Australian Equities

Australia Small Cap Income

Investor updates

Below you will find this month’s commentary and portfolio update for TAMIM Australia Small Cap unit class.

July 2025 | Investor Update

Dear Investor,

We provide this monthly report to you following conclusion of the month of July 2025.

The TAMIM Small Cap Fund was up +6.40% (net of fees) during the month, versus the Small Ords up +2.82%.

July was a very positive month for the Fund in what was a generally bouyant equity market environment. Several of our Fund’s holdings delivered strong trading updates which resulted in positive share price reactions. This is what we expect in a normal market behavior environment – good news rewarded and bad news punished.

We are also experiencing significant Takeover activity in the Fund’s holdings and expect more M&A to emerge in the coming months. We are quite optimistic on the outlook for markets heading into the August reporting season and the second half of the year.

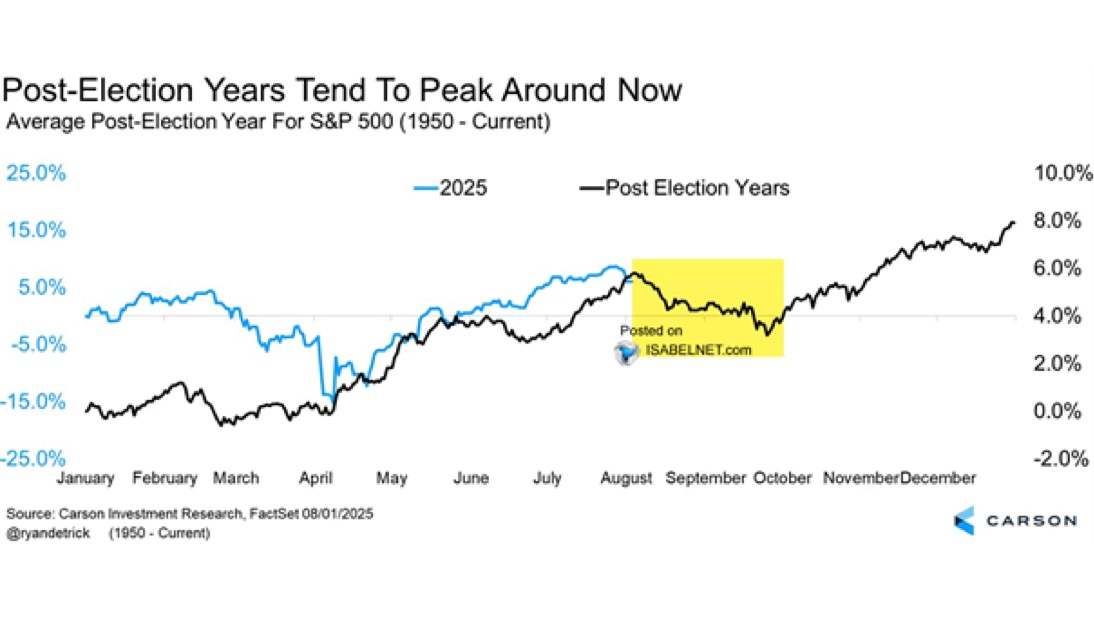

Investors should keep in mind that after several months of positive returns, it is always inevitable a possible market pullback may arise. We see any market pullback as a good opportunity to top up for the medium to long term.

Finally we provide a brief commentary on portfolio updates during the month in the portfolio section of the report. We look forward to providing further updates in our next monthly report in September.

Sincerely yours,

Ron Shamgar and the TAMIM Team.

Fund Performance

Portfolio Highlights

Austco Healthcare Limited (ASX: AHC) has provided a trading update and guidance upgrade for FY25. Highlights include:

-

- Revenue: $80-$82 million, up 37%-41% from FY24

- EBITDA: $12.5-$13.5 million, up 54%-67% from FY24

- Cash at bank: $14.4 million, up 6% from FY24

- Unfilled contracted revenue: $55.8 million

- Amentco acquisition outperformed expectations, leading to an additional $2.5 million earn-out expense

- G&S Technologies acquisition completed on 30 May 2025, funded through operating cash flows

AHC unfilled order book closed the year at $50m with a strong pipeline of opportunities. We anticipate FY26 Ebitda of at least $16m and an EPS of 2.8-3 cents. The stock has reached an inflection point of a market cap above $100m and an undemanding multiple - which should attract more eyeballs to the stock and potential investors to the register.

Enero Group Limited (ASX: EGG) sold its 51% stake in OBMedia to minority shareholders for a nominal amount, incurring a non-cash loss of A$14–16 million. The divestment aligns with Enero’s strategy to focus on its high-performing agencies—Hotwire Global, BMF, and Orchard—to drive growth and value.

Enero expects FY25 EBITDA at the upper end of its guidance ($22–26 million underlying, $18–20 million economic interest), fueled by new Australian client wins, strong cost control, and operational excellence.

We believe the core business will generate $12-$14m of Ebitda in FY26. The company has in excess of $30m of net cash versus a market cap of $90m. With the OBmedia business divested - the potential poison pill to a takeover has been removed. We expect the company to be acquired at some point or for the stock to re rate towards our $1.50+ valuation as capital management initiatives are announced.

Humm group limited (ASX: HUM) during the month has received a non-binding indicative offer from The Abercrombie Group Pty Ltd (TAG) to acquire all ordinary shares not held by TAG and its associates for $0.58 per share. TAG and its associates currently hold 26.6% of hummgroup shares. The offer is subject to due diligence and a mutually agreed scheme implementation deed, whilst TAG has 4 weeks to conduct due diligence.

We initiated a position in HUM at 45 cents earlier in the month and were positively surprised to see the takeover offer emerge only days after our acquisition of shares. We believe that the offer undervalues the company but we are also cognisant to the fact that the bidder is the largest holder. The makes a competing offer highly unlikely and we believe a 10-20% bump in the offer price should get the board and most shareholders over the line.

Johns Lyng Group (ASX: JLG) has entered into a Scheme Implementation Deed with Sherwood BidCo Pty Ltd, managed by Pacific Equity Partners (PEP) during the month. PEP to acquire 100% of JLG shares at $4.00 per share with the Scheme valuing JLG's equity at approximately $1.1 billion.

JLG is a classic Tamim playbook stock pick. As can be seen from the chart below, JLG over the last few years traded at elevated levels we struggled to see value. We followed the story closely like most stocks - but could not justify what was a very popular stock with fundies yet carried a highly expensive multiple.

Over the last year or so, the company disappointed the market with multiple downgrades as its building restoration business was cycling a strong prior years performance but lower industry activity in the short term. This all culminated in a disappointing February 2025 results which saw the stock reach its lows of $2.00. Having followed the story closely and seeing management acquire material amount of shares on market, we took the opportunity to meet the company and initiated a position at $2.20.

JLG ticks the boxes of what we look for in a business: founder led and majority holder, industry leader, solid balance sheet, positive outlook as industry conditions improved, and finally an undemanding valuation. In June/July we were pleased that the company agreed to a takeover in what was a material premium of $4.00 vs our $2.20 entry price.

Fund Facts

Investment Parameters

| Management Style: | Active |

| Investments: | Australian Equities |

| Investment Universe: | Australian Small Cap |

| Reference Index: | ASX Small Ords |

| Number of Securities: | 20-40 (10-20 Value, 10-20 Growth) |

| Single Security Limit: | +/-5% |

| Market Capitalisation: | Small Cap |

| Leverage: | No |

| Portfolio Turnover: | <50% p.a. |

| Cash Level (typical): | 0-100% (0-50%) |

Fund Profile

| Investment Structure: | Unlisted Unit Trust (available to wholesale investors) |

| Minimum Investment: | $100,000 |

| Management Fee: | 1.25% p.a. |

| Admin & Expense Recovery: | Up to 0.35% |

| Performance Fee: | 20% of performance in excess of hurdle |

| Hurdle: | Greater of: RBA Cash Rate + 2.50% or 4% |

| Entry/Exit Fee: | Nil |

| Buy/Sell Spread: | +0.25% / -0.25% |

| Distributions: | Semi-annual |

| Applications/Redemptions: | Monthly |

| Redemptions: | Monthly with 30 days' notice |

| Investment Horizon: | 3 - 5 years + |

Invest via TAMIM Fund

Request additional details by using the form or if you're ready to invest select the apply now button.

Invest via IMA

The TAMIM Australia Small Cap strategy is available as an Individually Managed Account (IMA). Please see the Strategy Summary for terms or request Investment Documentation via form.