD continue to separate themselves from the pack by now beginning to really lean into the software/AI side of their respective businesses — which will ultimately power their autonomous driving experiences and the surrounding ecosystem. The recent progress on the self-driving front has been notable — across both Tesla vehicles (see step functions improvements in chart below), as well as what’s coming on the humanoid robot front (Elon’s latest robot views) which is a massive multi-trillion dollar opportunity (second chart below estimates). Overall, we believe Elon Musk will help guide the Trump administration to help accelerate automation in the US – given it is both a National Security concern (i.e., China pushing ahead by allowing for autonomous vehicles on the streets) and a potential huge boon for productivity (i.e., imagine all the extra time you’d have if you weren’t driving stuck in traffic).

MACOM Technology Solutions (MTSI) is a leading semiconductor company that designs and manufactures high-performance analog RF, microwave, millimeter wave, and photonic semiconductor products. Their components are critical enablers in various high-growth markets, including data centers, telecommunications infrastructure, aerospace and defense, and industrial applications. In the context of AI/automation, MACOM’s products play a crucial role in enabling high-speed data transmission, signal processing, and wireless communications. Their semiconductor solutions are used in 5G infrastructure, data center interconnects, and radar systems, which are fundamental to the development of AI and automation technologies. MACOM’s power amplifiers, switches, and other RF components contribute to the advancement of next-gen energy technologies and smart grid systems. Additionally, their high-performance analog and mixed-signal ICs are essential for precision control and sensing in robotics applications. By providing these critical components, MACOM supports the ongoing trends in AI, electrification, automation, and robotics across multiple industries, positioning itself as a key player in the semiconductor ecosystem supporting these transformative technologies.

MTSI is particularly well positioned as we move into the next phase of the AI infrastructure buildout — with a focus on resolving the bottlenecks around networking to help improve the compute throughput. MTSI is focused on the high-speed optical interconnects within data centers, which will be part of the solution to continuing to improve the price/performance equation that helps enable the next step function improvement in AI models. In addition, MTSI has secured incremental content in Nvidia’s Blackwell architecture, which should provide a positive tailwind for growth into 2025. Finally, MTSI is a key both a key supplier into the Defense industry and a key enabler of reshoring with their domestic US fabrication facilities — both of which have secular drivers from geopolitical instability and reshoring in the West.

Texas Instruments (TXN) is a global semiconductor company that designs, manufactures, tests, and sells analog and embedded processing chips for various markets, including industrial, automotive, personal electronics, communications equipment, and enterprise systems. Their portfolio includes embedded processors, microcontrollers (MCUs), and connectivity products that enhance computing performance, motor control, real-time communication, and AI capabilities. TI’s technologies are integral to the development of smart, efficient, and safe robotics systems, as demonstrated by their role in Amazon Robotics’ autonomous mobile robots. Additionally, TI’s power conversion, sensing, and control solutions support next-gen energy systems, contributing to the broader trend of electrification. By offering scalable, high-performance, and cost-effective semiconductor solutions, TI plays a pivotal role in advancing the capabilities of automation and robotics across various industries.

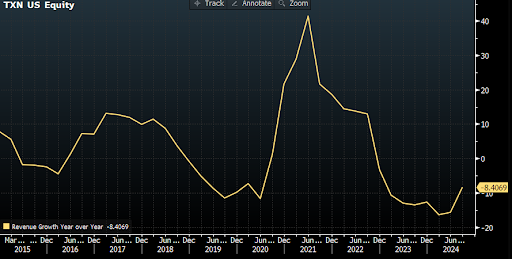

As the graph illustrates below, TXN revenue has been in a protracted downcycle over the last ~2 years, and unsurprisingly the stock has been rangebound as a result. On top of the downcycle in revenues (primarily industrial and automotive exposure, both of which are in the process of ~bottoming), TXN has been investing heavily on the capex side to further build out its domestic (US) 300mm fabrication facility capacity. While in the short run this capex suppresses TXN’s free cash flow, over the medium term it will further solidify its competitive advantage with local, resilient manufacturing capacity (reshoring beneficiary) and enhance gross margins and its cost structure advantage (300mm huge advantage in analog over 200mm wafers). Overall, they are particularly well positioned to capitalise on the next upcycle and we are just beginning to see the second derivative of revenue growth begin to tick up in the September Quarter.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Global Equities |

| Investable universe: | Nasdaq Composite |

| Number of securities: | 40-50 |

| Derivatives: | Yes |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-20%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust available to wholesale or sophisticated investors |

| Minimum Investment: | $150,000 |

| Management Fee: | 1.50% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate +2.5% or 4% |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | None |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 5+ years |

| Distributions: | Annual |