Australian Equities

Australia Small Cap Income

Investor updates

Below you will find this month’s commentary and portfolio update for TAMIM Australia Small Cap unit class.

October 2025 | Investor Update

Dear Investor,

We provide this monthly report to you following conclusion of the month of October 2025.

The TAMIM Small Cap Income Fund was up +3.71% (net of fees) during the month, versus the Small Ords up +1.89%. Year to date the Fund is up +23.6%.

October continued the streak of now seven consecutive months of positive returns for the fund. During the month small/mid caps continued to play catchup and close the gap to their large cap peers. As we discussed in the last report, there is still substantial relative upside for that underperformance gap to narrow.

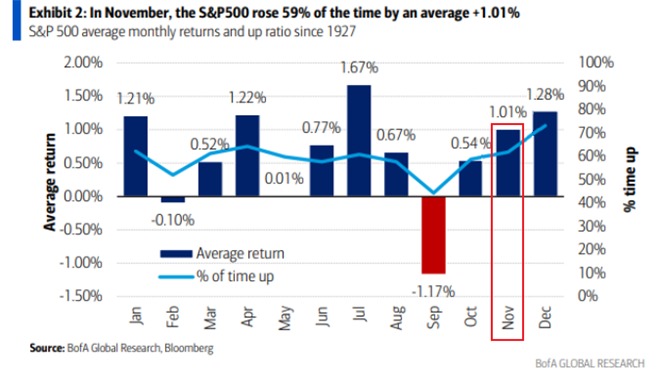

As we enter November, historically this is the best month of the year and seasonally the November to April period is a strong one for equities. In saying that, September is historically the weakest month yet this year saw positive returns, October is the most volatile month yet once again saw positive returns. So it is only inevitable that November may buck historical trends and end up being negative. Time will tell.

Finally as we enter the final two months stretch of the year, we gaze into 2026 with increased optimism. As we discussed throughout the year, the stars are aligning for another strong year of returns as the US economy benefits from the Trump policies implemented this year. These include, Tax cuts and Tariff revenues which will bring back significant investment into the US. Reduced regulations to accelerate investment. Lower interest rates and inflation which benefits consumer spending. And finally the backdrop of potentially one of the biggest technology revolutions of our lifetime – the AI thematic.

The above tailwinds should benefit investor sentiment globally and in Australia, and it is our job to hand pick companies that continue to grow and exceed market expectations.

We provide a brief commentary on portfolio updates during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in December.

Sincerely yours,

Ron Shamgar and the TAMIM Team.

Fund Performance

Portfolio Highlights

Clearview Wealth (ASX: CVW) provided a bullish Q1 FY26 update with 13% growth in new business and in-force premiums of $425.3m in Q1. Claims remain within expectations, with last year’s dip deemed a one-off. The company prioritises margin over volume in an 8% growing market, implementing targeted price increases (20% TPD, 11% income protection) and managing legacy TPD exposure. Retention is key, supported by customer transitions to newer products.

A major tech upgrade to Oracle and Salesforce will complete by Xmas, promising cost savings, ease of use by advisors and customers which will help accelerate growth in other products like retirement and direct channels. The board prefers buybacks over dividends, maintaining a 40–60% payout ratio. We have provided feedback to reinstate dividends as soon as possible. Trading on 8.5x PE whilst growing earnings at strong double digit highlights the significant upside on offer next 6-9 months. Management will provide a new medium term aspirational target at the August results which we see as a major catalyst to re rate the stock to 90 cents or higher.

Austco Healthcare (ASX: AHC) reported a strong Q1 FY26 with revenue up 51% to $23.2m, driven by organic and acquisition-led growth. EBITDA rose to $4.2m (18.1% margin), up from 16.0% at FY25 year-end, reflecting operating leverage and integration benefits. Unfilled Contracted Revenue stands at $54.6m, supporting future momentum. Demand remains robust for integrated nurse call, RTLS, and workflow solutions.

The company targets 10–14% organic revenue growth for FY26. CEO Clayton Astles highlighted positive acquisition contributions and margin expansion, reinforcing confidence in sustained profitable growth. We anticipate further contract wins and a possible acquisition during the year. We estimate AHC is on track for $18m in Ebitda with a net cash balance sheet and an undemanding valuation of 7.5x. The stock is still significantly under owned by instos and is an attractive takeover target for a global healthcare distributor.

Edu Holdings (ASX: EDU) provided an update on student enrollments for Ikon T3 and ALG T4. EDU reported significant growth in enrolments for Trimester 3, 2025 at Ikon Institute: • Total student enrolments: 4,537, up 82% on PCP • New student enrolments: 1,072, up 15% on PCP and 51% on T2'25

EDU has also reported student enrolments for Term 4, 2025 in its Vocational Education and Training business, Australian Learning Group (ALG): • New student enrolments (NSEs) for T4'25: 164, up 26% from T3'25 • Total student enrolments for T4'25: 1,425, down 4% from T3'25

More importantly in October 2025, the Government introduced the Education Legislation Amendment Bill 2025 into Parliament, replacing the lapsed Education Services for Overseas Students Amendment Bill 2024. The new Bill retains similar quality and integrity measures but removes all references to enrolment caps – a very positive development for the sector.

We expect EDU to deliver CY25 EPS of 8-9 cents and CY26 EPS of 10-11 cents. With an active buyback and a dividend, this places the stock on a low multiple of 5x or 3x EV/Ebitda. We think the stock is worth 100% more than current price.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Australian Equities |

| Investment Universe: | Australian Small Cap |

| Reference Index: | ASX Small Ords |

| Number of Securities: | 20-40 (10-20 Value, 10-20 Growth) |

| Single Security Limit: | +/-5% |

| Market Capitalisation: | Small Cap |

| Leverage: | No |

| Portfolio Turnover: | <50% p.a. |

| Cash Level (typical): | 0-100% (0-50%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate + 2.50% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Distributions: | Semi-annual |

| Applications/Redemptions: | Monthly |

| Redemptions: | Monthly with 30 days' notice |

| Investment Horizon: | 3 - 5 years + |

Invest via TAMIM Fund

Request additional details by using the form or if you're ready to invest select the apply now button.

Invest via IMA

The TAMIM Australia Small Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.