Global Equities

Global High Conviction

Investor Updates

November 2025 | Investor Update

The TAMIM Global High Conviction unit class was up +0.82% for the month of November 2025. The strategy has generated a return of +19.14% over the past 12 months and 18.41% p.a. over the past 3 years.

Try and remember what a substantial sell-off feels like!

We almost had the expected Autumnal retracement but then didn’t. Global equity markets finished November essentially flat after a rally late in the month. We got lucky in that some of the biggest positions in the fund had very strong returns. NGK Insulators and Kajima in Japan for example gained over 15% each.

We made a small number of trades in the global strategies investing in Hong Kong Exchanges and taking profits in Ebara and Ibiden in Japan.

The US consumer looks to be under serious pressure and warning signs are flashing everywhere from delinquencies in Auto Loans, Student Loans, and Credit Card debt.

The intention of this administration is to favour Main Street over Wall Street but unless there is more private sector capital expenditure and hiring in the next 6 months then this won’t be happening before the mid-terms. The Fed sure is going to be under pressure to cut and given the Big Beautiful Bill is quite stimulative it makes sense to us to hold reflation trades. There’ll be a chance to buy a lot of US bonds and the yield curve will get steeper either due to funding pressures or higher growth. Meanwhile Wall Street drives the Mag 7 to be over 33% of the S&P 500, both unprecedented and probably unwise. Try to remember what a substantial sell-off feels like!

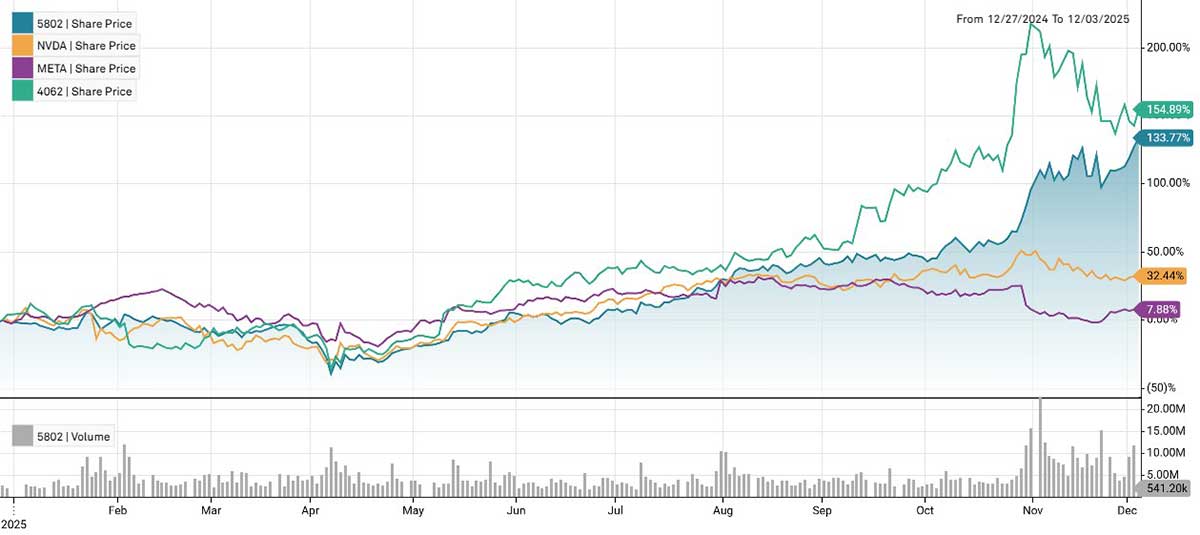

We remain underweight these 7 since they are expensive and large already and trees don’t grow to the sky. This has not hurt performance where we find equally attractive ‘true technology’ investments in Japan and have made good returns from those.

The chart below compares Ibiden 4062 (recently sold), Sumitomo Electric Industries 5802 Meta and even Nvidia. The Mag 7 should not be the only game in town or in your portfolio.

News from Europe continues to astound. Economic and social self-harm appears to be the objective of EU policy although some sort of U turn manoeuvres especially on energy are being discussed. The UK looks to be headed to oblivion and the last Budget hasn’t helped. We get (and applaud) the intention to reduce the disparities between income and wealth cohorts and rebalance the relationship between asset prices and incomes but “you don’t make poor people rich by making rich people poor”. Ack. W.C.

Until the Keynesian Kommunists are removed from decision making this relative economic trajectory of Europe down and RoW up, will continue. As a reminder the KKers believe that:-

Tax increases up to 100% always increase government tax take

Public spending from this increasing tax take produce productivity gains as large as private sector investment achieves

All profit belongs to the government; all economic activity is thanks to the government ergo more government is good

Meanwhile Japan and China continue to grow while they face-off and the new Japanese Prime Minister has clearly made it obvious that Japan is relevant economically, as a defence partner to the US in the Asia Pacific, and as the largest holder of US debt, relevant financially. We expect the BoJ to hint at raising rates and the risk to markets is a Yen spike up which will cause forced closure of the Yen carry trade supported positions. We remain overweight Japan and expect the consumer to start spending in Asia as real wage growth is being realised, unlike elsewhere.

We are, we believe, quite defensively positioned, but fully invested.

Fund Performance

Portfolio Highlights

Schlumberger (SLB)

The energy transition has been long on aspiration and short on basic arithmetic. Despite the headlines, global economies still rely heavily on hydrocarbons, and years of underinvestment are now forcing a normalisation in exploration and production spending.

Schlumberger remains one of the most disciplined and diversified service providers in the sector. Recent results show steady revenue growth, margin expansion, and continued strength across reservoir performance, well construction, and digital integration. EBITDA margins are approaching the mid twenties, and the balance sheet is in good order.

Valuation remains reasonable at around low teens earnings and a dividend yield above three percent. As energy security returns to the agenda for governments and corporates, demand for Schlumberger’s technology and services is well supported for several years. This cycle still has room to run.

Mizuho Financial Group

After three decades of monetary distortion, Japan is allowing rates to move towards something resembling normality. The steepening yield curve has improved net interest margins across the banking system, and Mizuho is one of the key beneficiaries.

The bank has delivered strong revenue growth and earnings expansion, supported by a robust capital position. The tier one ratio above sixteen percent offers significant flexibility for credit growth and higher returns to shareholders.

Despite the improvement, the shares still trade close to book value. Markets are slow to recognise that Japan is transitioning from stagnation to a more inflationary, higher wage, more productive regime. For banks, this is positive. Mizuho remains attractively valued for a multi-year recovery.

Jabil (JBL)

Away from the noise surrounding software, Jabil continues to play a critical role in the physical infrastructure required for AI, data centres, industrial automation, and high complexity electronics. The company manufactures and engineers the components most investors overlook: optics, sensors, power modules, and embedded systems.

Earnings growth remains solid, margins are stable, and institutional ownership is high. Next year’s valuation sits below twenty times earnings, which is unusually modest for a company directly enabling the AI build-out.

As capital expenditure on data infrastructure continues rising globally, Jabil should remain a beneficiary.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Global Equities |

| Number of securities: | 80-110 |

| Single security limit: | +/- 5% relative to Investable Universe |

| Country/Sector limit: | +/- 10% relative to Investable Universe |

| Market capitalisation: | US$2+bn |

| Derivatives: | No |

| Leverage: | No |

| Portfolio turnover: | Typically < 25% p.a. |

| Cash level: | 0-100% (typically 0-10%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust available to wholesale or sophisticated investors |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.00% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Fee Cap: | 2% of total FUM |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Applications: | Monthly |

| Redemptions: | Monthly with 30 days notice |

| Investment Horizon: | 3-5+ years |

| Distributions: | Annual |